Getty Images I'm sure you've heard by now that you will be charged lower fees while still being able to capture market growth if you invest in a diversified basket of index funds. But passive investing isn't for everyone. Here are a few reasons index funds might not be the best investment for you: You want to get rich quickly. No one is getting rich overnight using index funds. However, by consistently putting money away and staying the course when things seem dire you are extremely likely to get rich using index funds. Index investing takes patience to reap the rewards. You want attention from a fund manager. No one will buy you dinner as a passive investor because no one is making enough money off your wealth to bother. The math clearly points out the enormous fees you are paying to have a sales associate or investment manager attending to your needs. But the reality is that plenty of people enjoy the attention and the relationship. It may sound weird feeling grateful to have someone buy dinner for the two of you using your money, but some people enjoy the experience of being courted by a financial manager. You want to own the top-performing fund of the year. Index funds will never be the top performer on any list. While the index is generally in the better half of performing funds every year and performance gets better when you look at longer-term charts, an index fund is very unlikely to be the very highest performing fund in any category. You probably won't be able to skillfully pick the top performing fund, and even then, you are taking more risk by making that choice. But your emotions may tell you otherwise, especially when your friend happens to be invested in that top fund. And let's not forget that the friend will be sure to rub it in. You want instant returns. The additional increase in wealth using index funds over active management isn't all that visible. Sure, there are plenty of studies that make claims about how much richer an average person would be by investing in index funds, but no one can actually tell you how much better off you will be if you become a passive investor. It's difficult to calculate just how much tax you've avoided because of the tax efficiency of passive investing, and no one can determine the extra hair you will have because you didn't tear it out worrying about outperforming the market. You want something to brag about at the next party. You'll never be the talk of town with an index fund, and most people will brush you off as soon as you tell them you are an index investor. "Oh, average returns," they will say. Even if you know better than that, it's unlikely to make a very satisfying conversation. You want to never lose money. Investing passively doesn't mean that your investments will never go down. It doesn't guarantee positive returns, even though that's very likely going to be the case if you trust that the world economy is going to keep growing over the long haul. And because there's not likely to be much peer recognition in your social circle, it could be a challenge to maintain composure and hold onto the belief that you'll win out with passive indexing in the end. Passive indexing takes discipline to keep investing, knowledge of how the pieces work together to benefit you and patience to see things through in the long run. Those who have what it takes will reap huge rewards, but index funds are definitely not for everybody.

Getty Images I'm sure you've heard by now that you will be charged lower fees while still being able to capture market growth if you invest in a diversified basket of index funds. But passive investing isn't for everyone. Here are a few reasons index funds might not be the best investment for you: You want to get rich quickly. No one is getting rich overnight using index funds. However, by consistently putting money away and staying the course when things seem dire you are extremely likely to get rich using index funds. Index investing takes patience to reap the rewards. You want attention from a fund manager. No one will buy you dinner as a passive investor because no one is making enough money off your wealth to bother. The math clearly points out the enormous fees you are paying to have a sales associate or investment manager attending to your needs. But the reality is that plenty of people enjoy the attention and the relationship. It may sound weird feeling grateful to have someone buy dinner for the two of you using your money, but some people enjoy the experience of being courted by a financial manager. You want to own the top-performing fund of the year. Index funds will never be the top performer on any list. While the index is generally in the better half of performing funds every year and performance gets better when you look at longer-term charts, an index fund is very unlikely to be the very highest performing fund in any category. You probably won't be able to skillfully pick the top performing fund, and even then, you are taking more risk by making that choice. But your emotions may tell you otherwise, especially when your friend happens to be invested in that top fund. And let's not forget that the friend will be sure to rub it in. You want instant returns. The additional increase in wealth using index funds over active management isn't all that visible. Sure, there are plenty of studies that make claims about how much richer an average person would be by investing in index funds, but no one can actually tell you how much better off you will be if you become a passive investor. It's difficult to calculate just how much tax you've avoided because of the tax efficiency of passive investing, and no one can determine the extra hair you will have because you didn't tear it out worrying about outperforming the market. You want something to brag about at the next party. You'll never be the talk of town with an index fund, and most people will brush you off as soon as you tell them you are an index investor. "Oh, average returns," they will say. Even if you know better than that, it's unlikely to make a very satisfying conversation. You want to never lose money. Investing passively doesn't mean that your investments will never go down. It doesn't guarantee positive returns, even though that's very likely going to be the case if you trust that the world economy is going to keep growing over the long haul. And because there's not likely to be much peer recognition in your social circle, it could be a challenge to maintain composure and hold onto the belief that you'll win out with passive indexing in the end. Passive indexing takes discipline to keep investing, knowledge of how the pieces work together to benefit you and patience to see things through in the long run. Those who have what it takes will reap huge rewards, but index funds are definitely not for everybody.

Friday, February 28, 2014

6 Signs Index Funds Aren't For You

Monday, February 24, 2014

Hang up if a caller claims to be from the IRS

But the frightened woman slyly handed the teller a note that said "Robbery in Progress."

The police arrived at the bank, according to Grand Blanc Detective Steve Hatfield, because the teller thought that's who she needed to call.

Once the scam was explained, the police officer then actually talked to the guy on the cell, Hatfield said. But the brazen con artist caller threatened to lock up the police officer if he didn't pay the back-due taxes.

Susan Tompor:Did your cell phone ring just once? Do not call back

Susan Tompor: Better Business Bureau program guards against scams that target seniors

We're looking at one whacked out tax-time telephone scam here. But it's a scam that's growing to be more pervasive, according to the Internal Revenue Service.

The IRS wants to make it clear that the IRS is not calling and demanding that anyone put money on a GreenDot card or other prepaid card, suggesting that you give the IRS your credit card number over the phone. Do not believe anyone who demands that you wire the IRS money, either.

And no, you're not going to lose your driver's license if you don't pay up.

"They're calling people up and telling them they're the IRS and threatening them," said Cindy Burnett, special agent and public information officer for the Department of Treasury IRS criminal investigation office in Traverse City.

The IRS said scammers have called taxpayers in nearly every state in the country.

"They're hitting Michigan really hard," Burnett said.

Burnett heard of one case where a caller running a scam told a Michigan resident to pay the IRS by bringing a money order to a local gas station where the "IRS" would supposedly meet them.

One Troy resident received a morning call on Feb. 4 claiming to be from the IRS. The caller demanded that ! the man pay up and put $4,286.49 on a GreenDot prepaid card. The man left home to get the money but his wife was suspicious and called the Troy police. Once he was alerted about the scam, the man didn't buy the prepaid card or send any money.

The Grand Blanc Police Department received two other complaints in the past month or so about this scam, Hatfield said.

In late January, Hatfield said, one woman did end up sending about $3,500 via GreenDot prepaid cards for supposedly back-due taxes that her husband owed. The money was lost to fraudsters.

"It's gone," Hatfield said.

The IRS put out an earlier warning on this scam in the fall last year. But the scammers are making these calls now and the calls are likely to heat up as we move closer to the tax deadline April 15.

Some tell-tale signs of the scam: The scammers are targeting seniors or recent immigrants. The caller says the person owes money to the IRS and demands to be paid promptly. The taxpayer is told to go to the store to load cash onto a prepaid debit card or wire the cash. The person who buys a prepaid card may be asked to read the numbers over the phone so the money is immediately available to the con artist.

MORE: IRS releases 'Dirty Dozen' tax scams for 2014

Once money is put on a prepaid card or wired, it's harder to track the con artists, who could be overseas.

Other signs: Caller ID might show an IRS number but that number is being spoofed and it's not a real IRS call. The scammers may give a fake name and a fake IRS badge number to sound more authentic.

And the fake IRS callers act like they have your file right there.

"The thing that's really terrifying is they have the last four digits of your Social Security number. They know your name," said Luis D. Garcia, a spokesman for the IRS in Detroit.

MORE: Poor IRS customer service hurts taxpayers

Some callers are extremely intimidating, too.

"They become verbally abusive. They use foul language. You're not going! to get t! hat from the IRS," Garcia said.

If you hang up, it's even possible you'd receive another call that might look like its from it's from the local police or the Secretary of State and involve someone threatening to revoke a driver's license or business license. Again, that's a follow up scam call that's designed to convince you to wire money.

The first IRS contact with taxpayers on a legitimate tax issue is likely to take place via a letter sent in the regular mail, not e-mail or a phone call.

Contact the IRS directly if you believe you have a tax issue at 800-829-1040.

Contact Tompor at stompor@freepress.com

Friday, February 21, 2014

More Dollar From FDO: 14 Dividend Stocks Increasing Payouts

Popular Posts: Ford Revs Up Its Divvies: 7 Dividend Stocks Increasing Payouts Recent Posts: More Dollar From FDO: 14 Dividend Stocks Increasing Payouts Ford Revs Up Its Divvies: 7 Dividend Stocks Increasing Payouts Boeing Dividend Soars: 17 Companies Increasing Dividends View All Posts

Popular Posts: Ford Revs Up Its Divvies: 7 Dividend Stocks Increasing Payouts Recent Posts: More Dollar From FDO: 14 Dividend Stocks Increasing Payouts Ford Revs Up Its Divvies: 7 Dividend Stocks Increasing Payouts Boeing Dividend Soars: 17 Companies Increasing Dividends View All Posts Earnings season began in earnest this week, and with it came an increase in the number of companies increasing dividends.

Indeed, 14 dividend stocks increased their payouts over the past week, including discount retailing giant Family Dollar (FDO). Here’s a look at the new dividend being paid out to FDO stock holders, as well as the improvements from other dividend stocks in the past week.

Indeed, 14 dividend stocks increased their payouts over the past week, including discount retailing giant Family Dollar (FDO). Here’s a look at the new dividend being paid out to FDO stock holders, as well as the improvements from other dividend stocks in the past week.

(Note: all dividend yields are as of Jan. 17):

Investment management firm BlackRock (BLK) raised its quarterly dividend 15% to $1.93 cents per share, payable March 24 to shareholders of record March 7.

BLK Dividend Yield: 2.4%

The biggest increase in our dividend stocks this week came from reservoir management and services company Core Labs (CLB), which raised its quarterly dividend 56.25% to 50 cents per share, payable Feb. 21 to shareholders of record Jan. 24.

CBL Dividend Yield: 1.05%

Vehicle components, manufacturer and supplier Delphi (DLPH) raised its quarterly dividend 47% to 25 cents per share payable Feb. 27 to shareholders of record Feb. 18.

DLPH Dividend Yield: 1.60%

Entertainment properties real estate investment trust EPR Properties (EPR) raised its monthly dividend 28.5 cents per share, payable Feb. 18 to shareholders of record Jan. 31. EPR stock is the highest yielder of this week’s dividend stocks.

EPR Dividend Yield: 6.77%

Discount retail store chain Family Dollar (FDO) raised its quarterly dividend 19.2% to 31 cents per share. FDO has not announced a dividend payout or ex-dividend date.

FDO Dividend Yield: 1.91%

Mall-based specialty retailer Finish Line (FINL) raised its quarterly dividend 14% to 8 cents per share, payable March 17 to shareholders of record Feb. 28.

FINL Dividend Yield: 1.19%

Semi-fabricated aluminum products manufacturer Kaiser Aluminum (KALU) raised its quarterly dividend 17% to 35 cents per share, payable Feb. 14 to shareholders of record Jan. 24.

KALU Dividend Yield: 1.98%

Pipeline transportation and storage master limited partnership Kinder Morgan Energy Partners (KMP) raised its quarterly distribution 1% to $1.36 per share, payable Feb. 14 to shareholders of record Jan. 31.

KMP Dividend Yield: 6.68%

Analog integrated circuits and products manufacturer Linear Technology (LLTC) raised its quarterly dividend 3.8% to 27 cents per share, payable Feb. 26 to shareholders of record Feb. 14. This marks the 22nd consecutive annual dividend increase for Linear.

LLTC Dividend Yield: 2.33%

Television broadcasting and digital media company Nexstar Broadcasting (NXST) raised its quarterly dividend 25% to 15 cents per share payable Feb. 28 to shareholders of record Feb. 14.

NXST Dividend Yield: 1.28%

Healthcare facilities REIT Omega Healthcare (OHI) raised its quarterly dividend 2% to 49 cents per share, payable Feb. 14 to shareholders of record Jan. 31.

OHI Dividend Yield: 6.1%

Diversified energy provider Oneok (OKE) raised its quarterly dividend 5% to 40 cents per share payable Feb. 18 to shareholders of record Feb. 10.

OKS Dividend Yield: 2.38%

Midstream natural and liquid gas services company Targa Resources Partners LP (NGLS) raised its quarterly dividend 2% to 74.75 cents per share, payable Feb. 14 to shareholders of record Jan. 27.

NGLS Dividend Yield: 5.93%

Diversified utility holding company Wisconsin Energy (WEC) raised its quarterly dividend 2% to 39 cents per share, payable March 1 to shareholders of record Jan. 31.

WES Dividend Yield: 3.78%

Marc Bastow is an Assistant Editor at InvestorPlace.com. As of this writing he did not hold a position in any of the aforementioned securities. For more dividend stocks increasing payouts, see previous weeks' lists of Companies Increasing Dividends.

Federal Reserve Overstepped Bounds with Monetary Policy

By EconMatters

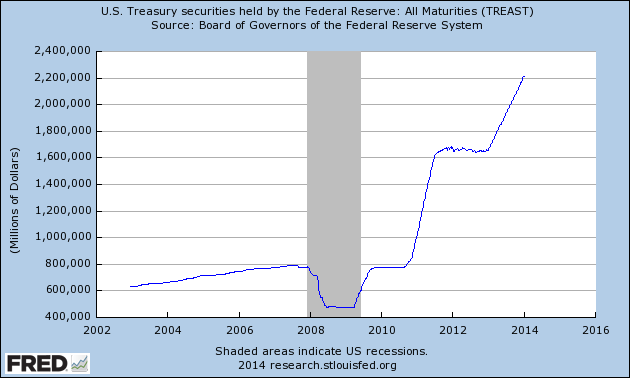

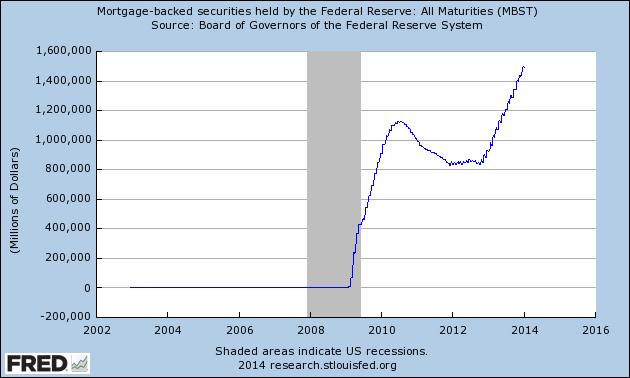

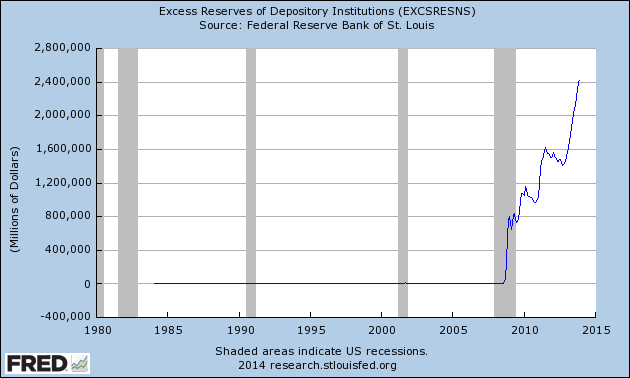

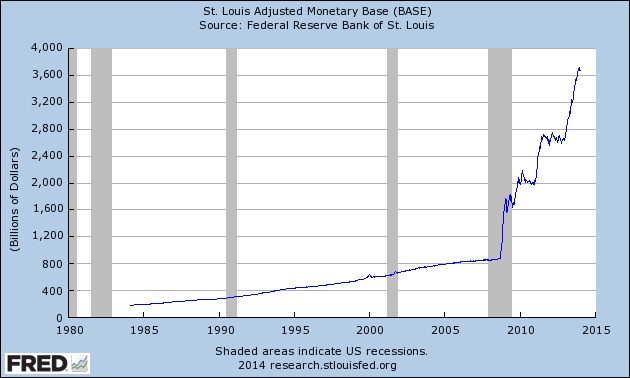

Checks & Balances If you think about it the President has checks and balances, the Supreme Court has checks and balances, and even the two houses of Congress have checks and balances. However as we have seen with the last 5 years of Fed policy that there is no actual checks and balances for what the Federal Reserve can and cannot do with regard to monetary policy, and there should be. It might not be so apparent now, but it sure will be five years from now when all is evaluated. The big takeaway will be how in the heck did we let the Federal Reserve conduct all of these ad-hoc policy initiatives with some obvious detrimental effects and unintended consequences for financial markets and the US economy? Where would Markets Go without $75 Billion assistance each month? Let us start with the most obvious detriment to financial markets the bubble that is the US equities market. Despite what Goldman Sachs says with their double speak to appease wealthy clients who they told to be invested in markets last week and this week said the markets are 10% over-valued, but there is no bubble – there is in fact a bubble in stocks.

Checks & Balances If you think about it the President has checks and balances, the Supreme Court has checks and balances, and even the two houses of Congress have checks and balances. However as we have seen with the last 5 years of Fed policy that there is no actual checks and balances for what the Federal Reserve can and cannot do with regard to monetary policy, and there should be. It might not be so apparent now, but it sure will be five years from now when all is evaluated. The big takeaway will be how in the heck did we let the Federal Reserve conduct all of these ad-hoc policy initiatives with some obvious detrimental effects and unintended consequences for financial markets and the US economy? Where would Markets Go without $75 Billion assistance each month? Let us start with the most obvious detriment to financial markets the bubble that is the US equities market. Despite what Goldman Sachs says with their double speak to appease wealthy clients who they told to be invested in markets last week and this week said the markets are 10% over-valued, but there is no bubble – there is in fact a bubble in stocks.  Seems like a Bubble The barometer to use is this: If the Fed stopped cold turkey tomorrow all asset purchases, the Dow would drop 3,500-4,000 points in less than a year (maybe even as little as 6 months), and this is a conservative 25% drop in value just in the short term. If they were never allowed to intervene in financial markets with asset purchases ever again, eventually markets would fall back to sustainable levels, and all the previous liquidity fueled price appreciation in equities of the last 5 plus years would eventually come out of assets like stocks and real fundamental value would be established. My guess is that the Dow would fall back to around the 1,000 level on its own merits over the next 3 years with no asset purchases whatsoever by the Federal Reserve, something in the order of a 40% drop in value. Bond Market: A Debt Risk Valuation Mechanism The Bond market is intended for debt to be issued by parties with parties independent of the debt issuers to then determine a fair market price for the risk of holding said debt in the marketplace, and not a social instrument for creating additional liquidity in financial markets which finds its way into the equities, commodities and currency markets via carry trade liquidity driven fund flows.

Seems like a Bubble The barometer to use is this: If the Fed stopped cold turkey tomorrow all asset purchases, the Dow would drop 3,500-4,000 points in less than a year (maybe even as little as 6 months), and this is a conservative 25% drop in value just in the short term. If they were never allowed to intervene in financial markets with asset purchases ever again, eventually markets would fall back to sustainable levels, and all the previous liquidity fueled price appreciation in equities of the last 5 plus years would eventually come out of assets like stocks and real fundamental value would be established. My guess is that the Dow would fall back to around the 1,000 level on its own merits over the next 3 years with no asset purchases whatsoever by the Federal Reserve, something in the order of a 40% drop in value. Bond Market: A Debt Risk Valuation Mechanism The Bond market is intended for debt to be issued by parties with parties independent of the debt issuers to then determine a fair market price for the risk of holding said debt in the marketplace, and not a social instrument for creating additional liquidity in financial markets which finds its way into the equities, commodities and currency markets via carry trade liquidity driven fund flows.  It is supposed to be a risk profiler to keep governments and issuers in check in regard to issuing responsible debt at appropriate times. When debt levels reach unsustainable levels, a healthy and natural bond market prices risk accordingly; thereby incentivizing necessary changes to fiscal and monetary policies. This mechanism has been greatly distorted by Fed policy, and the long-term consequences are hard to adequately calculate at this point, but they are definitely a cost – the debate is just how high a cost? Stock Market: A Valuation Mechanism The most important point is this the stock market was intended to be a valuation mechanism for public companies based upon how well their business was being run, the economics of their given business paradigm, and the health of the broader macro-economic fundamentals of the market for their goods and services. Social Engineering Instrument It was not built as an instrument for social engineering, manipulation by a government entity, or tool to be used for monetary policy; private companies went public to raise additional financing for their capital structure to grow the business, and the market put a value on the business based upon the future prospects of the given business. It was never intended as a risk free enterprise. Companies were going to fail, investors were going to lose money; others would flourish, investors would reward these companies with higher stock prices. Fundamentally, the market mechanism would both reward and punish based upon actual operating results of the companies. This is how a healthy financial market is supposed to work, and we have devolved so far from this healthy and natural market valuation model that there cannot without question be major price discovery distortions in stocks, as in, a bubble in stocks, and the stock market pricing mechanism in general! The Fed has positively incentivized the more Nefarious Elements of Stock Buybacks Stock buybacks are bad enough, and have distorted operating results considerably with artificially making earnings appear better than they actually are, it provides incentives for other investors to front-run these company buybacks, and they are not being used properly these days by companies, i.e., buying back when shares are cheap relative to company prospects, and selling shares when they are expensive relative to company prospects – again a natural valuation mechanism. Instead they are being utilized by management to distort prices not because business prospects are so bright, but rather they can borrow cheaply right now ( again thanks to the Fed) and artificially boost their own stock prices and make shareholders happy in their performance of running and managing the company. Stock buybacks have in a sense become so perverted from their original purpose that they have become payoffs to like and invest in the company, not because the company is performing so well from an operation`s standpoint, but because they are going to buy back their own stock. It becomes both a deterrent for shorting the stock, and sort of 'mafia bribe' for shareholders to invest in the company. Remember, this isn`t even company money, these companies are borrowing to buy back shares! This is fundamentally as screwed up from a management standpoint as one can get, one should borrow money to grow the business and create long-term value, not create balance sheet liabilities for the company solely for the purpose of juicing up the company`s stock price! This further distorts actual natural market pricing in stocks, there is no actual business evaluation going on currently in financial markets, there are just liquidity injections or price distorting practices. Textbook Definition of Bubble: Non Market Price Discovery Moreover, since all these liquidity injection practices are from the long side, it would stand to reason that value is being distorted heavily to the upside, this is about as close to the text book definition of a bubble that one could possibly create, and the Federal Reserve is at the heart of doing just this act! The stock market I repeat is supposed to be an evaluator of companies, and not a social welfare program to bring about some higher good for economy policy.

It is supposed to be a risk profiler to keep governments and issuers in check in regard to issuing responsible debt at appropriate times. When debt levels reach unsustainable levels, a healthy and natural bond market prices risk accordingly; thereby incentivizing necessary changes to fiscal and monetary policies. This mechanism has been greatly distorted by Fed policy, and the long-term consequences are hard to adequately calculate at this point, but they are definitely a cost – the debate is just how high a cost? Stock Market: A Valuation Mechanism The most important point is this the stock market was intended to be a valuation mechanism for public companies based upon how well their business was being run, the economics of their given business paradigm, and the health of the broader macro-economic fundamentals of the market for their goods and services. Social Engineering Instrument It was not built as an instrument for social engineering, manipulation by a government entity, or tool to be used for monetary policy; private companies went public to raise additional financing for their capital structure to grow the business, and the market put a value on the business based upon the future prospects of the given business. It was never intended as a risk free enterprise. Companies were going to fail, investors were going to lose money; others would flourish, investors would reward these companies with higher stock prices. Fundamentally, the market mechanism would both reward and punish based upon actual operating results of the companies. This is how a healthy financial market is supposed to work, and we have devolved so far from this healthy and natural market valuation model that there cannot without question be major price discovery distortions in stocks, as in, a bubble in stocks, and the stock market pricing mechanism in general! The Fed has positively incentivized the more Nefarious Elements of Stock Buybacks Stock buybacks are bad enough, and have distorted operating results considerably with artificially making earnings appear better than they actually are, it provides incentives for other investors to front-run these company buybacks, and they are not being used properly these days by companies, i.e., buying back when shares are cheap relative to company prospects, and selling shares when they are expensive relative to company prospects – again a natural valuation mechanism. Instead they are being utilized by management to distort prices not because business prospects are so bright, but rather they can borrow cheaply right now ( again thanks to the Fed) and artificially boost their own stock prices and make shareholders happy in their performance of running and managing the company. Stock buybacks have in a sense become so perverted from their original purpose that they have become payoffs to like and invest in the company, not because the company is performing so well from an operation`s standpoint, but because they are going to buy back their own stock. It becomes both a deterrent for shorting the stock, and sort of 'mafia bribe' for shareholders to invest in the company. Remember, this isn`t even company money, these companies are borrowing to buy back shares! This is fundamentally as screwed up from a management standpoint as one can get, one should borrow money to grow the business and create long-term value, not create balance sheet liabilities for the company solely for the purpose of juicing up the company`s stock price! This further distorts actual natural market pricing in stocks, there is no actual business evaluation going on currently in financial markets, there are just liquidity injections or price distorting practices. Textbook Definition of Bubble: Non Market Price Discovery Moreover, since all these liquidity injection practices are from the long side, it would stand to reason that value is being distorted heavily to the upside, this is about as close to the text book definition of a bubble that one could possibly create, and the Federal Reserve is at the heart of doing just this act! The stock market I repeat is supposed to be an evaluator of companies, and not a social welfare program to bring about some higher good for economy policy.  Even if they succeeded in creating a short-term wealth effect for a portion of the population that ended up trickling down to some small extent to the broader economy, the damage to the already shaky financial markets that have crashed three times in fifteen years from a long-term perspective is just a case of the Fed overstepping their bounds and destroying financial markets in the process! On any reasonably weighted Cost/Benefit Analysis this is just too high a price to pay! Do not Trust Anything an I-Bank says for Public Consumption Goldman Sachs like many of these investment banks have benefited immensely from the Fed overstepping their bounds in financial markets with asset purchases, they are never going to openly tell the American public whether there is a bubble in stocks.

Even if they succeeded in creating a short-term wealth effect for a portion of the population that ended up trickling down to some small extent to the broader economy, the damage to the already shaky financial markets that have crashed three times in fifteen years from a long-term perspective is just a case of the Fed overstepping their bounds and destroying financial markets in the process! On any reasonably weighted Cost/Benefit Analysis this is just too high a price to pay! Do not Trust Anything an I-Bank says for Public Consumption Goldman Sachs like many of these investment banks have benefited immensely from the Fed overstepping their bounds in financial markets with asset purchases, they are never going to openly tell the American public whether there is a bubble in stocks.  In fact, they have a long history of not even telling their own clients their actual feelings on markets. And given how many times these investment banks have royally screwed up their own financial investments, half of them probably have no clue of the conditions ripe for constituting a bubble in the first place until after the fact! Precedents & Moral Hazard The real overstepping by the Federal Reserve to actually buying up financial assets has severely distorted the market process, and the long-term damage to what financial markets are supposed to be about from an overall philosophy, fundamental and mechanical methodology standpoint with the associated costs is really incalculable.

In fact, they have a long history of not even telling their own clients their actual feelings on markets. And given how many times these investment banks have royally screwed up their own financial investments, half of them probably have no clue of the conditions ripe for constituting a bubble in the first place until after the fact! Precedents & Moral Hazard The real overstepping by the Federal Reserve to actually buying up financial assets has severely distorted the market process, and the long-term damage to what financial markets are supposed to be about from an overall philosophy, fundamental and mechanical methodology standpoint with the associated costs is really incalculable.  How do you put a value on destroying natural price discovery in financial markets? You cannot, so despite the current size of the bubble the fed has created short-term, the long-term bubble of completely destroying actual price discovery in financial markets by being able to step in and buy financial assets in markets is the real harm here. Moreover, that this act has become acceptable fed policy turf, this precedent and the fact that there were no proper checks and balances to restrict and question this intervention is the harmful and malicious fallout that will inevitably become the Bernanke Legacy. Either Markets are forever Annual Social Welfare Policy Programs or Legislation is Required to Restrict future Fed Intervention in Financial Markets with intermittent Asset Purchases There are many other measures the Fed could entertain instead of the path that Bernanke chose in destroying forever the concept of what constitutes a market mechanism. Consequently unless the Fed has forever changed what markets actually are, social good mechanisms for government wealth creation, and that means a socialized commitment for eternity, i.e., the market must appreciate 10% every year regardless of broader economics or fundamentals. Then they have caused more damage by creating a short-term bubble that is unsustainable on its own, and have set the stage for future ad-hoc interventionist asset purchases in markets on equally subjectivist timeframes and justification! This is the real area where the Fed is guilty of overstepping its bounds. They have forever destroyed financial markets with interventionist policies, and future legislation will have to be created to limit the Fed`s power in this area, and restore financial markets back to their intended purpose. Yes financial markets are built and intended to fail at times, once they are no longer allowed to fail, they become state tools for policy outcomes. And this reality is a bigger failure in a democratic state, than any short-term and well-meaning goals that result from such policies.

How do you put a value on destroying natural price discovery in financial markets? You cannot, so despite the current size of the bubble the fed has created short-term, the long-term bubble of completely destroying actual price discovery in financial markets by being able to step in and buy financial assets in markets is the real harm here. Moreover, that this act has become acceptable fed policy turf, this precedent and the fact that there were no proper checks and balances to restrict and question this intervention is the harmful and malicious fallout that will inevitably become the Bernanke Legacy. Either Markets are forever Annual Social Welfare Policy Programs or Legislation is Required to Restrict future Fed Intervention in Financial Markets with intermittent Asset Purchases There are many other measures the Fed could entertain instead of the path that Bernanke chose in destroying forever the concept of what constitutes a market mechanism. Consequently unless the Fed has forever changed what markets actually are, social good mechanisms for government wealth creation, and that means a socialized commitment for eternity, i.e., the market must appreciate 10% every year regardless of broader economics or fundamentals. Then they have caused more damage by creating a short-term bubble that is unsustainable on its own, and have set the stage for future ad-hoc interventionist asset purchases in markets on equally subjectivist timeframes and justification! This is the real area where the Fed is guilty of overstepping its bounds. They have forever destroyed financial markets with interventionist policies, and future legislation will have to be created to limit the Fed`s power in this area, and restore financial markets back to their intended purpose. Yes financial markets are built and intended to fail at times, once they are no longer allowed to fail, they become state tools for policy outcomes. And this reality is a bigger failure in a democratic state, than any short-term and well-meaning goals that result from such policies.

© EconMatters All Rights Reserved | Facebook | Twitter | Post Alert | Kindle

The following article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

Posted-In: Economics Federal Reserve Markets

Originally posted here...

Most Popular 9 One-Time Penny Stocks Didn't Stay That Way China Gold Stone Mining Reports Cash Tender Bid for Allied Nevada Shares, Tendering Holders Will Be Paid $7.50/Share in Cash UPDATE: Ralph Nader Issues Letter to Sirius XM Holders Bank of America vs. Citigroup - Which Is The Better Bet? Four Apple Stories From Monday You May Have Missed Ford's Alan Mulally Talks Aluminum, His Future & His Favorite Ride Related Articles () Stocks Going Ex Dividend the Fourth Week of January Citi Announces Sale of Mortgage Servicing Rights for Loans with Unpaid Principal Balance of $10.3B Kinder Morgan Energy Partners Rises Slightly After Q4 Earnings Beat Market Wrap For January 15: Bulls Take Over As Economic Growth Remains Healthy CSX Falls 3% After In-Line Q4 Zoom Technologies Confirms Plans to Buy Tinho Union Holding Group Around the Web, We're Loving... Lightspeed Trading Presents: Thunder and Tubleweeds: Trading Techniques for the New Market Enviroment Pope Francis Rips 'Trickle-Down' Economics Come See How the Pro's Trade in this Exclusive Webinar Wynn, MGM, Other Casino Giants Vying For U.S. Turf What Should You Know About AMZN? View the discussion thread. Partner NetworkThursday, February 20, 2014

5 Ugly Facts From Wal-Mart’s Disappointing Earnings

Popular Posts: 10 Things You Didn’t Know About Microsoft CEO Satya Nadella3 Reasons Chipotle Is Destroying McDonald’sWalmart Is Losing the Low-Price Wars to Dollar Stores Recent Posts: 5 Ugly Facts From Wal-Mart’s Disappointing Earnings New Barbie Is An Entrepreneur With a Tablet And Smartphone Walmart Is Losing the Low-Price Wars to Dollar Stores View All Posts

Popular Posts: 10 Things You Didn’t Know About Microsoft CEO Satya Nadella3 Reasons Chipotle Is Destroying McDonald’sWalmart Is Losing the Low-Price Wars to Dollar Stores Recent Posts: 5 Ugly Facts From Wal-Mart’s Disappointing Earnings New Barbie Is An Entrepreneur With a Tablet And Smartphone Walmart Is Losing the Low-Price Wars to Dollar Stores View All Posts Wal-Mart (WMT) announced Q4 adjusted earnings of $1.60 per share this morning, a penny higher than analysts’ expectations.

Guidance was fairly weak, and the early read on Q2 doesn’t seem too promising.

Guidance was fairly weak, and the early read on Q2 doesn’t seem too promising.

Management pointed to unfavorable external factors.

But we can’t ignore internal issues.

Brian Sozzi, chief equities strategist at Belus Capital Advisors, points to “five shocking aspects” of the report. From his note to clients:

Wal-Mart is accelerating new store openings in the U.S. while failing to address (and communicate to the Street) the operating issues in its supercenters, such as unproductive space and out of stocks in fast-turning products (fresh food, consumables). That turning a blind eye is a recipe for long-term margin and returns pressure. Bill Simon has entered 2014 as the President of Wal-Mart U.S. following another year of over-promising and under-delivering. We think if performance does not stabilize shortly, the company will make a change in its U.S. leadership ahead of back to school 2014. At +2.4%, Wal-Mart's inventory growth continues to run in advance of its negative comps. This is something on display in our latest video footage inside Wal-Mart stores. Specifically, excess clothing and seasonal goods on deep discount in dedicated areas of the store (such as garden centers). Core Wal-Mart and Sam's Club 4Q13 comps (excluding online) -0.7% and -0.5%, respectively. Our interpretation is that this performance was worse than implied by management's warning issued in late January. Gross margin -40 bps in 4Q13, giving us a glimpse into what Wal-Mart is having to do on price to compete with price matching competitors and their (and its own) website.“Wal-Mart is not one to acknowledge operating missteps,” writes Sozzi. “The company went onto express confidence in positive U.S. comps for 1Q14 after underperforming its goal consistently in 2013, and beginning the quarter with weather and economic impacted negative comps.”

See Also:

WAL-MART: Americans Are Getting Squeezed By Reduced Government Benefits, Higher Taxes And Tighter Credit Here’s Zuckerberg’s Statement On WhatsApp Facebook Is Buying Huge Messaging App WhatsApp For $19 Billion! Here’s A Full List Of Medal Winners At The Sochi Olympics Tesla Announces Earnings Today — Here’s What To ExpectAbbott: Growth and a Rising Payout

Our latest featured value recommendation spun-off its research-based prescription drug business at the beginning of 2013; it is now focused on nutritional products, diagnostic equipment, generic drugs, and medical devices, explains J. Royden Ward, editor of Cabot Benjamin Graham Value Investor.

Founded in 1888, Abbott Laboratories (ABT) is the leading provider of blood screening products used to detect pregnancy, heart disease, prostate cancer, hepatitis, HIV, sports doping, and other medical conditions.

The company also produces coronary metallic drug-eluting stents, and LASIK devices used in laser vision surgery.

Abbott has completed two acquisitions to add to its Medical Devices business. The first is IDEV Technologies, which makes a new drug-eluting stent and expands Abbott's endovascular segment.

OptiMedica is the second purchase. It makes an intraocular lens used after cataract surgery and provides Abbott with an immediate entry into the laser cataract surgery market.

Based on an upbeat year in 2013, management provided a very positive outlook for 2014 earnings. I expect sales to increase 7% and earnings per share to climb 12% to 2.25 in 2014.

Solid growth in nutritional products and diagnostic equipment sales will boost results. The company could exceed my forecast if pharmaceutical and medical device sales begin to improve.

The board of directors raised ABT's dividend by 57%, which now provides a yield of 2.4%. The increase marks the 42nd consecutive year that Abbott has increased its dividend payout.

Abbott shares sell at a reasonable current P/E (price to earnings ratio) of 17.8. The company's balance sheet is very strong with lots of cash and low debt.

Subscribe to Cabot Benjamin Graham Value Investor here…

More from MoneyShow.com:

Bristol-Myers Bets on Diabetes and Oncology

Pharmacyclics

Celgene

Wednesday, February 19, 2014

Top Electric Utility Stocks To Watch Right Now

Very mixed news has been released lately on�Tata Motors (NYSE: TTM).

The Mumbai-based company reported a 71 percent jump in net profit to $566 million (35.42 billion rupees) for its fiscal second quarter ending September 30, compared to the same time period a year earlier. Revenue rose 31 percent, beating analysts' expectations.

But nearly all of that profit came from Tata's high-end stable of luxury cars at its Jaguar Land Rover (JLR) Automotive unit ��which was purchased from Ford (NYSE: F) in 2008 and where , according to the Associated Press, quarterly profit climbed 66 percent to $815 million (507 million pounds).

Top Electric Utility Stocks To Watch Right Now: United Reef Limited (URP.V)

New Klondike Exploration Ltd. engages in the acquisition, exploration, and development of mineral properties in Canada. The company holds an option to acquire interest in the Santa Maria gold project, which consists of 5 mining claims that include 11 claim units in the Kenora mining division, northwestern Ontario. It also has a 100% interest in the Nickel Offsets project that consists of 12 patented and 5 unpatented mining claims located in the Sudbury mining division, Ontario. The company was formerly known as Chromos Molecular Systems Inc. and changed its name to New Klondike Exploration Ltd. in August 2012. New Klondike Exploration Ltd. was founded in 1948 and is based in Toronto, Canada.

Top Electric Utility Stocks To Watch Right Now: IRSA Inversiones Y Representaciones S.A. (IRS)

IRSA Investments and Representations Inc., through its subsidiaries, engages in a range of diversified real estate investment and related activities in Argentina. The company is involved in the acquisition, development, and operation of shopping centers, offices, and other non-shopping center properties primarily for rental purposes; development and sale of residential properties; acquisition and operation of luxury hotels; and acquisition of undeveloped land reserves for future development purpose. It also engages in consumer financing activities, including credit card products to its consumers at shopping centers, hypermarkets, and street stores. IRSA Investments and Representations, Inc. was founded in 1943 and is headquartered in Buenos Aires, Argentina.

Top Small Cap Stocks To Invest In 2015: Wynnstay Properties(WSP.L)

Wynnstay Properties plc engages in the investment, development, and management of properties in the United Kingdom. It owns and manages office, retail, warehouse, and industrial properties in southern England. The company was incorporated in 1886 and is based in London, the United Kingdom.

Top Electric Utility Stocks To Watch Right Now: NetSpend Holdings Inc.(NTSP)

Netspend Holdings, Inc., together with its subsidiaries, provides general purpose reloadable (GPR) prepaid debit and payroll cards, and alternative financial service solutions to underbanked and other consumers in the United States. Its GPR cards offer access to FDIC-insured depository accounts with a menu of pricing and features tailored to underbanked consumers needs; and serves as access devices to an FDIC-insured depository account with a bank. The company also provides various products and services to its cardholders, such as direct deposit, interest-bearing savings accounts, bill pay functionality, card-to-card transfer capability, personal financial management tools, and online and mobile phone card account access, as well as overdraft protection through its issuing Banks, and complimentary insurance coverage services. Netspend Holdings, Inc. markets its cards through various distribution channels, including retail distributors, direct-to-consumer and online marketi ng programs, and contractual relationships with corporate employers. As of December 31, 2011, it offered approximately 2.1 million active cards through approximately 600 retail distributors at approximately 40,000 locations; and reload services through approximately 450 retailers at approximately 130,000 locations. The company was founded in 1999 and is based in Austin, Texas.

Advisors' Opinion:- [By Jane Edmondson]

One additional item of note: the stock has been a rumored take-out candidate since another large competitor, NetSpend (NTSP), received an offer to be acquired in February by global payment solutions provider TSYS (TSS).

Top Electric Utility Stocks To Watch Right Now: Peter Hambro Mining Ord 1p(POG.L)

Petropavlovsk PLC engages in the exploration, development, and production of gold deposits in the Pokrovskiy, Pioneer, and Malomir properties in the Russian Federation. The company also involves in the acquisition, exploration, and development of reserves and resources in the Amur north-east belt, Yamal, and Krasnoyarsk regions; and iron-related reserves and resources, which include the Kuranakh, Garinskoye, and Bolshoi Seym deposits in the Amur region, as well as the Kimkanskoye and Sutarskoye deposits in Evreyskaya Avtonomnaya Oblast (EAO). In addition, it engages in the development of related infrastructural opportunities comprising the Nizhneleninskoye-Tongjiang bridge project in the EAO and the Sovertskaya Gavan seaport project in the Khabarovsk Krai region. The company was formerly known as Peter Hambro Mining Plc and changed its name to Petropavlovsk PLC in September 2009. Petropavlovsk PLC was founded in 1994 and is based in London, the United Kingdom.

Top Electric Utility Stocks To Watch Right Now: Genesis Energy LP (GEL)

Genesis Energy, L.P. (Genesis) is a limited partnership focused on the midstream segment of the oil and gas industry in the Gulf Coast region of the United States, primarily Texas, Louisiana, Arkansas, Mississippi, Alabama, Florida and in the Gulf of Mexico. The Company has a portfolio of customers, operations and assets, including pipelines, refinery-related plants, storage tanks and terminals, barges and trucks. Genesis provides an integrated range of services to refineries, oil, natural gas and carbon dioxide (CO2) producers, industrial and commercial enterprises that use sodium hydrosulfide (NaHS) and caustic soda, and businesses that use CO2 and other industrial gases. The Company operates in three segments: Pipeline Transportation, Refinery Services, and Supply and Logistics. In August 2011, the Company acquired black oil barge transportation business of Florida Marine Transporters, Inc. In November 2011, it acquired a 90% interest in a 3,500 barrel per day refinery located in Converse County, Wyoming, including 300 miles of abandoned 3- 6 pipeline. On January 3, 2012, it acquired interests in several Gulf of Mexico crude oil pipeline systems, including its 28% interest in the Poseidon pipeline system, its 29% interest in the Odyssey pipeline system, and its 23% interest in the Eugene Island pipeline system. In August 2013, the Company announced that it has completed the acquisition of all the assets of the downstream transportation business of Hornbeck Offshore Transportation, LLC (Hornbeck).

Pipeline Transportation

The Company transports crude oil and carbon dioxide (CO2) for others for a fee in the Gulf Coast region of the United States through approximately 550 miles of pipeline. Its Pipeline Transportation segment owns and operates three crude oil common carrier pipelines and two CO2 pipelines. Its 235-mile Mississippi System provides shippers of crude oil in Mississippi indirect access to refineries, pipelines, storage terminals and other crude oil infrastructure ! located in the Midwest. Its 100-mile Jay System originates in southern Alabama and the panhandle of Florida and provides crude oil shippers access to refineries, pipelines and storage near Mobile, Alabama. The Company�� 90-mile Texas System transports crude oil from West Columbia to several delivery points near Houston. Its crude oil pipeline systems include access to a total of approximately 0.7 million barrels of crude oil storage.

The Company�� Free State Pipeline is an 86-mile, 20 CO2 pipelines that extends from CO2 source fields near Jackson, Mississippi, to oil fields in eastern Mississippi. It has a twenty-year transportation services agreement (through 2028) related to the transportation of CO2 on its Free State Pipeline.

Refinery Services

Genesis provides services to eight refining operations located in Texas, Louisiana and Arkansas, which operates storage and transportation assets in relation to its business and sell NaHS and caustic soda to industrial and commercial companies. The refinery services involve processing refiner�� sulfur (sour) gas streams to remove the sulfur. The refinery services also include terminals and it utilizes railcars, ships, barges and trucks to transport product. Its contracts are long-term in nature and have an average remaining term of four years.

Supply and Logistics

The Company provides services to Gulf Coast oil and gas producers and refineries through a combination of purchasing, transporting, storing, blending and marketing of crude oil and refined products, primarily fuel oil. It has access to a range of more than 250 trucks, 350 trailers and 50 barges with 1.5 million barrels of terminal storage capacity in multiple locations along the Gulf Coast, as well as capacity associated with its three common carrier crude oil pipelines.

Advisors' Opinion:- [By Seth Jayson]

Genesis Energy (NYSE: GEL ) is expected to report Q2 earnings around July 9. Here's what Wall Street wants to see:

The 10-second takeaway

Comparing the upcoming quarter to the prior-year quarter, average analyst estimates predict Genesis Energy's revenues will grow 30.3% and EPS will grow 52.2%.

Top Electric Utility Stocks To Watch Right Now: O'Reilly Automotive Inc.(ORLY)

O?Reilly Automotive, Inc., together with its subsidiaries, engages in the retail of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States. The company?s stores provide new and remanufactured automotive hard parts, including alternators, starters, fuel pumps, water pumps, brake system components, batteries, belts, hoses, chassis parts, and engine parts; maintenance items comprising oil, antifreeze, fluids, filters, wiper blades, lighting, engine additives, and appearance products; and accessories, such as floor mats, seat covers, and truck accessories. Its stores also offer auto body paint and related materials, automotive tools, and professional service provider service equipment. The company?s stores sell its brand name and private label products for domestic and imported automobiles, vans, and trucks to do-it-yourself customers and professional service providers. As of March 31, 2011, it operated 3,613 stores. The company was foun ded in 1957 and is headquartered in Springfield, Missouri.

Advisors' Opinion:- [By Ben Levisohn]

Autozone has dropped 0.3% to $413.22 �, while�Pep Boys (PBY) has gained 0.2% to $12.19 , Advanced Auto Parts�(AAP) has risen 0.3% to $80.35, and O’Reilly Automotive (ORLY) has advanced 0.3% to $124.42 .

- [By Sue Chang and Ben Eisen]

O��eilly Automotive Inc. (ORLY) �shares advanced 9.2% after it reported fourth-quarter earnings of $1.40 a share, above the $1.33 forecast by analysts. Shares of automotive parts retailer AutoZone Inc. (AZO) �rose 5.5%.

Top Electric Utility Stocks To Watch Right Now: Terra Energy Corp(TT.TO)

Terra Energy Corp., a junior exploration and production company, engages in the exploration, development, and production of petroleum and natural gas in Western Canada. Its operations are primarily located in northeastern British Columbia and the Peace River Arch region of Alberta. As of December 31, 2011, the company had interests in 117 net producing and 280 net non-producing oil, natural gas, and other wells. Terra Energy Corp. is headquartered in Calgary, Canada.

Top Electric Utility Stocks To Watch Right Now: MineFinders Corp. Ltd.(MFN)

Minefinders Corporation Ltd. engages in the exploration, development, and mining of precious and base metal properties. The company?s principal project includes the Dolores gold and silver mine, which consists of 7 claims in 3 concessions totaling an area of 27,700 hectares, located in the Madera Mining District in the state of Chihuahua, Mexico. It also has property interests in Sonora, Mexico; and in Nevada and Arizona, the United States. The company was formerly known as Twentieth Century Explorations Inc. and changed its name to Minefinders Corporation Ltd. in May 1979. Minefinders Corporation Ltd. was founded in 1975 and is headquartered in Vancouver, Canada.

Top Electric Utility Stocks To Watch Right Now: Inergetics Inc.(NRTI.OB)

Inergetics, Inc., through its subsidiary, Millennium Biotechnologies, Inc., operates as a research-based bio-nutraceutical company in the United States. The company engages in the research, development, and marketing of specialized nutritional supplements as an adjunct to medical treatments for select medical conditions, as well as for athletes seeking improved recovery. Its products are used by immuno-compromised individuals undergoing medical treatment for diseases, including cancer, as well as wound healing and post-surgical healing and geriatric patients. The company?s product line includes Resurgex Select, a nutritional formula for cancer patients undergoing chemotherapy or radiation treatments; and Resurgex Essential and Resurgex Essential Plus, the ready-to-drink product line for the long-term care-geriatric markets. It also provides Surgex, a nutritional support formula for athletes, who suffer from fatigue, lean muscle loss, lactic acid buildup, oxidative stress, and stressed immune systems. The company was formerly known as Millennium Biotechnologies Group, Inc. and changed its name to Inergetics, Inc. in March 2010. Inergetics, Inc. was founded in 1967 and is headquartered in Paramus, New Jersey.

Top Electric Utility Stocks To Watch Right Now: ICU Medical Inc.(ICUI)

ICU Medical, Inc. engages in the development, manufacture, and sale of medical technologies used in infusion therapy, oncology, and critical care applications. The company?s product line includes custom infusion systems, closed delivery systems for hazardous drugs, needleless infusion connectors, catheters, and cardiac monitoring systems. Its products enhance patient outcomes by preventing bloodstream infections, protecting healthcare workers and patients from exposure to infectious diseases or hazardous drugs, and monitoring the cardiac output of critical care patients. The company offers intravenous (I.V.) therapy lines consisting of a tube running from a bottle or plastic bag containing an I.V. solution to a catheter inserted in a patient?s vein for use in hospitals and ambulatory clinics; CLAVE product, a needleless I.V. connection device, which would be used with conventional peripheral or central vascular access systems for venous and arterial applications; custom infusion sets. It also provides critical care products that monitor vital signs and specific physiological functions of key organ systems, including disposable pressure-sensing devices, blood sampling systems, angiography kits, sensory catheters, pulmonary artery thermodilution catheters, and multi-lumen central venous catheters. In addition, the company provides TEGO for use in dialysis; a line of oncology products, including Spiros male luer connector device; the Genie vial access device; and custom I.V sets and ancillary products for chemotherapy. ICU Medical, Inc. sells its products to medical product manufacturers and independent medical supply distributors, as well as directly to the end customers worldwide. The company was founded in 1984 and is headquartered in San Clemente, California.

Advisors' Opinion:- [By Sean Williams]

What: Shares of ICU Medical (NASDAQ: ICUI ) �-- a medical device maker in the fields of infusion therapy, oncology, and critical care -- soared as much as 17% on a report that the company could be exploring a sale.

- [By CRWE]

ICU Medical, Inc. (Nasdaq:ICUI), a leader in the development, manufacture and sale of innovative medical devices used in infusion therapy, oncology and critical care applications, reported that Company management will be presenting at the UBS Global Life Sciences Conference to be held on September 19-20, 2012, at the Grand Hyatt Hotel, New York.

- [By Seth Jayson]

ICU Medical (Nasdaq: ICUI ) is expected to report Q2 earnings around July 16. Here's what Wall Street wants to see:

The 10-second takeaway

Comparing the upcoming quarter to the prior-year quarter, average analyst estimates predict ICU Medical's revenues will increase 8.0% and EPS will expand 4.8%.

Top Electric Utility Stocks To Watch Right Now: Regeneron Pharmaceuticals Inc.(REGN)

Regeneron Pharmaceuticals, Inc., a biopharmaceutical company, discovers, develops, and commercializes pharmaceutical products for the treatment of serious medical conditions in the United States. The company?s commercial product includes ARCALYST (rilonacept) injection for subcutaneous use for the treatment of cryopyrin-associated periodic syndromes, including familial cold auto-inflammatory syndrome and muckle-wells syndrome in adults and children. Its products under Phase III clinical development stage consist of VEGF Trap-Eye, an aflibercept ophthalmic solution developed using intraocular delivery for the treatment of serious eye diseases; ARCALYST for the prevention of gout flares in patients initiating uric acid-lowering treatment; and Aflibercept (VEGF Trap), which is developed in oncology. The company?s earlier stage clinical programs include various human antibodies, such as REGN727 for low-density lipoprotein cholesterol reduction, REGN88 for rheumatoid arthritis and ankylosing spondylitis; REGN668 for atopic dermatitis and asthma; REGN421 and REGN910 for oncology; REGN475 for the treatment of pain; and REGN728 and REGN846. It also conducts preclinical research programs in the areas of oncology and angiogenesis, ophthalmology, metabolic and related diseases, muscle diseases and disorders, inflammation and immune diseases, bone and cartilage, pain, cardiovascular diseases, and infectious diseases. The company distributes its products through third party service providers. It has strategic collaboration with sanofi-aventis Group to discover, develop, and commercialize human monoclonal antibodies; and Bayer HealthCare LLC to develop and commercialize VEGF Trap. Regeneron Pharmaceuticals, Inc. was founded in 1988 and is based in Tarrytown, New York.

Advisors' Opinion:- [By Sean Williams]

The lead drug

This is actually the most difficult choice because there are so many top-performing lead drug candidates. In deciding which one to choose I focused on a mixture of total sales potential, time until patent expiration, as well as the potential for indication expansion. I narrowed it down to two lead drug candidates: Celgene's (NASDAQ: CELG ) Revlimid and Regeneron Pharmaceuticals' (NASDAQ: REGN ) Eylea.

Top Electric Utility Stocks To Watch Right Now: HHGregg Inc.(HGG)

hhgregg, Inc. operates as a specialty retailer of consumer electronics, home appliances, and related services. The company offers video products, such as flat panel televisions, blu-rays, and DVD players; appliances, including washers and dryers, refrigerators, cooking ranges, dishwashers, freezers, and air conditioners; and digital camcorders, digital cameras, gaming bundles, home theater receivers, mattresses, MP3 players, computers, personal navigation, tablets, speaker systems, and telephones. It also sells a suite of services, including third-party premium service plans, and third-party in-home service and repair of products, as well as delivery and installation, and in-home repair and maintenance. The company operates its stores under the name of hhgregg. As of February 08, 2012, it operated 208 stores in Alabama, Delaware, Florida, Georgia, Illinois, Indiana, Kentucky, Maryland, Mississippi, New Jersey, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, and Virginia. The company is headquartered in Indianapolis, Indiana.

Advisors' Opinion:- [By Dan Caplinger]

Conn's (NASDAQ: CONN ) will release its quarterly report on Thursday, and the lesser-known retailer of appliances and consumer electronics has quietly put together an impressive long-term investing record. Yet with Best Buy (NYSE: BBY ) having bounced back over the past year from big losses in previous years, the future for Conn's investors hasn't stood out as much. Will smaller companies like Conn's and hhgregg (NYSE: HGG ) keep outpacing Best Buy, or will the larger company end up having the last laugh over its rivals?

Top Electric Utility Stocks To Watch Right Now: Eu Yan Sang International Ltd (E02.SI)

Eu Yan Sang International Ltd, an investment holding company, manufactures, processes, distributes, retails, and sells traditional Chinese and other medicines. It operates through three segments: Traditional Chinese Medicine, Clinics, and Others. The company offers approximately 900 products under the �Eu Yan Sang� brand name; and approximately 1,000 types of Chinese herbs and other medicinal products, which range from Chinese proprietary medicines and functional foods to nutrition or mineral supplements and personal care products. It is also involved in the property investment activities; development, manufacture, and distribution of spa products; and development of iGates, an advanced technology to decipher chemical components in traditional Chinese medicine. In addition, the company acts as a commission agent for various pharmaceutical products; and manufactures medical pills and capsules, as well as provides integrative medical, advertising agency, and packing and su b-processing services. Further, it is engaged in the import, distribution, and sale of honey products; ownership, distribution, retail, and franchising of healthy, beauty, and natural products; and manufacture, import, distribution, retail, and sale of ready-to-drink bird�s nest products and packaged foods. As of June 30, 2013, the company had a distribution network of 300 retail outlets in China, Hong Kong, Macau, Malaysia, Singapore, and Australia. It also operated a chain of 29 traditional Chinese medicine clinics in Singapore and Malaysia, and 2 integrative medical centers in Hong Kong. The company also offers its products through wholesalers, drugstores, pharmacies, medical halls, supermarkets, convenience stores, hospitals, health clubs, and spas in Australia, Canada, China, Hong Kong, Indonesia, Macau, Malaysia, New Zealand, Singapore, Taiwan, Thailand, the United Kingdom, the United States, and Vietnam. Eu Yan Sang International Ltd was founded in 1879 and is headqu artered in Singapore.

U.S. Olive Oil Industry Pushes Gov't to Test Imported Oils

Susan Walsh/APCalifornia Olive Oil Council Executive Director Patricia Darragh. WASHINGTON -- It's a pressing matter for the tiny U.S. olive oil industry: American shoppers more often are going for European imports, which are cheaper and viewed as more authentic. And that's pitting U.S. producers against importers of the European oil, with some likening the battle to the California wine industry's struggles to gain acceptance decades ago. The tiny California olive industry says European olive oil filling U.S. shelves often is mislabeled and lower-grade oil, and they're pushing the federal government to give more scrutiny to imported varieties. One congressman-farmer even goes so far as suggesting labels on imported oil say "extra rancid" rather than "extra virgin." Imposing stricter standards might help American producers grab more market share from the Europeans, who produce in bulk and now have 97 percent of the U.S. market. Olive oil production is growing steadily. The domestic industry, with mostly high-end specialty brands, has gone from 1 percent of the national olive oil market five years ago to 3 percent today. Most of the production is in California, although there are smaller operations in Texas, Georgia and a few other states. Seeking to build on that, the domestic industry has mounted an aggressive push in Washington, holding olive oil tastings for members of Congress and lobbying them to put stricter standards on imports. The strategy almost worked last year when industry-proposed language became part of a massive farm bill passed out of the House Agriculture Committee. The provision backed by California lawmakers would have allowed the Agriculture Department to extend mandatory quality controls for the domestic industry to imports. The bill's language would have allowed government testing of domestic and imported olive oil to ensure that it was labeled correctly. That testing, intended to prevent labeling lower-grade olive oil as "extra virgin" or fraudulently cutting in other types of oil, would be much more comprehensive than what imported oils are subjected to now. But the language was stripped from the bill when it reached the House floor, an effort led by lawmakers from New York, where many of the country's olive oil importers are based. They had the backing of food companies and grocery stores that use and sell olive oil. The floor fight broke down to one between East Coast and West Coast lawmakers. Republican Rep. Doug LaMalfa, a farmer from Northern California, suggested that labels for imported oil should say "extra rancid." "What we're after here is not to cause problems for our friends who would like to market it. It's more just the truth in advertising that's necessary," LaMalfa said. New York Republicans said new testing standards would cost importers millions of dollars. Republican Rep. Michael Grimm of Staten Island, N.Y., said his Greek-American and Italian-American constituents know good oil and haven't had problems. "It's not rancid," he said. "There is always going to be a problem in every industry, but this is nothing more than a multimillion-dollar earmark," he added, using the term for special provisions that sometimes are inserted into legislation. In the end, the final farm bill signed by President Barack Obama earlier this month was silent on olive oil. But a nonbinding statement accompanying the bill encouraged the Agriculture Department, the U.S. Trade Representative and the Food and Drug Administration to "remove the obstacles that are preventing the U.S. olive oil industry from reaching its potential." It cited a 2013 U.S. International Trade Commission report that said international standards are widely unenforced and allow many varieties to be mislabeled and possibly even adulterated. The report also cited subsidies for European olive oil producers and tariffs as barriers to the domestic industry's success. The California olive oil industry widely promoted that report and even boasted of helping to influence it. According to the American Olive Oil Producers Association, California producers arranged farm tours for federal investigators, arranged for witnesses to testify to the group, and even held an olive-oil tasting on Capitol Hill for lawmakers and administration officials. For now, the domestic industry says it will keep pushing. Kimberly Houlding, executive director of the American Olive Oil Producers Association, says producers are still considering petitioning the USDA for an order to establish mandatory quality standards, including frequent testing. Ideally the order would apply to the entire domestic industry, including importers, Houlding says. Eryn Balch of the North American Olive Oil Association, which represents the importers, says they would like to work with the domestic industry to grow the olive oil market in the United States. There's still a lot of the market to grab -- only around 40 percent of U.S. consumers use olive oil right now, and olive oil has only about 15 percent of the volume share compared with other cooking oils. But that market is growing along with increased awareness of olive oil's health benefits compared with other oils. Extra virgin olive oil is often rich in polyphenols, nutrients that are thought to be helpful in preventing heart disease and other illnesses. "If the industry promoted the key proven benefits with a common voice and positive message, the growth potential could be almost limitless," Balch said. The United States now consumes the third largest amount of olive oil of any nation, behind Italy and Spain, according to the trade commission report. The report said consumption has risen by more than 50 percent since 2001 but said most U.S. consumers aren't able to distinguish good olive oil from bad, so they gravitate toward the least costly. Patricia Darragh, director of the California Olive Oil Council, says the domestic industry wouldn't have the capacity to supply all of the country's olive oil, but it is a grassroots industry that is continuing to grow. And in another decade or two, Americans may be more familiar with the domestic variety. "We're where the California wine industry was 20 or 30 years ago," Darragh says. Pre-made soups can contain a large number of ingredients containing GMOs. For instance, Campbell's (CPB) popular condensed Tomato Soup lists high fructose corn syrup as its second biggest ingredient. According to the Non-GMO Project, nearly 88 percent of all corn planted in the United States is GMO.

Susan Walsh/APCalifornia Olive Oil Council Executive Director Patricia Darragh. WASHINGTON -- It's a pressing matter for the tiny U.S. olive oil industry: American shoppers more often are going for European imports, which are cheaper and viewed as more authentic. And that's pitting U.S. producers against importers of the European oil, with some likening the battle to the California wine industry's struggles to gain acceptance decades ago. The tiny California olive industry says European olive oil filling U.S. shelves often is mislabeled and lower-grade oil, and they're pushing the federal government to give more scrutiny to imported varieties. One congressman-farmer even goes so far as suggesting labels on imported oil say "extra rancid" rather than "extra virgin." Imposing stricter standards might help American producers grab more market share from the Europeans, who produce in bulk and now have 97 percent of the U.S. market. Olive oil production is growing steadily. The domestic industry, with mostly high-end specialty brands, has gone from 1 percent of the national olive oil market five years ago to 3 percent today. Most of the production is in California, although there are smaller operations in Texas, Georgia and a few other states. Seeking to build on that, the domestic industry has mounted an aggressive push in Washington, holding olive oil tastings for members of Congress and lobbying them to put stricter standards on imports. The strategy almost worked last year when industry-proposed language became part of a massive farm bill passed out of the House Agriculture Committee. The provision backed by California lawmakers would have allowed the Agriculture Department to extend mandatory quality controls for the domestic industry to imports. The bill's language would have allowed government testing of domestic and imported olive oil to ensure that it was labeled correctly. That testing, intended to prevent labeling lower-grade olive oil as "extra virgin" or fraudulently cutting in other types of oil, would be much more comprehensive than what imported oils are subjected to now. But the language was stripped from the bill when it reached the House floor, an effort led by lawmakers from New York, where many of the country's olive oil importers are based. They had the backing of food companies and grocery stores that use and sell olive oil. The floor fight broke down to one between East Coast and West Coast lawmakers. Republican Rep. Doug LaMalfa, a farmer from Northern California, suggested that labels for imported oil should say "extra rancid." "What we're after here is not to cause problems for our friends who would like to market it. It's more just the truth in advertising that's necessary," LaMalfa said. New York Republicans said new testing standards would cost importers millions of dollars. Republican Rep. Michael Grimm of Staten Island, N.Y., said his Greek-American and Italian-American constituents know good oil and haven't had problems. "It's not rancid," he said. "There is always going to be a problem in every industry, but this is nothing more than a multimillion-dollar earmark," he added, using the term for special provisions that sometimes are inserted into legislation. In the end, the final farm bill signed by President Barack Obama earlier this month was silent on olive oil. But a nonbinding statement accompanying the bill encouraged the Agriculture Department, the U.S. Trade Representative and the Food and Drug Administration to "remove the obstacles that are preventing the U.S. olive oil industry from reaching its potential." It cited a 2013 U.S. International Trade Commission report that said international standards are widely unenforced and allow many varieties to be mislabeled and possibly even adulterated. The report also cited subsidies for European olive oil producers and tariffs as barriers to the domestic industry's success. The California olive oil industry widely promoted that report and even boasted of helping to influence it. According to the American Olive Oil Producers Association, California producers arranged farm tours for federal investigators, arranged for witnesses to testify to the group, and even held an olive-oil tasting on Capitol Hill for lawmakers and administration officials. For now, the domestic industry says it will keep pushing. Kimberly Houlding, executive director of the American Olive Oil Producers Association, says producers are still considering petitioning the USDA for an order to establish mandatory quality standards, including frequent testing. Ideally the order would apply to the entire domestic industry, including importers, Houlding says. Eryn Balch of the North American Olive Oil Association, which represents the importers, says they would like to work with the domestic industry to grow the olive oil market in the United States. There's still a lot of the market to grab -- only around 40 percent of U.S. consumers use olive oil right now, and olive oil has only about 15 percent of the volume share compared with other cooking oils. But that market is growing along with increased awareness of olive oil's health benefits compared with other oils. Extra virgin olive oil is often rich in polyphenols, nutrients that are thought to be helpful in preventing heart disease and other illnesses. "If the industry promoted the key proven benefits with a common voice and positive message, the growth potential could be almost limitless," Balch said. The United States now consumes the third largest amount of olive oil of any nation, behind Italy and Spain, according to the trade commission report. The report said consumption has risen by more than 50 percent since 2001 but said most U.S. consumers aren't able to distinguish good olive oil from bad, so they gravitate toward the least costly. Patricia Darragh, director of the California Olive Oil Council, says the domestic industry wouldn't have the capacity to supply all of the country's olive oil, but it is a grassroots industry that is continuing to grow. And in another decade or two, Americans may be more familiar with the domestic variety. "We're where the California wine industry was 20 or 30 years ago," Darragh says. Pre-made soups can contain a large number of ingredients containing GMOs. For instance, Campbell's (CPB) popular condensed Tomato Soup lists high fructose corn syrup as its second biggest ingredient. According to the Non-GMO Project, nearly 88 percent of all corn planted in the United States is GMO.

Monday, February 17, 2014

Wednesday Analyst Moves: Bank of America Corp, Burger King Worldwide Inc, More (BAC, BKW, CAH, More)