Longleaf Partners Q1 Letter

Also check out: Mason Hawkins Undervalued Stocks Mason Hawkins Top Growth Companies Mason Hawkins High Yield stocks, and Stocks that Mason Hawkins keeps buying

About the author:Canadian Valuehttp://valueinvestorcanada.blogspot.com/

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

SPY STOCK PRICE CHART

186.39 (1y: +21%) $(function(){var seriesOptions=[],yAxisOptions=[],name='SPY',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[1368594000000,166.12],[1368680400000,165.34],[1368766800000,166.94],[1369026000000,166.93],[1369112400000,167.17],[1369198800000,165.93],[1369285200000,165.45],[1369371600000,165.31],[1369630800000,165.31],[1369717200000,166.3],[1369803600000,165.22],[1369890000000,165.83],[1369976400000,163.45],[1370235600000,164.35],[1370322000000,163.56],[1370408400000,161.27],[1370494800000,162.73],[1370581200000,164.8],[1370840400000,164.8],[1370926800000,163.1],[1371013200000,161.75],[1371099600000,164.21],[1371186000000,163.18],[1371358800000,163.18],[1371445200000,164.44],[1371531600000,165.74],[1371618000000,163.45],[1371704400000,159.4],[1371790800000,159.07],[1372050000000,157.06],[1372136400000,158.58],[1372222800000,160.14],[1372309200000,161.08],[1372395600000,160.42],[1372654800000,161.36],[1372741200000,161.21],[1372827600000,161.28],[1372914000000,161.28],[1373000400000,163.02],[1373259600000,163.95],[1373346000000,165.13],[1373432400000,165.19],[1373518800000,167.44],[1373605200000,167.51],[1373864400000,168.16],[1373950800000,167.53],[1374037200000,167.95],[1374123600000,168.87],[1374210000000,169.17],[1374469200000,169.5],[1374555600000,169.14],[1374642000000,168.52],[1374728400000,168.93],[1374814800000,169.11],[1375074000000,168.59],[1375160400000,168.59],[1375246800000,168.71],[1375333200000,170.66],[1375419600000,170.95],[1375678800000,170.7],[1375765200000,169.73],[1375851600000,169.18],[1375938000000,169.8],[1376024400000,169.31],[137628360! 0000,169..11],[1376370000000,169.61],[1376456400000,168.74],[1376542800000,166.38],[1376629200000,165.83],[1376888400000,164.77],[1376974800000,165.58],[1377061200000,164.56],[1377147600000,166.06],[1377234000000,166.62],[1377493200000,166],[1377579600000,163.33],[1377666000000,163.91],[1377752400000,164.17],[1377838800000,163.65],[1378098000000,163.65],[1378184400000,164.39],[1378270800000,165.75],[1378357200000,165.96],[1378443600000,166.04],[1378702800000,167.63],[1378789200000,168.87],[1378875600000,169.4],[1378962000000,168.95],[1379048400000,169.33],[1379307600000,170.31],[1379394000000,171.07],[1379480400000,173.05],[1379566800000,172.76],[1379653200000,170.72],[1379912400000,169.93],[1379998800000,169.53],[1380085200000,169.04],[1380171600000,169.69],[1380258000000,168.91],[1380517200000,168.01],[1380603600000,169.34],[1380690000000,169.18],[1380776400000,167.62],[1380862800000,168.89],[1381122000000,167.43],[1381208400000,165.48],[1381294800000,165.6],[1381381200000,169.17],[1381467600000,170.26],[1381726800000,170.94],[1381813200000,169.7],[1381899600000,172.07],[1381986000000,173.22],[1382072400000,174.39],[1382331600000,174.4],[1382418000000,175.41],[1382504400000,174.57],[1382590800000,175.15],[1382677200000,175.95],[1382936400000,176.23],[1383022800000,177.17],[1383109200000,176.29],[1383195600000,175.79],[1383282000000,176.21],[1383544800000,176.83],[1383631200000,176.27],[1383717600000,177.17],[1383804000000,174.93],[1383890400000,177.29],[1384149600000,177.32],[1384236000000,176.96],[1384322400000,178.38],[1384408800000,179.27],[1384495200000,180.05],[1384754400000,179.42],[1384840800000,179.03],[1384927200000,178.47],[1385013600000,179.91],[1385100000000,180.81],[1385359200000,180.63],[1385445600000,180.68],[1385532000000,181.12],[1385618400000,181.12],[1385704800000,181],[1385964000000,180.53],[1386050400000,179.75],[1386136800000,179.73],[1386223200000,178.94],[1386309600000,180.94],[1386568800000,181.4],[1386655200000,180.75],[1386741600000,178.72],[1386828000000,178.13],[1386914400! 000,178.11! ],[1387173600000,179.22],[1387260000000,178.65],[1387346400000,181.7],[1387432800000,181.49],[1387519200000,181.56],[1387778400000,182.53],[1387864800000,182.93],[1387951200000,182.93],[1388037600000,183.86],[1388124000000,183.85],[1388383200000,183.82],[1388469600000,184.69],[1388556000000,184.69],[1388642400000,182.92],[1388728800000,182.89],[1388988000000,182.36],[1389074400000,183.48],[1389160800000,183.52],[1389247200000,183.64],[1389333600000,184.14],[1389592800000,181.69],[1389679200000,183.67],[1389765600000,184.66],[1389852000000,184.42],[1389938400000,183.64],[1390197600000,183.64],[1390284000000,184.18],[1390370400000,184.3],[1390456800000,182.79],[1390543200000,178.89],[1390802400000,178.01],[1390888800000,179.07],[1390975200000,177.35],[1391061600000,179.23],[1391148000000,178.18],[1391407200000,174.17],[1391493600000,175.39],[1391580000000,175.17],[1391666400000,177.48],[1391752800000,179.68],[1392012000000,180.01],[1392098400000,181.98],[1392184800000,182.07],[1392271200000,183.01],[1392357600000,184.02],[1392616800000,184.02],[1392703200000,184.24],[1392789600000,183.02],[1392876000000,184.1],[1392962400000,183.89],[1393221600000,184.91],[1393308000000,184.84],[1393394400000,184.85],[1393480800000,185.82],[1393567200000,186.29],[1393826400000,184.98],[1393912800000,187.58],[1393999200000,187.75],[1394085600000,188.18],[1394172000000,188.26],[1394427600000,188.16],[1394514000000,187.23],[1394600400000,187.28],[1394686800000,185.18],[1394773200000,184.66],[1395032400000,186.33],[1395118800000,187.66],[1395205200000,186.66],[1395291600000,187.75],[1395378000000,186.2],[1395637200000,185.43],[1395723600000,186.31],[1395810000000,184.97],[1395896400000,184.58],[1395982800000,185.49],[1396242000000,187.01],[1396328400000,188.25],[1396414800000,188.88],[1396501200000,188.63],[1396587600000,186.4],[1396846800000,184.34],[1396933200000,185.1],[1397019600000,187.09],[1397106000000,183.16],[1397192400000,181.51],[1397451600000,182.94],[1397538000000,184.2],[1397624400000,186.13],[1397737085000,186.! 13],[1397! 737085000,186.13],[1397746800000,186.39]]};var reporting=$('#reporting');Highcharts.setOptions({lang:{rangeSelectorZoom:""}});var chart=new Highcharts.StockChart({chart:{renderTo:'container_chart',marginRight:20,borderRadius:0,events:{load:function(){var chart=this,axis=chart.xAxis[0],buttons=chart.rangeSelector.buttons;function reset_all_buttons(){$.each(chart.rangeSelector.buttons,function(index,valu

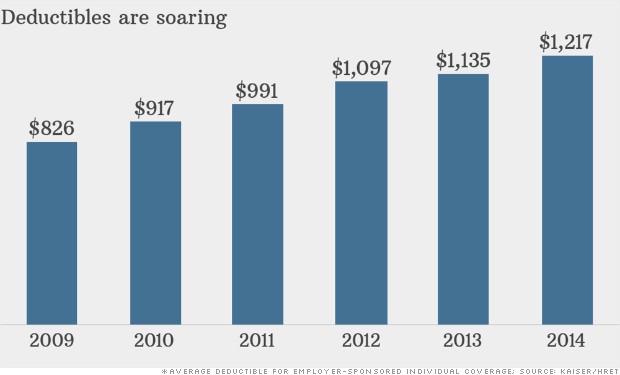

Health insurance: 5 basic questions to ask NEW YORK (CNNMoney) Got health insurance at work? You may still have to shell out thousands of dollars before it kicks in.

Health insurance: 5 basic questions to ask NEW YORK (CNNMoney) Got health insurance at work? You may still have to shell out thousands of dollars before it kicks in.

Medical care has become more costly for the Vance family under a high-deductible plan.

Medical care has become more costly for the Vance family under a high-deductible plan.

Popular Posts: 3 High-Yield Stocks on the Road Less TraveledAMZN Stock: What Do Amazon Earnings Have in Store?Why Retirement Investors Should Always Hold Energy Stocks Recent Posts: Rent-to-Own Stocks Look Compelling ELS Stock: Live Large With This REIT Why Retirement Investors Should Always Hold Energy Stocks View All Posts

Popular Posts: 3 High-Yield Stocks on the Road Less TraveledAMZN Stock: What Do Amazon Earnings Have in Store?Why Retirement Investors Should Always Hold Energy Stocks Recent Posts: Rent-to-Own Stocks Look Compelling ELS Stock: Live Large With This REIT Why Retirement Investors Should Always Hold Energy Stocks View All Posts  I'm talking about manufactured home communities. In the case of Equity LifeStyle Properties (ELS), 70% are communities for those 55 years of age or older. It's a great niche, and this REIT has grown into 370 communities and resorts in 32 states and British Columbia, which contain 140,000 actual sites. The properties certainly look nice on the company's home page, and community living for seniors has taken on increased popularity over the past twenty years.

I'm talking about manufactured home communities. In the case of Equity LifeStyle Properties (ELS), 70% are communities for those 55 years of age or older. It's a great niche, and this REIT has grown into 370 communities and resorts in 32 states and British Columbia, which contain 140,000 actual sites. The properties certainly look nice on the company's home page, and community living for seniors has taken on increased popularity over the past twenty years. Keith Srakocic/AP WASHINGTON -- Sales of new single-family homes rose to a six-year high in September, but a sharp downward revision to August's sales pace indicated the housing recovery remains tentative. The Commerce Department said Friday that sales increased 0.2 percent to a seasonally adjusted annual rate of 467,000 units, the highest reading since July 2008. August's sales rate was revised down to 466,000 units from 504,000 units. Economists polled by Reuters had forecast new home sales at a 470,000-unit pace last month. U.S. Treasury debt prices held on to gains after the data. U.S. stocks were slightly up, while the dollar edged down against the euro. The housing sector index was down 0.78 percent. U.S. homebuilder PulteGroup (PHM), which Thursday reported a 4 percent rise in quarterly revenue from home sales, was trading more than 1 percent lower. "We expect the housing market recovery to remain relatively gradual over the coming months," said Gennadiy Goldberg, an economist at TD Securities in New York. New home sales, which account for about 8 percent of the housing market, tend to be volatile month to month and large revisions aren't unusual. Compared to September last year, sales were up 17 percent. Housing is slowly regaining its footing after activity stalled in the second half of 2013 as mortgage rates soared. With the 30-year fixed mortgage rate falling this week to its lowest level since June of last year, sales could pick up. Falling Mortgage Rates Mortgage rates have declined in tandem with a sharp fall in U.S. Treasury debt yields as slowing global growth and a sharp sell-off in international stock markets prompted traders to push back expectations for an interest rate increase by the Federal Reserve. Slow wage growth, however, remains a constraint for an acceleration in home sales. Data this week showed sales of previously owned homes touched a one-year high in September. Last month, new home sales fell 8.9 percent in the West, handing back some of August's 28.1 percent surge. In the populous South, sales rose 2 percent, while they increased 12.3 percent in the Midwest. Sales were flat in the Northeast. With sales rising modestly, the stock of new houses available on the market rose 1.5 percent to the highest level since July 2010. Builders have been ramping up construction and the improvement in inventory should provide buyers with more choices and temper house price increases. At September's sales pace it would take 5.3 months to clear the supply of houses on the market, unchanged from August. Six months' supply is normally considered a healthy balance between supply and demand. The median new home price fell 4 percent to $259,000 from a year ago.

Keith Srakocic/AP WASHINGTON -- Sales of new single-family homes rose to a six-year high in September, but a sharp downward revision to August's sales pace indicated the housing recovery remains tentative. The Commerce Department said Friday that sales increased 0.2 percent to a seasonally adjusted annual rate of 467,000 units, the highest reading since July 2008. August's sales rate was revised down to 466,000 units from 504,000 units. Economists polled by Reuters had forecast new home sales at a 470,000-unit pace last month. U.S. Treasury debt prices held on to gains after the data. U.S. stocks were slightly up, while the dollar edged down against the euro. The housing sector index was down 0.78 percent. U.S. homebuilder PulteGroup (PHM), which Thursday reported a 4 percent rise in quarterly revenue from home sales, was trading more than 1 percent lower. "We expect the housing market recovery to remain relatively gradual over the coming months," said Gennadiy Goldberg, an economist at TD Securities in New York. New home sales, which account for about 8 percent of the housing market, tend to be volatile month to month and large revisions aren't unusual. Compared to September last year, sales were up 17 percent. Housing is slowly regaining its footing after activity stalled in the second half of 2013 as mortgage rates soared. With the 30-year fixed mortgage rate falling this week to its lowest level since June of last year, sales could pick up. Falling Mortgage Rates Mortgage rates have declined in tandem with a sharp fall in U.S. Treasury debt yields as slowing global growth and a sharp sell-off in international stock markets prompted traders to push back expectations for an interest rate increase by the Federal Reserve. Slow wage growth, however, remains a constraint for an acceleration in home sales. Data this week showed sales of previously owned homes touched a one-year high in September. Last month, new home sales fell 8.9 percent in the West, handing back some of August's 28.1 percent surge. In the populous South, sales rose 2 percent, while they increased 12.3 percent in the Midwest. Sales were flat in the Northeast. With sales rising modestly, the stock of new houses available on the market rose 1.5 percent to the highest level since July 2010. Builders have been ramping up construction and the improvement in inventory should provide buyers with more choices and temper house price increases. At September's sales pace it would take 5.3 months to clear the supply of houses on the market, unchanged from August. Six months' supply is normally considered a healthy balance between supply and demand. The median new home price fell 4 percent to $259,000 from a year ago.

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  186.39 (1y: +21%) $(function(){var seriesOptions=[],yAxisOptions=[],name='SPY',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[1368594000000,166.12],[1368680400000,165.34],[1368766800000,166.94],[1369026000000,166.93],[1369112400000,167.17],[1369198800000,165.93],[1369285200000,165.45],[1369371600000,165.31],[1369630800000,165.31],[1369717200000,166.3],[1369803600000,165.22],[1369890000000,165.83],[1369976400000,163.45],[1370235600000,164.35],[1370322000000,163.56],[1370408400000,161.27],[1370494800000,162.73],[1370581200000,164.8],[1370840400000,164.8],[1370926800000,163.1],[1371013200000,161.75],[1371099600000,164.21],[1371186000000,163.18],[1371358800000,163.18],[1371445200000,164.44],[1371531600000,165.74],[1371618000000,163.45],[1371704400000,159.4],[1371790800000,159.07],[1372050000000,157.06],[1372136400000,158.58],[1372222800000,160.14],[1372309200000,161.08],[1372395600000,160.42],[1372654800000,161.36],[1372741200000,161.21],[1372827600000,161.28],[1372914000000,161.28],[1373000400000,163.02],[1373259600000,163.95],[1373346000000,165.13],[1373432400000,165.19],[1373518800000,167.44],[1373605200000,167.51],[1373864400000,168.16],[1373950800000,167.53],[1374037200000,167.95],[1374123600000,168.87],[1374210000000,169.17],[1374469200000,169.5],[1374555600000,169.14],[1374642000000,168.52],[1374728400000,168.93],[1374814800000,169.11],[1375074000000,168.59],[1375160400000,168.59],[1375246800000,168.71],[1375333200000,170.66],[1375419600000,170.95],[1375678800000,170.7],[1375765200000,169.73],[1375851600000,169.18],[1375938000000,169.8],[1376024400000,169.31],[137628360! 0000,169..11],[1376370000000,169.61],[1376456400000,168.74],[1376542800000,166.38],[1376629200000,165.83],[1376888400000,164.77],[1376974800000,165.58],[1377061200000,164.56],[1377147600000,166.06],[1377234000000,166.62],[1377493200000,166],[1377579600000,163.33],[1377666000000,163.91],[1377752400000,164.17],[1377838800000,163.65],[1378098000000,163.65],[1378184400000,164.39],[1378270800000,165.75],[1378357200000,165.96],[1378443600000,166.04],[1378702800000,167.63],[1378789200000,168.87],[1378875600000,169.4],[1378962000000,168.95],[1379048400000,169.33],[1379307600000,170.31],[1379394000000,171.07],[1379480400000,173.05],[1379566800000,172.76],[1379653200000,170.72],[1379912400000,169.93],[1379998800000,169.53],[1380085200000,169.04],[1380171600000,169.69],[1380258000000,168.91],[1380517200000,168.01],[1380603600000,169.34],[1380690000000,169.18],[1380776400000,167.62],[1380862800000,168.89],[1381122000000,167.43],[1381208400000,165.48],[1381294800000,165.6],[1381381200000,169.17],[1381467600000,170.26],[1381726800000,170.94],[1381813200000,169.7],[1381899600000,172.07],[1381986000000,173.22],[1382072400000,174.39],[1382331600000,174.4],[1382418000000,175.41],[1382504400000,174.57],[1382590800000,175.15],[1382677200000,175.95],[1382936400000,176.23],[1383022800000,177.17],[1383109200000,176.29],[1383195600000,175.79],[1383282000000,176.21],[1383544800000,176.83],[1383631200000,176.27],[1383717600000,177.17],[1383804000000,174.93],[1383890400000,177.29],[1384149600000,177.32],[1384236000000,176.96],[1384322400000,178.38],[1384408800000,179.27],[1384495200000,180.05],[1384754400000,179.42],[1384840800000,179.03],[1384927200000,178.47],[1385013600000,179.91],[1385100000000,180.81],[1385359200000,180.63],[1385445600000,180.68],[1385532000000,181.12],[1385618400000,181.12],[1385704800000,181],[1385964000000,180.53],[1386050400000,179.75],[1386136800000,179.73],[1386223200000,178.94],[1386309600000,180.94],[1386568800000,181.4],[1386655200000,180.75],[1386741600000,178.72],[1386828000000,178.13],[1386914400! 000,178.11! ],[1387173600000,179.22],[1387260000000,178.65],[1387346400000,181.7],[1387432800000,181.49],[1387519200000,181.56],[1387778400000,182.53],[1387864800000,182.93],[1387951200000,182.93],[1388037600000,183.86],[1388124000000,183.85],[1388383200000,183.82],[1388469600000,184.69],[1388556000000,184.69],[1388642400000,182.92],[1388728800000,182.89],[1388988000000,182.36],[1389074400000,183.48],[1389160800000,183.52],[1389247200000,183.64],[1389333600000,184.14],[1389592800000,181.69],[1389679200000,183.67],[1389765600000,184.66],[1389852000000,184.42],[1389938400000,183.64],[1390197600000,183.64],[1390284000000,184.18],[1390370400000,184.3],[1390456800000,182.79],[1390543200000,178.89],[1390802400000,178.01],[1390888800000,179.07],[1390975200000,177.35],[1391061600000,179.23],[1391148000000,178.18],[1391407200000,174.17],[1391493600000,175.39],[1391580000000,175.17],[1391666400000,177.48],[1391752800000,179.68],[1392012000000,180.01],[1392098400000,181.98],[1392184800000,182.07],[1392271200000,183.01],[1392357600000,184.02],[1392616800000,184.02],[1392703200000,184.24],[1392789600000,183.02],[1392876000000,184.1],[1392962400000,183.89],[1393221600000,184.91],[1393308000000,184.84],[1393394400000,184.85],[1393480800000,185.82],[1393567200000,186.29],[1393826400000,184.98],[1393912800000,187.58],[1393999200000,187.75],[1394085600000,188.18],[1394172000000,188.26],[1394427600000,188.16],[1394514000000,187.23],[1394600400000,187.28],[1394686800000,185.18],[1394773200000,184.66],[1395032400000,186.33],[1395118800000,187.66],[1395205200000,186.66],[1395291600000,187.75],[1395378000000,186.2],[1395637200000,185.43],[1395723600000,186.31],[1395810000000,184.97],[1395896400000,184.58],[1395982800000,185.49],[1396242000000,187.01],[1396328400000,188.25],[1396414800000,188.88],[1396501200000,188.63],[1396587600000,186.4],[1396846800000,184.34],[1396933200000,185.1],[1397019600000,187.09],[1397106000000,183.16],[1397192400000,181.51],[1397451600000,182.94],[1397538000000,184.2],[1397624400000,186.13],[1397737085000,186.! 13],[1397! 737085000,186.13],[1397746800000,186.39]]};var reporting=$('#reporting');Highcharts.setOptions({lang:{rangeSelectorZoom:""}});var chart=new Highcharts.StockChart({chart:{renderTo:'container_chart',marginRight:20,borderRadius:0,events:{load:function(){var chart=this,axis=chart.xAxis[0],buttons=chart.rangeSelector.buttons;function reset_all_buttons(){$.each(chart.rangeSelector.buttons,function(index,valu

186.39 (1y: +21%) $(function(){var seriesOptions=[],yAxisOptions=[],name='SPY',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[1368594000000,166.12],[1368680400000,165.34],[1368766800000,166.94],[1369026000000,166.93],[1369112400000,167.17],[1369198800000,165.93],[1369285200000,165.45],[1369371600000,165.31],[1369630800000,165.31],[1369717200000,166.3],[1369803600000,165.22],[1369890000000,165.83],[1369976400000,163.45],[1370235600000,164.35],[1370322000000,163.56],[1370408400000,161.27],[1370494800000,162.73],[1370581200000,164.8],[1370840400000,164.8],[1370926800000,163.1],[1371013200000,161.75],[1371099600000,164.21],[1371186000000,163.18],[1371358800000,163.18],[1371445200000,164.44],[1371531600000,165.74],[1371618000000,163.45],[1371704400000,159.4],[1371790800000,159.07],[1372050000000,157.06],[1372136400000,158.58],[1372222800000,160.14],[1372309200000,161.08],[1372395600000,160.42],[1372654800000,161.36],[1372741200000,161.21],[1372827600000,161.28],[1372914000000,161.28],[1373000400000,163.02],[1373259600000,163.95],[1373346000000,165.13],[1373432400000,165.19],[1373518800000,167.44],[1373605200000,167.51],[1373864400000,168.16],[1373950800000,167.53],[1374037200000,167.95],[1374123600000,168.87],[1374210000000,169.17],[1374469200000,169.5],[1374555600000,169.14],[1374642000000,168.52],[1374728400000,168.93],[1374814800000,169.11],[1375074000000,168.59],[1375160400000,168.59],[1375246800000,168.71],[1375333200000,170.66],[1375419600000,170.95],[1375678800000,170.7],[1375765200000,169.73],[1375851600000,169.18],[1375938000000,169.8],[1376024400000,169.31],[137628360! 0000,169..11],[1376370000000,169.61],[1376456400000,168.74],[1376542800000,166.38],[1376629200000,165.83],[1376888400000,164.77],[1376974800000,165.58],[1377061200000,164.56],[1377147600000,166.06],[1377234000000,166.62],[1377493200000,166],[1377579600000,163.33],[1377666000000,163.91],[1377752400000,164.17],[1377838800000,163.65],[1378098000000,163.65],[1378184400000,164.39],[1378270800000,165.75],[1378357200000,165.96],[1378443600000,166.04],[1378702800000,167.63],[1378789200000,168.87],[1378875600000,169.4],[1378962000000,168.95],[1379048400000,169.33],[1379307600000,170.31],[1379394000000,171.07],[1379480400000,173.05],[1379566800000,172.76],[1379653200000,170.72],[1379912400000,169.93],[1379998800000,169.53],[1380085200000,169.04],[1380171600000,169.69],[1380258000000,168.91],[1380517200000,168.01],[1380603600000,169.34],[1380690000000,169.18],[1380776400000,167.62],[1380862800000,168.89],[1381122000000,167.43],[1381208400000,165.48],[1381294800000,165.6],[1381381200000,169.17],[1381467600000,170.26],[1381726800000,170.94],[1381813200000,169.7],[1381899600000,172.07],[1381986000000,173.22],[1382072400000,174.39],[1382331600000,174.4],[1382418000000,175.41],[1382504400000,174.57],[1382590800000,175.15],[1382677200000,175.95],[1382936400000,176.23],[1383022800000,177.17],[1383109200000,176.29],[1383195600000,175.79],[1383282000000,176.21],[1383544800000,176.83],[1383631200000,176.27],[1383717600000,177.17],[1383804000000,174.93],[1383890400000,177.29],[1384149600000,177.32],[1384236000000,176.96],[1384322400000,178.38],[1384408800000,179.27],[1384495200000,180.05],[1384754400000,179.42],[1384840800000,179.03],[1384927200000,178.47],[1385013600000,179.91],[1385100000000,180.81],[1385359200000,180.63],[1385445600000,180.68],[1385532000000,181.12],[1385618400000,181.12],[1385704800000,181],[1385964000000,180.53],[1386050400000,179.75],[1386136800000,179.73],[1386223200000,178.94],[1386309600000,180.94],[1386568800000,181.4],[1386655200000,180.75],[1386741600000,178.72],[1386828000000,178.13],[1386914400! 000,178.11! ],[1387173600000,179.22],[1387260000000,178.65],[1387346400000,181.7],[1387432800000,181.49],[1387519200000,181.56],[1387778400000,182.53],[1387864800000,182.93],[1387951200000,182.93],[1388037600000,183.86],[1388124000000,183.85],[1388383200000,183.82],[1388469600000,184.69],[1388556000000,184.69],[1388642400000,182.92],[1388728800000,182.89],[1388988000000,182.36],[1389074400000,183.48],[1389160800000,183.52],[1389247200000,183.64],[1389333600000,184.14],[1389592800000,181.69],[1389679200000,183.67],[1389765600000,184.66],[1389852000000,184.42],[1389938400000,183.64],[1390197600000,183.64],[1390284000000,184.18],[1390370400000,184.3],[1390456800000,182.79],[1390543200000,178.89],[1390802400000,178.01],[1390888800000,179.07],[1390975200000,177.35],[1391061600000,179.23],[1391148000000,178.18],[1391407200000,174.17],[1391493600000,175.39],[1391580000000,175.17],[1391666400000,177.48],[1391752800000,179.68],[1392012000000,180.01],[1392098400000,181.98],[1392184800000,182.07],[1392271200000,183.01],[1392357600000,184.02],[1392616800000,184.02],[1392703200000,184.24],[1392789600000,183.02],[1392876000000,184.1],[1392962400000,183.89],[1393221600000,184.91],[1393308000000,184.84],[1393394400000,184.85],[1393480800000,185.82],[1393567200000,186.29],[1393826400000,184.98],[1393912800000,187.58],[1393999200000,187.75],[1394085600000,188.18],[1394172000000,188.26],[1394427600000,188.16],[1394514000000,187.23],[1394600400000,187.28],[1394686800000,185.18],[1394773200000,184.66],[1395032400000,186.33],[1395118800000,187.66],[1395205200000,186.66],[1395291600000,187.75],[1395378000000,186.2],[1395637200000,185.43],[1395723600000,186.31],[1395810000000,184.97],[1395896400000,184.58],[1395982800000,185.49],[1396242000000,187.01],[1396328400000,188.25],[1396414800000,188.88],[1396501200000,188.63],[1396587600000,186.4],[1396846800000,184.34],[1396933200000,185.1],[1397019600000,187.09],[1397106000000,183.16],[1397192400000,181.51],[1397451600000,182.94],[1397538000000,184.2],[1397624400000,186.13],[1397737085000,186.! 13],[1397! 737085000,186.13],[1397746800000,186.39]]};var reporting=$('#reporting');Highcharts.setOptions({lang:{rangeSelectorZoom:""}});var chart=new Highcharts.StockChart({chart:{renderTo:'container_chart',marginRight:20,borderRadius:0,events:{load:function(){var chart=this,axis=chart.xAxis[0],buttons=chart.rangeSelector.buttons;function reset_all_buttons(){$.each(chart.rangeSelector.buttons,function(index,valu

), Wells Fargo (WFC

), Wells Fargo (WFC