Expedia (EXPE), an online travel company in the United States and internationally announced the acquisition of Wotif Group on July 6, 2014. This article discusses the acquisition, the positives from the acquisition and the other growth triggers for Expedia, which make the company an attractive long-term investment option.

Acquisition of Wotif Group

On June 6, 2014, Expedia announced the acquisition of Wotif Group for a consideration of $658 million or $3.09 per share. The acquisition is a positive step by Expedia and is likely to bring significant long-term benefits.

Wotif Group is an Australian-based online travel company with Asia-Pacific region with a portfolio of leading travel brands. Wotif Group operates online travel brands in the Asia-Pacific region including, Wotif.com, lastminute.com.au, travel.com.au, Asia Web Direct, LateStays.com, GoDo.com.au and Arnold Travel Technology. The company's multi-product portfolio focuses primarily on hotel and air, offering consumers more than 29,000 bookable properties in destinations around the world.

One of the biggest positives for Expedia is an increased exposure to the Asia pacific region, which is a high growth region as compared to developed markets. Expedia has been looking to expand its presence in Asia Pacific and the acquisition fits perfectly in the company's strategy to target high growth markets.

In one of my earlier articles, I had discussed the long-term prospects for make MakeMyTrip (MMYT) and also the growth the company has witnessed with strong presence in India. An increasing presence in the Asia Pacific region will boost Expedia's growth as well and the acquisition is a positive step in that direction. Priceline (PCLN) has also adopted a similar growth strategy for expanding in the Asia Pacific and it is working for the company.

I believe that Expedia will be on a look-out for more interesting acquisitions in Asia Pacific. The company seems to be on an acquisition spree as the company acquired Escape Group in June 2014 as well. Escape Group is one of Europe's leading online car rental reservation companies.

Positive Clarification on eLong (LONG)

There were rumours in the recent past that Expedia is considering selling its 65% stake in eLong. On July 7, 2014, Expedia announced that the talk on selling the stake was indeed a rumour and Expedia remains a long-term investor in eLong to support eLong's drive to become the leading Chinese travel site.

This is another positive announcement coming from Expedia in the last few days. I do believe that eLong has the potential to become one of the leading travel sites in China. eLong is already the second largest online travel company in China. The fact that eLong is backed by the world's largest online travel company is encouraging and eLong will continue to enjoy strong funding support for its expansion activities in China.

Strong Fundamentals To Support Acquisition Spree

Expedia has a strong balance sheet and cash flow position and this will support the company's aggressive acquisition spree and expansion into high growth markets. As of December 2013, Expedia had a cash balance of $1 billion. Further, the company had a low debt to capitalization of 36%, giving the company sufficient room to take debt for expansion or acquisition.

For the year ended December 2013, Expedia also had an operating cash flow position of $763 million as compared to cash interest payment of $84 million. Therefore, debt servicing is not a concern at all for the company.

Besides the growth from emerging markets and the capital appreciation benefits from that, Expedia also has a current annual dividend of $0.6 per share and a dividend yield of 0.8%. I believe that the company's dividend payout will also increase in the future with strong operating cash flows.

Conclusion

Expedia is certainly not complacent with its current position as the world's leading online travel company. The company is actively looking for new growth opportunities and attractive acquisitions. I believe that Asia Pacific will play a key role in the company's growth with the acquisition of Wotif Group.

Analyst estimates peg Expedia's earnings growth for 2014 and 2015 at 33% and 23% respectively. The stock, with a strong growth outlook, is a buy for the long-term. However, broad markets are trading at stretched levels and investors can buy the stock in a staggered investment style than bulk to average out on any decline.

About the author:Faisal HumayunSenior Research Analyst with experience in the field of equity research, credit research, financial modelling and economic research

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

EXPE STOCK PRICE CHART

78.78 (1y: +25%) $(function(){var seriesOptions=[],yAxisOptions=[],name='EXPE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373346000000,63.02],[1373432400000,63.22],[1373518800000,63.08],[1373605200000,63.75],[1373864400000,64.34],[1373950800000,64.5],[1374037200000,65.1],[1374123600000,65.52],[1374210000000,64.43],[1374469200000,63.95],[1374555600000,63.78],[1374642000000,63.78],[1374728400000,65],[1374814800000,47.2],[1375074000000,46.026],[1375160400000,47.49],[1375246800000,47.13],[1375333200000,47.2],[1375419600000,48.17],[1375678800000,49.69],[1375765200000,50.97],[1375851600000,50.8],[1375938000000,50.9],[1376024400000,50.68],[1376283600000,49.67],[1376370000000,49.38],[1376456400000,48.79],[1376542800000,47.77],[1376629200000,47.39],[1376888400000,46.84],[1376974800000,47.6],[1377061200000,45.7],[1377147600000,46.47],[1377234000000,48.84],[1377493200000,47.2],[1377579600000,46.96],[1377666000000,47],[1377752400000,47.09],[1377838800000,46.76],[1378184400000,47.27],[1378270800000,48.91],[1378357200000,48.18],[1378443600000,49.68],[1378702800000,50.641],[1378789200000,51.84],[1378875600000,52.09],[1378962000000,51.18],[1379048400000,51.19],[1379307600000,52.42],[1379394000000,52.26],[1379480400000,53.471],[1379566800000,53.12],[1379653200000,52.82],[1379912400000,51.86],[1379998800000,52.19],[1380085200000,51.59],[1380171600000,52.02],[1380258000000,52.21],[1380517200000,51.81],[1380603600000,52.86],[1380690000000,53.46],[1380776400000,52.15],[1380862800000,51.67],[1381122000000,51.77],[1381208400000,50.63],[1381294800000,49.99],[1381381200000,51.392],[1381467600000,51.73],[1381726800000,48.51],[1381813200000,47.89],[1381899600000,47.9],[1381986000000,48.21],[1382072400000,48.43],[1382331600000,48.19],[1382418000000,48.91],[1382504400000,49.2],[1382590800000,50.5],[1382677200000,50.45],[1382936400000,49.93],[1383022800000,50.68],[1383109200000,49.96],[1383195600000,58.965],[1383282000000,60.11],[1383544800000,60.24],[1383631200000,59.58],[1383717600000,59.81],[1383804000000,58.91],[1383890! 400000,59.88],[1384149600000,61.25],[1384236000000,62.02],[1384322400000,61.72],[1384408800000,61.04],[1384495200000,61.19],[1384754400000,61.05],[1384840800000,60.7],[1384927200000,61.11],[1385013600000,62.59],[1385100000000,62.05],[1385359200000,61.39],[1385445600000,62.33],[1385532000000,63.3],[1385704800000,63.69],[1385964000000,62.61],[1386050400000,62.56],[1386136800000,62.84],[1386223200000,63.58],[1386309600000,63.48],[1386568800000,63.5],[1386655200000,63.2],[1386741600000,62.31],[1386828000000,62.54],[1386914400000,62.73],[1387173600000,65.88],[1387260000000,66.39],[1387346400000,67.55],[1387432800000,66.795],[1387519200000,67.61],[1387778400000,68.68],[1387864800000,68.5],[1388037600000,69.03],[1388124000000,68.76],[1388383200000,68.84],[1388469600000,69.66],[1388642400000,69.21],[1388728800000,69.2],[1388988000000,68.96],[1389074400000,71.45],[1389160800000,70.31],[1389247200000,69.55],[1389333600000,69.6],[1389592800000,67.87],[1389679200000,69.33],[1389765600000,69.42],[1389852000000,68.48],[1389938400000,70.69],[1390284000000,67.67],[1390370400000,67.06],[1390456800000,66.5],[1390543200000,66.3],[1390802400000,65.46],[1390888800000,66.95],[1390975200000,65.47],[1391061600000,65.52],[1391148000000,64.98],[1391407200000,63.27],[1391493600000,63.97],[1391580000000,63.93],[1391666400000,65.14],[1391752800000,74.45],[1392012000000,74.32],[1392098400000,74.79],[1392184800000,75.86],[1392271200000,76.69],[1392357600000,77.13],[1392703200000,78.02],[1392789600000,79.62],[1392876000000,79.71],[1392962400000,79.99],[1393221600000,79.26],[1393308000000,79.44],[1393394400000,78.52],[1393480800000,78.62],[1393567200000,78.53],[1393826400000,76.7],[1393912800000,77.04],[1393999200000,75.73],[1394085600000,74.71],[1394172000000,75.19],[1394427600000,75.23],[1394514000000,74.74],[1394600400000,76.51],[1394686800000,75.47],[1394773200000,75.77],[1395032400000,76.76],[1395118800000,76.93],[1395205200000,75.29],[1395291600000,75.21],[1395378000000,74.2],[1395637200000,72.294],[1395723600000,72.07],[13958100! 00000,71.! 16],[1395896400000,71.83],[1395982800000,72.21],[1396242000000,72.5],[1396328400000,75.9],[1396414800000,76.01],[1396501200000,73.43],[1396587600000,70.05],[1396846800000,68.55],[1396933200000,70.02],[1397019600000,71.81],[1397106000000,68.6],[1397192400000,68.79],[1397451600000,70.205],[1397538000000,70.92],[1397624400000,72.44],[1397710800000,72.46],[1398056400000,72.21],[1398142800000,73.54],[1398229200000,72.48],[1398315600000,72.1],[1398402000000,69.41],[1398661200000,68.57],[1398747600000,70.59],[1398834000000,70.99],[1398920400000,73.87],[1399006800000,71.15],[1399266000000,71.77],[1399352400000,70.51],[1399438800000,69],[1399525200000,68.44],[1399611600000,68.65],[1399870800000,70.8],[1399957200000,71.11],[1400043600000,70.56],[1400130000000,69.78],[1400216400000,69.94],[1400475600000,70.66],[1400562000000,70.18

Bloomberg Fed Chair Janet Yellen

Bloomberg Fed Chair Janet Yellen

Related BZSUM Amazon Rating And Price Target Cut; Pandora Reports Slow Growth Markets Open Lower; Xerox Profit Beats Estimates

Related BZSUM Amazon Rating And Price Target Cut; Pandora Reports Slow Growth Markets Open Lower; Xerox Profit Beats Estimates

Popular Posts: Apple Earnings Set to Give AAPL Stock a LiftApple’s So-So Quarter Could Kill AAPL’s Mojo3 Blue Chip Stocks To Buy Low Recent Posts: Don’t Get Burned by Under Armour Stock Stock Showdown: Ford vs. GM stock PEP Stock – Is PepsiCo Right for Retirement? View All Posts Stock Showdown: Ford vs. GM stock

Popular Posts: Apple Earnings Set to Give AAPL Stock a LiftApple’s So-So Quarter Could Kill AAPL’s Mojo3 Blue Chip Stocks To Buy Low Recent Posts: Don’t Get Burned by Under Armour Stock Stock Showdown: Ford vs. GM stock PEP Stock – Is PepsiCo Right for Retirement? View All Posts Stock Showdown: Ford vs. GM stock  Source: iStockphoto.com

Source: iStockphoto.com  Ford stock got a nice lift in early trading after Ford posted better-than-expected earnings despite a small decline in sales. On an adjusted basis, Ford earnings came to 40 cents per share, vs. analysts’ forecast of 36 cents.

Ford stock got a nice lift in early trading after Ford posted better-than-expected earnings despite a small decline in sales. On an adjusted basis, Ford earnings came to 40 cents per share, vs. analysts’ forecast of 36 cents. You can’t talk about GM without leading with its seemingly never-ending recall debacle. GM has recalled nearly 30 million vehicles, and the related costs absolutely clobbered the bottom line. For the most recent quarter, GM said net income fell 80% after taking a hit of $1.2 billion in recall charges.

You can’t talk about GM without leading with its seemingly never-ending recall debacle. GM has recalled nearly 30 million vehicles, and the related costs absolutely clobbered the bottom line. For the most recent quarter, GM said net income fell 80% after taking a hit of $1.2 billion in recall charges. Source: Ford

Source: Ford  Related BNO Brent Near $108 Ahead Of Inventory Data Brent Steady With Geopolitical Tension In Focus Related DBE Geopolitical Tension Back In The Driver Seat For Crude Oil Prices Up On Chinese And U.S. Demand

Related BNO Brent Near $108 Ahead Of Inventory Data Brent Steady With Geopolitical Tension In Focus Related DBE Geopolitical Tension Back In The Driver Seat For Crude Oil Prices Up On Chinese And U.S. Demand

Popular Posts: 5 Biggest Risks Facing the Rally in Q3Alibaba IPO Date Influenced by Chinese MysticismOil, Chips and Diesel Power Lead 10 Dividend Stocks Increasing Payouts Recent Posts: Oil, Chips and Diesel Power Lead 10 Dividend Stocks Increasing Payouts Harman Is Loudest of 4 Dividend Stocks Increasing Payouts 5 Biggest Risks Facing the Rally in Q3 View All Posts Oil, Chips and Diesel Power Lead 10 Dividend Stocks Increasing Payouts

Popular Posts: 5 Biggest Risks Facing the Rally in Q3Alibaba IPO Date Influenced by Chinese MysticismOil, Chips and Diesel Power Lead 10 Dividend Stocks Increasing Payouts Recent Posts: Oil, Chips and Diesel Power Lead 10 Dividend Stocks Increasing Payouts Harman Is Loudest of 4 Dividend Stocks Increasing Payouts 5 Biggest Risks Facing the Rally in Q3 View All Posts Oil, Chips and Diesel Power Lead 10 Dividend Stocks Increasing Payouts  Vetta/Getty Images Apart from retirement, saving for college expenses is one of the longest-term goals that families set for their finances. After scrimping for years to build up your college savings, the last thing you want to do is make mistakes that will cost you when it comes time to make withdrawals. If you've used 529 plans to save for college, making the most of the available tax advantages is just part of the picture. Here are five tips for making the most of your 529 plan cash. 1. Spend Your 529 Plan Money on the Right Expenses You're allowed to get tax-free treatment on withdrawals for qualified higher education expenses. Those expenses include tuition, fees, books, supplies and equipment. If the student attends college at least half-time or more, room and board also qualifies -- but the amount is limited to a figure set by the school. So if the student lives off-campus, ask the school for its maximum. 2. Don't Waste Your Opportunities for Other Tax Credits Even if you have enough 529 plan money to cover every penny of your college expenses, you still might not want to withdraw the full amount you owe. That's because multiple tax breaks are available for college expenses, but you can only use each dollar of expenses for one benefit.

Vetta/Getty Images Apart from retirement, saving for college expenses is one of the longest-term goals that families set for their finances. After scrimping for years to build up your college savings, the last thing you want to do is make mistakes that will cost you when it comes time to make withdrawals. If you've used 529 plans to save for college, making the most of the available tax advantages is just part of the picture. Here are five tips for making the most of your 529 plan cash. 1. Spend Your 529 Plan Money on the Right Expenses You're allowed to get tax-free treatment on withdrawals for qualified higher education expenses. Those expenses include tuition, fees, books, supplies and equipment. If the student attends college at least half-time or more, room and board also qualifies -- but the amount is limited to a figure set by the school. So if the student lives off-campus, ask the school for its maximum. 2. Don't Waste Your Opportunities for Other Tax Credits Even if you have enough 529 plan money to cover every penny of your college expenses, you still might not want to withdraw the full amount you owe. That's because multiple tax breaks are available for college expenses, but you can only use each dollar of expenses for one benefit. Related ALB Benzinga's M&A Chatter for Tuesday July 15, 2014 Goldman Sachs, JPMorgan Chase Report Strong Earnings; Retail Numbers Fall Below Estimates

Related ALB Benzinga's M&A Chatter for Tuesday July 15, 2014 Goldman Sachs, JPMorgan Chase Report Strong Earnings; Retail Numbers Fall Below Estimates

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  78.78 (1y: +25%) $(function(){var seriesOptions=[],yAxisOptions=[],name='EXPE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373346000000,63.02],[1373432400000,63.22],[1373518800000,63.08],[1373605200000,63.75],[1373864400000,64.34],[1373950800000,64.5],[1374037200000,65.1],[1374123600000,65.52],[1374210000000,64.43],[1374469200000,63.95],[1374555600000,63.78],[1374642000000,63.78],[1374728400000,65],[1374814800000,47.2],[1375074000000,46.026],[1375160400000,47.49],[1375246800000,47.13],[1375333200000,47.2],[1375419600000,48.17],[1375678800000,49.69],[1375765200000,50.97],[1375851600000,50.8],[1375938000000,50.9],[1376024400000,50.68],[1376283600000,49.67],[1376370000000,49.38],[1376456400000,48.79],[1376542800000,47.77],[1376629200000,47.39],[1376888400000,46.84],[1376974800000,47.6],[1377061200000,45.7],[1377147600000,46.47],[1377234000000,48.84],[1377493200000,47.2],[1377579600000,46.96],[1377666000000,47],[1377752400000,47.09],[1377838800000,46.76],[1378184400000,47.27],[1378270800000,48.91],[1378357200000,48.18],[1378443600000,49.68],[1378702800000,50.641],[1378789200000,51.84],[1378875600000,52.09],[1378962000000,51.18],[1379048400000,51.19],[1379307600000,52.42],[1379394000000,52.26],[1379480400000,53.471],[1379566800000,53.12],[1379653200000,52.82],[1379912400000,51.86],[1379998800000,52.19],[1380085200000,51.59],[1380171600000,52.02],[1380258000000,52.21],[1380517200000,51.81],[1380603600000,52.86],[1380690000000,53.46],[1380776400000,52.15],[1380862800000,51.67],[1381122000000,51.77],[1381208400000,50.63],[1381294800000,49.99],[1381381200000,51.392],[1381467600000,51.73],[1381726800000,48.51],[1381813200000,47.89],[1381899600000,47.9],[1381986000000,48.21],[1382072400000,48.43],[1382331600000,48.19],[1382418000000,48.91],[1382504400000,49.2],[1382590800000,50.5],[1382677200000,50.45],[1382936400000,49.93],[1383022800000,50.68],[1383109200000,49.96],[1383195600000,58.965],[1383282000000,60.11],[1383544800000,60.24],[1383631200000,59.58],[1383717600000,59.81],[1383804000000,58.91],[1383890! 400000,59.88],[1384149600000,61.25],[1384236000000,62.02],[1384322400000,61.72],[1384408800000,61.04],[1384495200000,61.19],[1384754400000,61.05],[1384840800000,60.7],[1384927200000,61.11],[1385013600000,62.59],[1385100000000,62.05],[1385359200000,61.39],[1385445600000,62.33],[1385532000000,63.3],[1385704800000,63.69],[1385964000000,62.61],[1386050400000,62.56],[1386136800000,62.84],[1386223200000,63.58],[1386309600000,63.48],[1386568800000,63.5],[1386655200000,63.2],[1386741600000,62.31],[1386828000000,62.54],[1386914400000,62.73],[1387173600000,65.88],[1387260000000,66.39],[1387346400000,67.55],[1387432800000,66.795],[1387519200000,67.61],[1387778400000,68.68],[1387864800000,68.5],[1388037600000,69.03],[1388124000000,68.76],[1388383200000,68.84],[1388469600000,69.66],[1388642400000,69.21],[1388728800000,69.2],[1388988000000,68.96],[1389074400000,71.45],[1389160800000,70.31],[1389247200000,69.55],[1389333600000,69.6],[1389592800000,67.87],[1389679200000,69.33],[1389765600000,69.42],[1389852000000,68.48],[1389938400000,70.69],[1390284000000,67.67],[1390370400000,67.06],[1390456800000,66.5],[1390543200000,66.3],[1390802400000,65.46],[1390888800000,66.95],[1390975200000,65.47],[1391061600000,65.52],[1391148000000,64.98],[1391407200000,63.27],[1391493600000,63.97],[1391580000000,63.93],[1391666400000,65.14],[1391752800000,74.45],[1392012000000,74.32],[1392098400000,74.79],[1392184800000,75.86],[1392271200000,76.69],[1392357600000,77.13],[1392703200000,78.02],[1392789600000,79.62],[1392876000000,79.71],[1392962400000,79.99],[1393221600000,79.26],[1393308000000,79.44],[1393394400000,78.52],[1393480800000,78.62],[1393567200000,78.53],[1393826400000,76.7],[1393912800000,77.04],[1393999200000,75.73],[1394085600000,74.71],[1394172000000,75.19],[1394427600000,75.23],[1394514000000,74.74],[1394600400000,76.51],[1394686800000,75.47],[1394773200000,75.77],[1395032400000,76.76],[1395118800000,76.93],[1395205200000,75.29],[1395291600000,75.21],[1395378000000,74.2],[1395637200000,72.294],[1395723600000,72.07],[13958100! 00000,71.! 16],[1395896400000,71.83],[1395982800000,72.21],[1396242000000,72.5],[1396328400000,75.9],[1396414800000,76.01],[1396501200000,73.43],[1396587600000,70.05],[1396846800000,68.55],[1396933200000,70.02],[1397019600000,71.81],[1397106000000,68.6],[1397192400000,68.79],[1397451600000,70.205],[1397538000000,70.92],[1397624400000,72.44],[1397710800000,72.46],[1398056400000,72.21],[1398142800000,73.54],[1398229200000,72.48],[1398315600000,72.1],[1398402000000,69.41],[1398661200000,68.57],[1398747600000,70.59],[1398834000000,70.99],[1398920400000,73.87],[1399006800000,71.15],[1399266000000,71.77],[1399352400000,70.51],[1399438800000,69],[1399525200000,68.44],[1399611600000,68.65],[1399870800000,70.8],[1399957200000,71.11],[1400043600000,70.56],[1400130000000,69.78],[1400216400000,69.94],[1400475600000,70.66],[1400562000000,70.18

78.78 (1y: +25%) $(function(){var seriesOptions=[],yAxisOptions=[],name='EXPE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373346000000,63.02],[1373432400000,63.22],[1373518800000,63.08],[1373605200000,63.75],[1373864400000,64.34],[1373950800000,64.5],[1374037200000,65.1],[1374123600000,65.52],[1374210000000,64.43],[1374469200000,63.95],[1374555600000,63.78],[1374642000000,63.78],[1374728400000,65],[1374814800000,47.2],[1375074000000,46.026],[1375160400000,47.49],[1375246800000,47.13],[1375333200000,47.2],[1375419600000,48.17],[1375678800000,49.69],[1375765200000,50.97],[1375851600000,50.8],[1375938000000,50.9],[1376024400000,50.68],[1376283600000,49.67],[1376370000000,49.38],[1376456400000,48.79],[1376542800000,47.77],[1376629200000,47.39],[1376888400000,46.84],[1376974800000,47.6],[1377061200000,45.7],[1377147600000,46.47],[1377234000000,48.84],[1377493200000,47.2],[1377579600000,46.96],[1377666000000,47],[1377752400000,47.09],[1377838800000,46.76],[1378184400000,47.27],[1378270800000,48.91],[1378357200000,48.18],[1378443600000,49.68],[1378702800000,50.641],[1378789200000,51.84],[1378875600000,52.09],[1378962000000,51.18],[1379048400000,51.19],[1379307600000,52.42],[1379394000000,52.26],[1379480400000,53.471],[1379566800000,53.12],[1379653200000,52.82],[1379912400000,51.86],[1379998800000,52.19],[1380085200000,51.59],[1380171600000,52.02],[1380258000000,52.21],[1380517200000,51.81],[1380603600000,52.86],[1380690000000,53.46],[1380776400000,52.15],[1380862800000,51.67],[1381122000000,51.77],[1381208400000,50.63],[1381294800000,49.99],[1381381200000,51.392],[1381467600000,51.73],[1381726800000,48.51],[1381813200000,47.89],[1381899600000,47.9],[1381986000000,48.21],[1382072400000,48.43],[1382331600000,48.19],[1382418000000,48.91],[1382504400000,49.2],[1382590800000,50.5],[1382677200000,50.45],[1382936400000,49.93],[1383022800000,50.68],[1383109200000,49.96],[1383195600000,58.965],[1383282000000,60.11],[1383544800000,60.24],[1383631200000,59.58],[1383717600000,59.81],[1383804000000,58.91],[1383890! 400000,59.88],[1384149600000,61.25],[1384236000000,62.02],[1384322400000,61.72],[1384408800000,61.04],[1384495200000,61.19],[1384754400000,61.05],[1384840800000,60.7],[1384927200000,61.11],[1385013600000,62.59],[1385100000000,62.05],[1385359200000,61.39],[1385445600000,62.33],[1385532000000,63.3],[1385704800000,63.69],[1385964000000,62.61],[1386050400000,62.56],[1386136800000,62.84],[1386223200000,63.58],[1386309600000,63.48],[1386568800000,63.5],[1386655200000,63.2],[1386741600000,62.31],[1386828000000,62.54],[1386914400000,62.73],[1387173600000,65.88],[1387260000000,66.39],[1387346400000,67.55],[1387432800000,66.795],[1387519200000,67.61],[1387778400000,68.68],[1387864800000,68.5],[1388037600000,69.03],[1388124000000,68.76],[1388383200000,68.84],[1388469600000,69.66],[1388642400000,69.21],[1388728800000,69.2],[1388988000000,68.96],[1389074400000,71.45],[1389160800000,70.31],[1389247200000,69.55],[1389333600000,69.6],[1389592800000,67.87],[1389679200000,69.33],[1389765600000,69.42],[1389852000000,68.48],[1389938400000,70.69],[1390284000000,67.67],[1390370400000,67.06],[1390456800000,66.5],[1390543200000,66.3],[1390802400000,65.46],[1390888800000,66.95],[1390975200000,65.47],[1391061600000,65.52],[1391148000000,64.98],[1391407200000,63.27],[1391493600000,63.97],[1391580000000,63.93],[1391666400000,65.14],[1391752800000,74.45],[1392012000000,74.32],[1392098400000,74.79],[1392184800000,75.86],[1392271200000,76.69],[1392357600000,77.13],[1392703200000,78.02],[1392789600000,79.62],[1392876000000,79.71],[1392962400000,79.99],[1393221600000,79.26],[1393308000000,79.44],[1393394400000,78.52],[1393480800000,78.62],[1393567200000,78.53],[1393826400000,76.7],[1393912800000,77.04],[1393999200000,75.73],[1394085600000,74.71],[1394172000000,75.19],[1394427600000,75.23],[1394514000000,74.74],[1394600400000,76.51],[1394686800000,75.47],[1394773200000,75.77],[1395032400000,76.76],[1395118800000,76.93],[1395205200000,75.29],[1395291600000,75.21],[1395378000000,74.2],[1395637200000,72.294],[1395723600000,72.07],[13958100! 00000,71.! 16],[1395896400000,71.83],[1395982800000,72.21],[1396242000000,72.5],[1396328400000,75.9],[1396414800000,76.01],[1396501200000,73.43],[1396587600000,70.05],[1396846800000,68.55],[1396933200000,70.02],[1397019600000,71.81],[1397106000000,68.6],[1397192400000,68.79],[1397451600000,70.205],[1397538000000,70.92],[1397624400000,72.44],[1397710800000,72.46],[1398056400000,72.21],[1398142800000,73.54],[1398229200000,72.48],[1398315600000,72.1],[1398402000000,69.41],[1398661200000,68.57],[1398747600000,70.59],[1398834000000,70.99],[1398920400000,73.87],[1399006800000,71.15],[1399266000000,71.77],[1399352400000,70.51],[1399438800000,69],[1399525200000,68.44],[1399611600000,68.65],[1399870800000,70.8],[1399957200000,71.11],[1400043600000,70.56],[1400130000000,69.78],[1400216400000,69.94],[1400475600000,70.66],[1400562000000,70.18

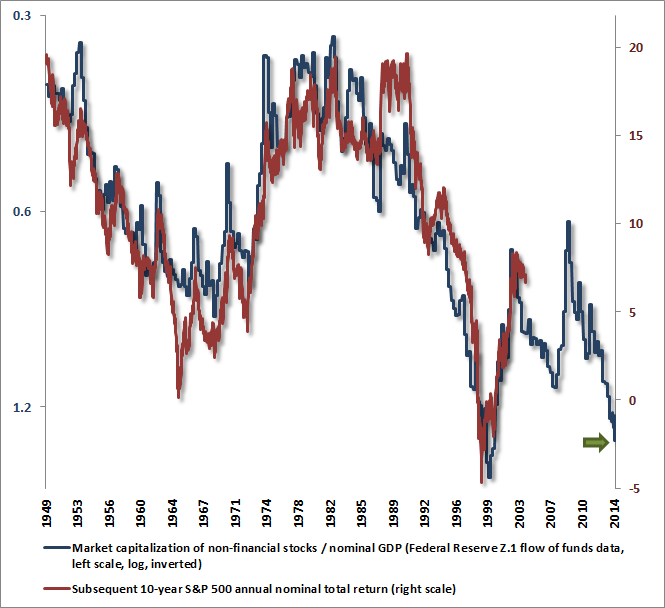

Continue reading: http://www.hussmanfunds.com/wmc/wmc140707.htmAbout the author:Canadian Valuehttp://valueinvestorcanada.blogspot.com/

Continue reading: http://www.hussmanfunds.com/wmc/wmc140707.htmAbout the author:Canadian Valuehttp://valueinvestorcanada.blogspot.com/  Your road trip is only as good as the vehicle you choose. Here are 10 great vehicles for exploring the American landscape. (Prices MSRP.)... 10 best cars for a summer road trip Read More About

Your road trip is only as good as the vehicle you choose. Here are 10 great vehicles for exploring the American landscape. (Prices MSRP.)... 10 best cars for a summer road trip Read More About  We all know Fourth of July food can be explosive. Just think of Uncle Frank an hour after he has washed down his hot dog and baked beans ... How fireworks became an icon of American patriotism Read More About

We all know Fourth of July food can be explosive. Just think of Uncle Frank an hour after he has washed down his hot dog and baked beans ... How fireworks became an icon of American patriotism Read More About  Robert Powell offers advice on all matters of personal finance. His column appears Tuesdays and Thursdays at usaweekend.com.I owe $6,000 ... Personal Finance: Simple tips to pay off credit card Read More About

Robert Powell offers advice on all matters of personal finance. His column appears Tuesdays and Thursdays at usaweekend.com.I owe $6,000 ... Personal Finance: Simple tips to pay off credit card Read More About  Steven Petrow helps you navigate the digital world in the real world:I think my boss is upset that I haven't accepted his friend request ... Your Digital Life: Should I friend my boss on Facebook? Read More About

Steven Petrow helps you navigate the digital world in the real world:I think my boss is upset that I haven't accepted his friend request ... Your Digital Life: Should I friend my boss on Facebook? Read More About  Tennis' most prestigious event - officially called The Champisonships, Wimbledon but most commonly referred to as simply "Wimbledon" - is... 10 best Wimbledon champions Read More About

Tennis' most prestigious event - officially called The Champisonships, Wimbledon but most commonly referred to as simply "Wimbledon" - is... 10 best Wimbledon champions Read More About  Your Digital Life columnist Steven Petrow helps you navigate the digital world in the real world.I'm seeing a lot of "selfies" on social ... Your Digital Life: How many selfies are too many? Read More About JOIN THE CONVERSATIONReady for Your Dream Vacation?

Your Digital Life columnist Steven Petrow helps you navigate the digital world in the real world.I'm seeing a lot of "selfies" on social ... Your Digital Life: How many selfies are too many? Read More About JOIN THE CONVERSATIONReady for Your Dream Vacation?