This article was written by Oilprice.com , the leading provider of energy news in the world. Also check out these recent articles:

Why These Lagging Oil Stocks Are Worth A Look

Shell Keen to Put Troubled Nigerian Assets Behind It

Last week, Ukrainian Prime Minister Yatsenyuk pushed a bill through the Verkhovna Rada that would see his country's gas transportation system sold off to a group of international investors. The provisions of the law would permit the transit of natural gas to be blocked. This decision may hurt the fragile industrial recovery in Germany and finish off Ukraine's potential as a gas transit route to Europe.

Germany, which is the industrial heart of the European Union and a major creditor for its debtor nations, is facing the challenge of the double-edged consequences of its inverted Ostpolitik as it pertains to the trade in natural gas. Even the temporary transit risks ensuing from Kiev's decision to block the pipeline may cause a business slump.

The Nobel laureate Joseph Stiglitz offered an unnerving forecast for the German economy. The Columbia University professor, speaking at the conference in the southern German city of Lindau, described economic growth in the Eurozone as "sluggish." The German economy in particular failed to grow during the second quarter, threatening the EU's fragile industrial recovery.

In the years to come, coping with Kiev's attempts to jeopardize the gas-transit system and cut off Europe from its quintessential energy source in the east could become a real headache for Germany's foreign minister, Frank-Walter Steinmeier. The most vivid example of Ukraine's self-destructive policy that has the potential to affect European taxpayers is the recent sale of its gas transportation system.

The imminent agreement, with many conflicting political overtones, will allow sales of 49 percent of Ukraine's gas transportation system to a cobbled-together coalition of foreign shareholders.

First, the non-transparent deal -- sponsored by high-ranking government officials -- is a textbook case of restrictive practices that violate World Trade Organization rules. Secondly, the pipeline itself is anything but an attractive offer.

The major players in the European energy market are very well aware of the quality of the asset. They know that the pipeline is sorely in need of repair and is dependent on gas from a third party. According to some provisions of the law, the transit of natural gas through Ukraine can be blocked. If it really happens, the pipeline's price will immediately plummet to $2 to $3 billion.

Who would buy a broken-down car that can only run using your neighbor's gas?

That's why, in July, Prime Minister Yatsenyuk was so interested in pushing the bill through the Verkhovna Rada that he threatened deputies with his resignation. Last week Mr. Yatsenyuk finally succeeded in passing the buck.

For many years, Ukraine has argued that its gas transportation system is an asset of national importance that wasn't for sale. But the Euromaidan protests changed everything. Ukraine's new media reported that Chevron wants to buy into the country's transit company. While the official representatives of the corporation declined to comment on the "rumors," last year Chevron co-sponsored a conference, "Ukraine in Washington 2013," which starred the U.S. Assistant Secretary of State Victoria Nuland. Her deep involvement in Ukrainian politics, along with her unorthodox but honest vision of the EU, is generally well known.

In passing the new law, government officials in Kiev and the Verkhovna Rada (now dissolved) ignored the fact that the majority of business-savvy Ukrainian voters would never approve the all-Ukrainian referendum on the summertime sale of the country's last reasonably valuable asset. After all, the industrial region of Donbass has been irrevocably lost and the country needs to collect taxes.

The situation surrounding the pipeline deal is reminiscent of the tactics of the United Fruit Company in the mid and late 1960s. Radically right-wing governments were installed in Central and Latin America and that corporation gained control over those countries' main export, bananas.

In Eastern Europe, many countries are not ready to follow Ukraine's footsteps and renounce energy sovereignty. It's no longer fashionable to be a banana republic. The deep-seated crisis in Ukraine and the success story of Nord Stream have encouraged other EU countries, such as Hungary, to diversify their natural-gas supply routes. Hungary's secretary of state for public diplomacy and relations, Zoltán Kovács, recently quoted a statement from his country's prime minister, Viktor Orbán: "No one can question our sovereign right to guarantee our natural gas supplies." The leaders in Budapest are sure that no economic recovery is possible in Germany and EU without long-term natural-gas contracts. All EU members will benefit from stable regional trade patterns.

Events in Ukraine should not dominate the agenda of the whole continent. That would simply be dangerous. It has already become a cliché to compare the Ukrainian crisis with the Spanish Civil War. A couple of years ago, the total "Ukrainization" of EU policy would have been perceived as a bad joke. Today 300,000 jobs are at stake in Germany and it is high time for Berlin to step in and prevent the nationalist frenzy in Kiev from ruining decades of successful business cooperation. Heiko Lohmann, a German natural-gas expert, believes that a fundamental prerequisite for normalization is the continuity of energy relations.

Viewed from this perspective, Hungary's position looks much more "pro-European." Interestingly, the EU's official energy policy papers (the European Ten-Year Network Development Plan (TYNDP 2011-2020) and Energy Infrastructure Priorities for 2020 and Beyond) contradict the hardline political statements of the acting members of the European Commission. According to the published data, Brussels expects to increase natural gas imports from Russia up to 40 percent. Time will tell whether Ukraine's problem-plagued gas transportation system will play any role in these plans.

Do you know this energy tax "loophole"?

You already know record oil and natural gas production is changing the lives of millions of Americans. But what you probably haven't heard is that the IRS is encouraging investors to support our growing energy renaissance, offering you a tax loophole to invest in some of America's greatest energy companies. Take advantage of this profitable opportunity by grabbing your brand-new special report, "The IRS Is Daring You to Make This Investment Now!," and you'll learn about the simple strategy to take advantage of a little-known IRS rule. Don't miss out on advice that could help you cut taxes for decades to come. Click here to learn more.

This building on New York's Upper West Side will have a separate entrance for low-income residents. NEW YORK (CNNMoney) It's a tale of two cities in Manhattan, as the city okayed plans for a luxury condominium with a separate door for low-income residents.

This building on New York's Upper West Side will have a separate entrance for low-income residents. NEW YORK (CNNMoney) It's a tale of two cities in Manhattan, as the city okayed plans for a luxury condominium with a separate door for low-income residents.  Johannes Eisele/AFP/Getty Images The top dog in this generation of video game consoles continues to pad its lead. Sony (SNE) revealed last week that it has sold 10 million PlayStation 4 systems since hitting the market nine months ago. Microsoft (MSFT) has yet to respond, but the latest data out of industry tracker NPD shows that the PS4 was once again the country's best selling system in July. The last time we got comparable data it wasn't even close. Ahead of June's E3 gamer conference, Sony announced that it had sold 7 million PS4s. Microsoft countered by revealing that it had sold 5 million Xbox One consoles to retailers. This wasn't a difference of 2 million boxes. Sony's figure was for devices that had made it all the way into the hands of gamers, while Microsoft's tally included all of the systems collecting dust on store shelves. Technology blog Extreme Tech estimates that Microsoft has sold just half as many of the current generation consoles to consumers as Sony at this point. Add it up, and it's not too shabby. Few figured that the Xbox One and PS4 -- released just a week apart last November -- would have sold a combined 15 million right now. And 5 million XBox Ones is nothing to sneeze at. This doesn't mean that Microsoft can rest easy. It's in a bind. History hasn't been kind to former market leaders that fail to keep up in future generations. If you need proof, just think about what Atari, 3DO and Sega are doing on the console front these days. Gamers are noticing the shift in dominance. Investors will have to follow suit. There Are No Cheat Codes "History has shown us that the first company to reach 10 million in console sales wins the generation battle," is a quote that may come to haunt Microsoft. Those words were spoekn in 2008 by then-Xbox head Don Mattrick when the Xbox 360 beat the PS4 to that meaty milestone. It should be said that the Xbox 360 came out a year before the PS4. It also didn't help that the PS3 hit the market as the priciest of the three systems at the time, setting gamers back as much as $599 in its 2006 debut. Sony learned its lesson. It made sure that it hit the market at a lower price than Microsoft this round. When Microsoft announced last year that it would hit the market at $499, Sony revealed that it would price its device at $399. When Microsoft infuriated gamers by suggesting that it would incorporate some software protective features, Sony cashed in by poking fun of the measures that Microsoft eventually abandoned. The same Sony that gamers hated two years ago when its online gaming network was hacked has suddenly become the rock star in the eyes and controller-clutching grips of diehard gamers. Investors thought that this would be a close race, but folks who play the games and follow the industry knew that PS4 was going to have the early lead in this generation. Microsoft's losing, and it doesn't have a lot of time to catch up. Game On Microsoft has gone from trying to please software developers last summer to trying to woo players this summer. It rolled out a new Xbox One that matches the PS4 at its $399 price point, forgoing the Kinect motion-based camera controller. This upset developers that were making games under the assumption that Kinect would be available to all players, but the gamble seemed to initially pay off when Microsoft announced that Xbox One sales tripled after the pricing move. However, as long as Sony has the lead -- and NPD's data shows that PS4's lead is only widening this summer -- this could lead to bigger headaches for Microsoft. A console needs developers, and game makers aren't going to spend as much time working on titles to serve an estimated 5 million Xbox One players when that same time and effort can be used to target Sony's much larger audience of PS4 owners. Microsoft has several games that are exclusive to the Xbox One, but it's also not a surprise to see that last month's best-selling game -- "The Last of Us Remastered" -- is a PlayStation exclusive. Sony is making sure that it doesn't take anything for granted. At E3 two months ago, it introduced a cloud-based game streaming service called PlayStation Now and entered the set-top media player market with PlayStation TV. Microsoft, on the other hand, continues to reel backwards. Last year's dreams of making the Xbox One the centerpiece of today's home theater haven't played out, and now it's closing the entertainment studio that was going to deliver original video streaming content. Microsoft is back to trying to market its Xbox One as a machine for gamers, but with 10 million early adopters already choosing its longtime rival, it's not going to be easy to stand out. More from Rick Aristotle Munarriz

Johannes Eisele/AFP/Getty Images The top dog in this generation of video game consoles continues to pad its lead. Sony (SNE) revealed last week that it has sold 10 million PlayStation 4 systems since hitting the market nine months ago. Microsoft (MSFT) has yet to respond, but the latest data out of industry tracker NPD shows that the PS4 was once again the country's best selling system in July. The last time we got comparable data it wasn't even close. Ahead of June's E3 gamer conference, Sony announced that it had sold 7 million PS4s. Microsoft countered by revealing that it had sold 5 million Xbox One consoles to retailers. This wasn't a difference of 2 million boxes. Sony's figure was for devices that had made it all the way into the hands of gamers, while Microsoft's tally included all of the systems collecting dust on store shelves. Technology blog Extreme Tech estimates that Microsoft has sold just half as many of the current generation consoles to consumers as Sony at this point. Add it up, and it's not too shabby. Few figured that the Xbox One and PS4 -- released just a week apart last November -- would have sold a combined 15 million right now. And 5 million XBox Ones is nothing to sneeze at. This doesn't mean that Microsoft can rest easy. It's in a bind. History hasn't been kind to former market leaders that fail to keep up in future generations. If you need proof, just think about what Atari, 3DO and Sega are doing on the console front these days. Gamers are noticing the shift in dominance. Investors will have to follow suit. There Are No Cheat Codes "History has shown us that the first company to reach 10 million in console sales wins the generation battle," is a quote that may come to haunt Microsoft. Those words were spoekn in 2008 by then-Xbox head Don Mattrick when the Xbox 360 beat the PS4 to that meaty milestone. It should be said that the Xbox 360 came out a year before the PS4. It also didn't help that the PS3 hit the market as the priciest of the three systems at the time, setting gamers back as much as $599 in its 2006 debut. Sony learned its lesson. It made sure that it hit the market at a lower price than Microsoft this round. When Microsoft announced last year that it would hit the market at $499, Sony revealed that it would price its device at $399. When Microsoft infuriated gamers by suggesting that it would incorporate some software protective features, Sony cashed in by poking fun of the measures that Microsoft eventually abandoned. The same Sony that gamers hated two years ago when its online gaming network was hacked has suddenly become the rock star in the eyes and controller-clutching grips of diehard gamers. Investors thought that this would be a close race, but folks who play the games and follow the industry knew that PS4 was going to have the early lead in this generation. Microsoft's losing, and it doesn't have a lot of time to catch up. Game On Microsoft has gone from trying to please software developers last summer to trying to woo players this summer. It rolled out a new Xbox One that matches the PS4 at its $399 price point, forgoing the Kinect motion-based camera controller. This upset developers that were making games under the assumption that Kinect would be available to all players, but the gamble seemed to initially pay off when Microsoft announced that Xbox One sales tripled after the pricing move. However, as long as Sony has the lead -- and NPD's data shows that PS4's lead is only widening this summer -- this could lead to bigger headaches for Microsoft. A console needs developers, and game makers aren't going to spend as much time working on titles to serve an estimated 5 million Xbox One players when that same time and effort can be used to target Sony's much larger audience of PS4 owners. Microsoft has several games that are exclusive to the Xbox One, but it's also not a surprise to see that last month's best-selling game -- "The Last of Us Remastered" -- is a PlayStation exclusive. Sony is making sure that it doesn't take anything for granted. At E3 two months ago, it introduced a cloud-based game streaming service called PlayStation Now and entered the set-top media player market with PlayStation TV. Microsoft, on the other hand, continues to reel backwards. Last year's dreams of making the Xbox One the centerpiece of today's home theater haven't played out, and now it's closing the entertainment studio that was going to deliver original video streaming content. Microsoft is back to trying to market its Xbox One as a machine for gamers, but with 10 million early adopters already choosing its longtime rival, it's not going to be easy to stand out. More from Rick Aristotle Munarriz Reuters Allergan Chief Executive David Pyott

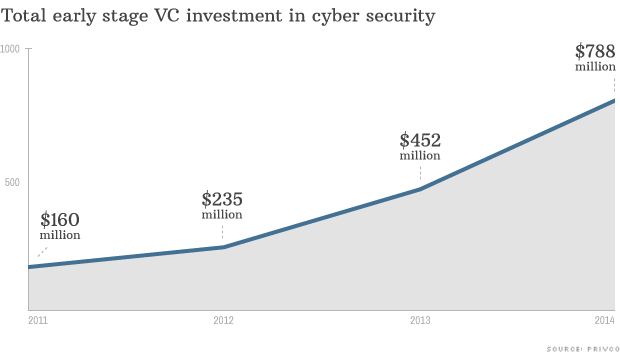

Reuters Allergan Chief Executive David Pyott  NEW YORK (CNNMoney) Online privacy is on the tips of everyone's tongues these days, and investors are rushing to pour money into cybersecurity startups.

NEW YORK (CNNMoney) Online privacy is on the tips of everyone's tongues these days, and investors are rushing to pour money into cybersecurity startups.  Nati Harnik/AP There are all sorts of exclusive clubs on Wall Street -- and then there's Warren Buffett's Berkshire Hathaway (BRK-A). On Thursday, it became the only member of the $200,000-a-share club. That's right: A single share of its Class A stock is trading for more than $200,000. And Berkshire is likely to remain the sole member of that club for a very long time. The next-highest priced stock is Tower Properties (TPRP), a real estate holding company that trades over the counter for $10,500 a share. Some critics have argued for years that Berkshire is overvalued, but it has marched steadily higher year after year. According to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, Berkshire has delivered an annual return of 22.6 percent (including reinvested dividends) ever since the stock topped $100 a share back in 1977. That's a record of consistently outstanding performance unmatched by any other Wall Street guru. $1,000 to $2 Million That means, if you invested $1,000 in Berkshire stock in May of 1977 and let it ride, your investment would be worth $2 million today. The stock is up 13 percent so far this year, well ahead of the 5.6 percent gain for the S&P 500 (^GSPC). Berkshire Hathaway is basically a mutual fund of Buffett's investments, including dozens of companies that he's bought and operated, as well as huge stakes in other publicly traded stocks. The company's biggest stock holdings are in Wells Fargo (WFC) (more than $23 billion worth of stock) and in Coca-Cola (KO) (more than $16- billion). Buffett has also placed big bets on financial companies American Express (AXP) and Goldman Sachs (GS), energy giants Exxon Mobil (XOM) and ConocoPhillips (COP), DirecTV (DTV), DaVita Healthcare (DVA), and many others. Buy and Hold Buffett has long preached a buy-and-hold investment strategy, and he's maintained investments in many of these companies for several decades. In addition to those stock market investments, Berkshire also owns a long list of insurance, railroad, energy and consumer business. Among the best-known brands are Geico, Burlington Northern Santa Fe, Fruit of the Loom, Dairy Queen and Mars. Last year, Berkshire acquired H.J. Heinz. But unlike most other big-time buyout specialists, Buffett and partner Charlie Munger usually keep the existing management and staff of the companies being bought. Just like his stock market strategy, he buys with a long-term view, not so worried about the quarter-to-quarter gyrations that dominate Wall Street trading. Pilgrimages to Omaha Buffett is widely considered an investment genius, and his nickname of the "Oracle of Omaha" reflects that he still lives in that same Nebraska city where he was born. Each year, tens of thousand of Berkshire Hathaway investors flock to Omaha for the company's annual Investor Day activities, hoping that some of Buffett's wisdom will rub off on them. Buffett, who turns 84 later this month, was ranked as the world's richest person back in 2008, before he started giving billions of his vast fortune, primarily through the Bill & Melinda Gates Foundation. Unlike most companies, Berkshire has refused to split its stock to make it more affordable for investors. Buffett believes the high price encourages investors to be more like him -- willing to place long-term bets on the American economy. More from Drew Trachtenberg

Nati Harnik/AP There are all sorts of exclusive clubs on Wall Street -- and then there's Warren Buffett's Berkshire Hathaway (BRK-A). On Thursday, it became the only member of the $200,000-a-share club. That's right: A single share of its Class A stock is trading for more than $200,000. And Berkshire is likely to remain the sole member of that club for a very long time. The next-highest priced stock is Tower Properties (TPRP), a real estate holding company that trades over the counter for $10,500 a share. Some critics have argued for years that Berkshire is overvalued, but it has marched steadily higher year after year. According to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, Berkshire has delivered an annual return of 22.6 percent (including reinvested dividends) ever since the stock topped $100 a share back in 1977. That's a record of consistently outstanding performance unmatched by any other Wall Street guru. $1,000 to $2 Million That means, if you invested $1,000 in Berkshire stock in May of 1977 and let it ride, your investment would be worth $2 million today. The stock is up 13 percent so far this year, well ahead of the 5.6 percent gain for the S&P 500 (^GSPC). Berkshire Hathaway is basically a mutual fund of Buffett's investments, including dozens of companies that he's bought and operated, as well as huge stakes in other publicly traded stocks. The company's biggest stock holdings are in Wells Fargo (WFC) (more than $23 billion worth of stock) and in Coca-Cola (KO) (more than $16- billion). Buffett has also placed big bets on financial companies American Express (AXP) and Goldman Sachs (GS), energy giants Exxon Mobil (XOM) and ConocoPhillips (COP), DirecTV (DTV), DaVita Healthcare (DVA), and many others. Buy and Hold Buffett has long preached a buy-and-hold investment strategy, and he's maintained investments in many of these companies for several decades. In addition to those stock market investments, Berkshire also owns a long list of insurance, railroad, energy and consumer business. Among the best-known brands are Geico, Burlington Northern Santa Fe, Fruit of the Loom, Dairy Queen and Mars. Last year, Berkshire acquired H.J. Heinz. But unlike most other big-time buyout specialists, Buffett and partner Charlie Munger usually keep the existing management and staff of the companies being bought. Just like his stock market strategy, he buys with a long-term view, not so worried about the quarter-to-quarter gyrations that dominate Wall Street trading. Pilgrimages to Omaha Buffett is widely considered an investment genius, and his nickname of the "Oracle of Omaha" reflects that he still lives in that same Nebraska city where he was born. Each year, tens of thousand of Berkshire Hathaway investors flock to Omaha for the company's annual Investor Day activities, hoping that some of Buffett's wisdom will rub off on them. Buffett, who turns 84 later this month, was ranked as the world's richest person back in 2008, before he started giving billions of his vast fortune, primarily through the Bill & Melinda Gates Foundation. Unlike most companies, Berkshire has refused to split its stock to make it more affordable for investors. Buffett believes the high price encourages investors to be more like him -- willing to place long-term bets on the American economy. More from Drew Trachtenberg Paul Morris/Bloomberg/Getty Images There were plenty of winners and losers this week, with a fast food chain's attempt to offer healthier fare falling short and the world's largest networking equipment company letting pink slips fly. Here's a rundown of the week's smartest moves and biggest blunders. Satisfries -- Loser Burger King Worldwide (BKW) is giving up on trying to woo calorie counters. The burger chain is discontinuing Satisfies -- the crinkle-cut fries that contain 40 percent less fat and 30 percent fewer calories than McDonald's (MCD) signature spud sticks -- at most restaurants. Some franchisees will keep offering Satisfries, but the item didn't stick on its menu for much more than a year. Burger King claims that the item didn't sell well despite clearing roughly 100 million orders for the slightly less unhealthy fries. One can argue that Satisfries were doomed because of Burger King chose to charge more for an order than its traditional fries. Fast food joints are magnetic to folks looking to save money. Plus Burger King isn't a big draw to folks on a diet despite following rivals into salads. Monster Beverage (MNST) -- Winner Coca-Cola (KO) has struggled to make a dent in the energy drink market dominated by Red Bull and Monster, so it's betting on a winner. Coca-Cola is investing $2.15 billion to buy a 16.7 percent stake in Monster Beverage. It's a smart move for Coca-Cola as it continues to diversify from carbonated drinks that have fallen out of favor with consumers. However, it's a bigger deal for Monster Beverage. The stock jumped on the news, and rightfully so. Green Mountain Coffee Roasters (GMCR) has soared since Coca-Cola made a similar investment earlier this year. Cisco (CSCO) -- Loser It's another round of pink slips at Cisco. The networking gear giant announced that it that it will be dismissing 6,000 workers or 8 percent of its staff. It's a big number, but the market shouldn't be surprised. This is the fourth summer in a row that it has announced layoffs. Cisco has seen better days. It was the country's most valuable company for a little while at the peak of the dot-com boom. It's been harder to find growth on this end of the dot-com bubble as failed acquisitions and competitive challenges have weighed on results. If these summer layoffs continue, it won't be long before employee morale is a bigger concern than opportunities for growth. MannKind (MNKD) -- Winner MannKind has a game-changing drug on its hands, and now it has a financially strong partner to help market it. Afrezza -- an inhaled insulin that was approved by the Food and Drug Administration earlier this summer -- could be a godsend to folks with diabetes who are weary of needle pricks. Now MannKind is teaming up with Sanofi (SNY) to help get it to market in time for next year's launch. MannKind isn't flush with cash or seasoned with experience, and that's why many upstart biotechs and drug makers team up with larger partners. Some of the warnings associated with Afrezza could have scared off potential partners, but the far-reaching potential of Afrezza was too tempting for Sanofi to pass up here. SeaWorld Entertainment (SEAS) -- Loser It's been a great summer for theme park operators, unless you happen to be SeaWorld. Shares of the company behind the namesake marine life attractions, Busch Gardens and a few water parks plunged after posting disappointing quarterly results. Revenue fell when analysts were holding out for growth. With the Easter holiday and good weather in its favor, it seemed as if this would be a rare winning quarter for SeaWorld. It wasn't. SeaWorld can't seem to shake the negative consumer sentiment that has been brewing since last summer's release of the "Blackfish" documentary that takes the park to task for having orcas in captivity. It's not just the seasonally potent summer quarter that's not working out for SeaWorld. It's hosing down its guidance for the entire year. More from Rick Aristotle Munarriz

Paul Morris/Bloomberg/Getty Images There were plenty of winners and losers this week, with a fast food chain's attempt to offer healthier fare falling short and the world's largest networking equipment company letting pink slips fly. Here's a rundown of the week's smartest moves and biggest blunders. Satisfries -- Loser Burger King Worldwide (BKW) is giving up on trying to woo calorie counters. The burger chain is discontinuing Satisfies -- the crinkle-cut fries that contain 40 percent less fat and 30 percent fewer calories than McDonald's (MCD) signature spud sticks -- at most restaurants. Some franchisees will keep offering Satisfries, but the item didn't stick on its menu for much more than a year. Burger King claims that the item didn't sell well despite clearing roughly 100 million orders for the slightly less unhealthy fries. One can argue that Satisfries were doomed because of Burger King chose to charge more for an order than its traditional fries. Fast food joints are magnetic to folks looking to save money. Plus Burger King isn't a big draw to folks on a diet despite following rivals into salads. Monster Beverage (MNST) -- Winner Coca-Cola (KO) has struggled to make a dent in the energy drink market dominated by Red Bull and Monster, so it's betting on a winner. Coca-Cola is investing $2.15 billion to buy a 16.7 percent stake in Monster Beverage. It's a smart move for Coca-Cola as it continues to diversify from carbonated drinks that have fallen out of favor with consumers. However, it's a bigger deal for Monster Beverage. The stock jumped on the news, and rightfully so. Green Mountain Coffee Roasters (GMCR) has soared since Coca-Cola made a similar investment earlier this year. Cisco (CSCO) -- Loser It's another round of pink slips at Cisco. The networking gear giant announced that it that it will be dismissing 6,000 workers or 8 percent of its staff. It's a big number, but the market shouldn't be surprised. This is the fourth summer in a row that it has announced layoffs. Cisco has seen better days. It was the country's most valuable company for a little while at the peak of the dot-com boom. It's been harder to find growth on this end of the dot-com bubble as failed acquisitions and competitive challenges have weighed on results. If these summer layoffs continue, it won't be long before employee morale is a bigger concern than opportunities for growth. MannKind (MNKD) -- Winner MannKind has a game-changing drug on its hands, and now it has a financially strong partner to help market it. Afrezza -- an inhaled insulin that was approved by the Food and Drug Administration earlier this summer -- could be a godsend to folks with diabetes who are weary of needle pricks. Now MannKind is teaming up with Sanofi (SNY) to help get it to market in time for next year's launch. MannKind isn't flush with cash or seasoned with experience, and that's why many upstart biotechs and drug makers team up with larger partners. Some of the warnings associated with Afrezza could have scared off potential partners, but the far-reaching potential of Afrezza was too tempting for Sanofi to pass up here. SeaWorld Entertainment (SEAS) -- Loser It's been a great summer for theme park operators, unless you happen to be SeaWorld. Shares of the company behind the namesake marine life attractions, Busch Gardens and a few water parks plunged after posting disappointing quarterly results. Revenue fell when analysts were holding out for growth. With the Easter holiday and good weather in its favor, it seemed as if this would be a rare winning quarter for SeaWorld. It wasn't. SeaWorld can't seem to shake the negative consumer sentiment that has been brewing since last summer's release of the "Blackfish" documentary that takes the park to task for having orcas in captivity. It's not just the seasonally potent summer quarter that's not working out for SeaWorld. It's hosing down its guidance for the entire year. More from Rick Aristotle Munarriz

Popular Posts: 13 “Triple A” Stocks to Buy5 Pharmaceutical Stocks to Buy Now9 Biotechnology Stocks to Buy Now Recent Posts: 3 Durable Goods Stocks to Buy Now 3 Machinery Stocks to Buy Now 3 Chemicals Stocks to Buy Now View All Posts 3 Machinery Stocks to Buy Now

Popular Posts: 13 “Triple A” Stocks to Buy5 Pharmaceutical Stocks to Buy Now9 Biotechnology Stocks to Buy Now Recent Posts: 3 Durable Goods Stocks to Buy Now 3 Machinery Stocks to Buy Now 3 Chemicals Stocks to Buy Now View All Posts 3 Machinery Stocks to Buy Now  Alamy For millions of Americans, the idea of retirement without Social Security is unthinkable. According to the Social Security Administration, about 41 million retirees and dependents receive retirement benefits from Social Security, with disabled workers and their dependents making up nearly 11 million more recipients and 6.2 million survivors relying on Social Security benefits as well. Yet with the $863 billion that the SSA anticipates paying out in benefits this year making up almost a quarter of federal spending , concerns about the long-term financial sustainability of Social Security have made many younger Americans nervous that they'll never see benefits at all. Before you panic about the uncertainty over Social Security's future, though, it's important to take stock of the program's full condition. In addition, there are steps you can take to shore up your own financial situation to ensure that no matter what happens to Social Security, you'll be in the best position possible to take care of your own money needs in retirement. Will Social Security Be There for You? A recent survey from the Transamerica Center for Retirement Studies looked at attitudes among adults aged 18 to 35 about Social Security and other economic and political issues. More than 80 percent said they were concerned that Social Security was unlikely to be there for them by the time they retired. And two-thirds expect to get most of their retirement income not from Social Security but rather than their own savings and investments, either inside or outside of specific retirement-savings vehicles like individual retirement accounts and employer-sponsored 401(k) plans. Of course, millennials have the benefit of one of the most valuable resources in investing: time. With 30 years or more before they expect to retire, millennials have the most flexibility in tailoring their finances to balance current financial needs and wishes against future money issues. But even if you don't have that long a time horizon, you can still handle the uncertainty about Social Security. 1. Know the Worst-Case Scenarios Despite the survey's revelations about our fears, the reality is that it's unlikely that Social Security will disappear entirely. Even once the Social Security Trust Fund runs out of money, which is currently projected to happen in 2034, ongoing payroll taxes are expected to provide the program with enough income to pay more than three-quarters of scheduled Social Security benefits. So at this point, what many see as the potential worst-case Social Security scenario is that, then the Trust Fund is exhausted, benefits will have to be cut by around 25 percent to keep the program stable. A trim of that size to the average monthly benefit -- currently around $1,300 -- means you'll be losing about $350 of the monthly income you could have expected. You'll either need to replace that money with your own investments, or tighten your belt. 2. Get Smarter About Investing for Retirement One of the most impressive findings of the Transamerica survey was the extent to which millennials are taking action sooner rather than later. An estimated 70 percent of millennials have already started saving for retirement, and they typically began saving at 22. More than 75 percent have discussed saving, investing and retirement planning with family members, friends and other respected peers. That's encouraging -- and a wise choice whatever your age. Moreover, taking advantage of opportunities to save for retirement through work has become essential. The typical millennial contributes 10 percent of their annual pay to a 401(k) plan, taking full advantage of company matches and using vehicles like target-date funds or strategic allocation funds to get age-appropriate diversified exposure to a variety of different investments. 3. Keep Your Job Skills Competitive One of the most discouraging aspects of the recent economic downturn was that high unemployment rates lasted for a long time even after the recovery began. More recently, job growth has started to pick up somewhat, and that has put Americans in better position to provide for their financial futures. Nevertheless, it's more important than ever to remain valuable as a worker. For many who are close to retirement age, the best way to make sure their limited resources last through retirement is to work for a few extra years. But in today's sharply competitive labor market, getting the opportunity to stay in your job isn't a given. So for workers nearing retirement age, consistently demonstrating your value to your employer is essential if you are to remain employed as long as you choose. Somewhat younger workers have even more at stake to stay at the top of their game to reduce the chance of an early layoff, and looking at educational opportunities to bulk up your skills can be a smart way to protect against a drop in eventual Social Security retirement income. Fixing Social Security's long-term financial woes will require either raising taxes, raising the retirement age, modifying how benefits are paid, or some combination of those -- none of which are politically feasible in the current environment, so repairs aren't likely to happen soon. Your best bet for getting financial security you desire is to take matters into your own hands by boosting your own savings and investing. That way, Social Security can be less of a necessity and more of a welcome supplement by the time you retire. More from Dan Caplinger

Alamy For millions of Americans, the idea of retirement without Social Security is unthinkable. According to the Social Security Administration, about 41 million retirees and dependents receive retirement benefits from Social Security, with disabled workers and their dependents making up nearly 11 million more recipients and 6.2 million survivors relying on Social Security benefits as well. Yet with the $863 billion that the SSA anticipates paying out in benefits this year making up almost a quarter of federal spending , concerns about the long-term financial sustainability of Social Security have made many younger Americans nervous that they'll never see benefits at all. Before you panic about the uncertainty over Social Security's future, though, it's important to take stock of the program's full condition. In addition, there are steps you can take to shore up your own financial situation to ensure that no matter what happens to Social Security, you'll be in the best position possible to take care of your own money needs in retirement. Will Social Security Be There for You? A recent survey from the Transamerica Center for Retirement Studies looked at attitudes among adults aged 18 to 35 about Social Security and other economic and political issues. More than 80 percent said they were concerned that Social Security was unlikely to be there for them by the time they retired. And two-thirds expect to get most of their retirement income not from Social Security but rather than their own savings and investments, either inside or outside of specific retirement-savings vehicles like individual retirement accounts and employer-sponsored 401(k) plans. Of course, millennials have the benefit of one of the most valuable resources in investing: time. With 30 years or more before they expect to retire, millennials have the most flexibility in tailoring their finances to balance current financial needs and wishes against future money issues. But even if you don't have that long a time horizon, you can still handle the uncertainty about Social Security. 1. Know the Worst-Case Scenarios Despite the survey's revelations about our fears, the reality is that it's unlikely that Social Security will disappear entirely. Even once the Social Security Trust Fund runs out of money, which is currently projected to happen in 2034, ongoing payroll taxes are expected to provide the program with enough income to pay more than three-quarters of scheduled Social Security benefits. So at this point, what many see as the potential worst-case Social Security scenario is that, then the Trust Fund is exhausted, benefits will have to be cut by around 25 percent to keep the program stable. A trim of that size to the average monthly benefit -- currently around $1,300 -- means you'll be losing about $350 of the monthly income you could have expected. You'll either need to replace that money with your own investments, or tighten your belt. 2. Get Smarter About Investing for Retirement One of the most impressive findings of the Transamerica survey was the extent to which millennials are taking action sooner rather than later. An estimated 70 percent of millennials have already started saving for retirement, and they typically began saving at 22. More than 75 percent have discussed saving, investing and retirement planning with family members, friends and other respected peers. That's encouraging -- and a wise choice whatever your age. Moreover, taking advantage of opportunities to save for retirement through work has become essential. The typical millennial contributes 10 percent of their annual pay to a 401(k) plan, taking full advantage of company matches and using vehicles like target-date funds or strategic allocation funds to get age-appropriate diversified exposure to a variety of different investments. 3. Keep Your Job Skills Competitive One of the most discouraging aspects of the recent economic downturn was that high unemployment rates lasted for a long time even after the recovery began. More recently, job growth has started to pick up somewhat, and that has put Americans in better position to provide for their financial futures. Nevertheless, it's more important than ever to remain valuable as a worker. For many who are close to retirement age, the best way to make sure their limited resources last through retirement is to work for a few extra years. But in today's sharply competitive labor market, getting the opportunity to stay in your job isn't a given. So for workers nearing retirement age, consistently demonstrating your value to your employer is essential if you are to remain employed as long as you choose. Somewhat younger workers have even more at stake to stay at the top of their game to reduce the chance of an early layoff, and looking at educational opportunities to bulk up your skills can be a smart way to protect against a drop in eventual Social Security retirement income. Fixing Social Security's long-term financial woes will require either raising taxes, raising the retirement age, modifying how benefits are paid, or some combination of those -- none of which are politically feasible in the current environment, so repairs aren't likely to happen soon. Your best bet for getting financial security you desire is to take matters into your own hands by boosting your own savings and investing. That way, Social Security can be less of a necessity and more of a welcome supplement by the time you retire. More from Dan Caplinger Related BZSUM U.S. Stocks Reverse; Cheetah Mobile Back In Google App Store Rankings Markets Open Higher; Brinker Profit Misses Estimates

Related BZSUM U.S. Stocks Reverse; Cheetah Mobile Back In Google App Store Rankings Markets Open Higher; Brinker Profit Misses Estimates  Bulletproof vests for canine cops Johnson City and Binghamton, NY (CNNMoney) Nobody wants to see a police dog get hurt.

Bulletproof vests for canine cops Johnson City and Binghamton, NY (CNNMoney) Nobody wants to see a police dog get hurt.

Popular Posts: Trade of the Day: MGM Resorts (MGM)Buy Cognizant Now and Hold On for Big UpsideBest Stocks Update: EMES Continues to Shine Recent Posts: Buy Cognizant Now and Hold On for Big Upside Trade of the Day: MGM Resorts (MGM) Trade of the Day: Halliburton (HAL) View All Posts Buy Cognizant Now and Hold On for Big Upside

Popular Posts: Trade of the Day: MGM Resorts (MGM)Buy Cognizant Now and Hold On for Big UpsideBest Stocks Update: EMES Continues to Shine Recent Posts: Buy Cognizant Now and Hold On for Big Upside Trade of the Day: MGM Resorts (MGM) Trade of the Day: Halliburton (HAL) View All Posts Buy Cognizant Now and Hold On for Big Upside  My editors asked me for a one-year idea at the start of 2014, and my suggestion was Emerge Energy Services (EMES), which mines a special sort of sand used in shale “fracking” by energy producers. It’s up about 160% so far, so I am ready to put that in the “win” column and move on.

My editors asked me for a one-year idea at the start of 2014, and my suggestion was Emerge Energy Services (EMES), which mines a special sort of sand used in shale “fracking” by energy producers. It’s up about 160% so far, so I am ready to put that in the “win” column and move on.