GWImages/Shutterstock LOS ANGELES -- Americans typically spend nearly $5 billion on gifts for graduates, with a little over half giving cash and a third offering gift cards, according to last year's National Retail Federation survey. Those surveyed spent an average of $49, which won't buy a laptop, a retirement fund or many of the other gifts often touted as "financially savvy." If you actually want to do some future good with your gift, here are some money-smart suggestions for grads from personal finance experts, college consultants and recent graduates: Living Life Experiences give us more happiness than stuff, according to various researchers. You can put those findings to practical use in a variety of ways. "I'm a sucker for experiences over products, so I might give a gift certificate or Groupon (GRPN) to a nice restaurant or a Paint Nite with a few friends," said personal finance columnist Kathy Kristof, Los Angeles-based author of "Taming the Tuition Tiger" and mother of a recent college graduate. (For her own daughter, Kristof bought the airline tickets for four months spent "kicking around the world.") College consultant Shirley Bloomquist of Great Falls, Virginia, sometimes buys gift certificates for lunch, dinner or a theater outing for the graduate and a friend. Cooking Essentials Learning to fix meals from scratch at home will save your graduate a fortune. A good basic cookbook, such as Mark Bittman's "How to Cook Everything," is one option. Kitchen starter sets are another. Ikea has 7-piece cookware sets for $25 to $50, while Caphalon and Oxo have kitchen gadget sets for $40 to $50. College consultant Bloomquist recently gave a gift certificate for a cooking class to a law school graduate that she could share with some buddies. Help Being Grown Up Transitioning to the work world often isn't easy. Grads may benefit from the services of a resume doctor, a career counselor, a wardrobe stylist, a fee-only financial planner -- or other professionals. "I know someone who had an interior designer just spend a day rearranging things in their apartment," said Zac Bisonnette, author of "Debt-Free U" and "Good Advice from Bad People." Such help, he said, "can turn an ad hoc sort of deal into something more adult." Professional help isn't cheap, however. The cost for any of these services can be $150 an hour, or more. Some may offer discounted initial sessions, but givers on a budget may have to resort to self-help books instead. For career advice, Lynn O'Shaughnessy, author of "The College Solution," recommends "Getting from College to Career: Your Essential Guide to Succeeding in the Real World," by Lindsey Pollak and "Graduate to a Great Job: Make Your College Degree Pay Off in Today's Market," by David DeLong. Some other titles to consider: "Get a Financial Life: Personal Finance in Your Twenties and Thirties," by Beth Kobliner. "Style Bible: What to Wear to Work," by Lauren A. Rothman. "Apartment Therapy: The Eight-Step Home Cure," by Maxwell Ryan. Prepaid Cards If you're still leaning toward a cash gift, you might consider a reloadable prepaid card that allows users to track their spending and offers some protection against loss, theft or fraud. "The main advantage over cash is that cash tends to disappear quickly," said Curtis Arnold, founder of CardRatings.com and BestPrepaidDebitCards.com. "I have a son that graduated a year ago, and I would never give him a cash gift ... even though I required him to take a personal finance class during college." A prepaid card that charges fat fees is, however, the exact opposite of a financially savvy gift. Arnold recommends two lower-cost options: Serve from American Express (AXP) and Chase Liquid (JPM). Serve has a $1 monthly maintenance fee, free point-of-sale transactions and none of the typical hidden third-party costs such as ATM and cash load fees, he said. Users can also send money by email, text and Facebook (FB) and set up subaccounts to easily share money among family members, Arnold said. Chase Liquid offers unlimited free withdrawals at Chase ATMs. Point-of-sale transactions are free and there are no cash load fees. The card can be used for paying bills and its "sophisticated mobile apps" are well worth the $4.95 monthly maintenance fee, Arnold said. The card you choose could well become the gift that keeps on giving. "Once they spend your gift, they will hopefully consider reloading the card later rather than using a credit card and running the risk of increasing their debt load," Arnold said. (.)

GWImages/Shutterstock LOS ANGELES -- Americans typically spend nearly $5 billion on gifts for graduates, with a little over half giving cash and a third offering gift cards, according to last year's National Retail Federation survey. Those surveyed spent an average of $49, which won't buy a laptop, a retirement fund or many of the other gifts often touted as "financially savvy." If you actually want to do some future good with your gift, here are some money-smart suggestions for grads from personal finance experts, college consultants and recent graduates: Living Life Experiences give us more happiness than stuff, according to various researchers. You can put those findings to practical use in a variety of ways. "I'm a sucker for experiences over products, so I might give a gift certificate or Groupon (GRPN) to a nice restaurant or a Paint Nite with a few friends," said personal finance columnist Kathy Kristof, Los Angeles-based author of "Taming the Tuition Tiger" and mother of a recent college graduate. (For her own daughter, Kristof bought the airline tickets for four months spent "kicking around the world.") College consultant Shirley Bloomquist of Great Falls, Virginia, sometimes buys gift certificates for lunch, dinner or a theater outing for the graduate and a friend. Cooking Essentials Learning to fix meals from scratch at home will save your graduate a fortune. A good basic cookbook, such as Mark Bittman's "How to Cook Everything," is one option. Kitchen starter sets are another. Ikea has 7-piece cookware sets for $25 to $50, while Caphalon and Oxo have kitchen gadget sets for $40 to $50. College consultant Bloomquist recently gave a gift certificate for a cooking class to a law school graduate that she could share with some buddies. Help Being Grown Up Transitioning to the work world often isn't easy. Grads may benefit from the services of a resume doctor, a career counselor, a wardrobe stylist, a fee-only financial planner -- or other professionals. "I know someone who had an interior designer just spend a day rearranging things in their apartment," said Zac Bisonnette, author of "Debt-Free U" and "Good Advice from Bad People." Such help, he said, "can turn an ad hoc sort of deal into something more adult." Professional help isn't cheap, however. The cost for any of these services can be $150 an hour, or more. Some may offer discounted initial sessions, but givers on a budget may have to resort to self-help books instead. For career advice, Lynn O'Shaughnessy, author of "The College Solution," recommends "Getting from College to Career: Your Essential Guide to Succeeding in the Real World," by Lindsey Pollak and "Graduate to a Great Job: Make Your College Degree Pay Off in Today's Market," by David DeLong. Some other titles to consider: "Get a Financial Life: Personal Finance in Your Twenties and Thirties," by Beth Kobliner. "Style Bible: What to Wear to Work," by Lauren A. Rothman. "Apartment Therapy: The Eight-Step Home Cure," by Maxwell Ryan. Prepaid Cards If you're still leaning toward a cash gift, you might consider a reloadable prepaid card that allows users to track their spending and offers some protection against loss, theft or fraud. "The main advantage over cash is that cash tends to disappear quickly," said Curtis Arnold, founder of CardRatings.com and BestPrepaidDebitCards.com. "I have a son that graduated a year ago, and I would never give him a cash gift ... even though I required him to take a personal finance class during college." A prepaid card that charges fat fees is, however, the exact opposite of a financially savvy gift. Arnold recommends two lower-cost options: Serve from American Express (AXP) and Chase Liquid (JPM). Serve has a $1 monthly maintenance fee, free point-of-sale transactions and none of the typical hidden third-party costs such as ATM and cash load fees, he said. Users can also send money by email, text and Facebook (FB) and set up subaccounts to easily share money among family members, Arnold said. Chase Liquid offers unlimited free withdrawals at Chase ATMs. Point-of-sale transactions are free and there are no cash load fees. The card can be used for paying bills and its "sophisticated mobile apps" are well worth the $4.95 monthly maintenance fee, Arnold said. The card you choose could well become the gift that keeps on giving. "Once they spend your gift, they will hopefully consider reloading the card later rather than using a credit card and running the risk of increasing their debt load," Arnold said. (.)

Sunday, May 31, 2015

Financially Savvy Gifts For New Graduates

Thursday, May 28, 2015

'CHiPs' Erik Estrada on motorcycles: Don't look…

CHiPs star Erik Estrada gave Harris a personal training lesson on the motorcycle in the late 70s when a struggling actor Harris made a guest appearance on the show.

The unlikely screen duo now voice helicopters in the Disney animated film Planes, which dropped a new trailer on Tuesday.

But it's not the first time they have worked toget

her. Estrada couldn't help but to talk about schooling the now four-time Oscar nominee when Harris was on the CHiPs set. Harris was playing a one-off bad guy on the supremely popular California cop show.

Estrada, of course, was at the height of his Hollywood power playing highway patrol man Ponch on the series.

"I remember he didn't know how to ride a bike at the time," says Estrada. "(Harris) asked me, 'How do I ride this?' I told him it was easy, that I had never ridden a bike before until I came onto CHiPs."

His advice to Harris: "Don't look down and stay in first gear or second gear. Just go slow," Estrada recalls. "He did really well. He rode that bike. And he's gone onto a great career."

Estrada's other rules of the road: "Sit up straight, don't slouch and smile." These are words we can work into all aspects of our life really.

Naturally, Estrada also recommends keeping the best equipment such as gloves, boots and and a helmet.

"There's only two kinds of motorcycle riders," Estrada says. "Those who have been down and those who are going down."

Estrada still rides his Harley-Davidson Road King with the Blue Knights International Law Enforcement Motorcycle Club. He no longer cruises on his CHiPs mobile. But he does have one of the originals from the show, a gift from the Teamsters as a parting show of thanks. The bike sits in a place of honor in Estrada's guest house, right next to the pool table.

Estrada himself is looking good in uniform ! as the 1980s RadioShack commercial proved during the Super Bowl. He keeps in shape with 45 minutes of treadmill work daily. But he admits it's not the same motorcycle cop uniform.

"I had to let it out a bit," says Estrada, who just turned 65.

Even his aging secrets speak like a man who still knows how to ride on the road. Take note Ed Harris: "I'm Latin, I'm well-lubed," says Estrada. "And I color my hair."

Wednesday, May 27, 2015

Italy December orders fall on weak domestic demand

ROME--Italian industrial orders fell sharply in December, mainly due to a decline in orders from domestic firms, casting a shadow over hopes of an economic recovery after the worst postwar recession.

Orders declined 4.9% from November in seasonally adjusted terms, national statistics institute Istat said Thursday.

Domestic orders dropped 6.4%, while foreign orders fell 2.6% from November, according to Istat.

"There's no doubt that the overall drop is due to the internal market," said an Istat official.

Italian industrial sales shed 0.3% in December from November, with foreign sales decreasing 1.4% and domestic sales adding 0.3%, Istat added, using seasonally adjusted figures.

Italian industrial orders, however, rose 1.9% in December from the same month a year earlier, Istat said, citing unadjusted figures. Foreign orders drove the gain, rising 3.2%, while domestic orders climbed 1.1%.

Sales fell 0.6% from December 2012, with a 2.1% drop in domestic sales and a 2.8% gain in foreign sales, Istat said, using workday-adjusted figures.

Write to Liam Moloney at liam.moloney@wsj.com

Monday, May 25, 2015

Pfizer: Palbociclib Launch, Restructuring to Boost Shares, Jefferies Says

Pfizer’s (PFE) days as a market laggard might be over.

Getty Images

Getty Images In 2013, Pfizer returned 26%, lagging the S&P 500′s 32% total return and the 31% rise in major pharmaceutical companies like Merck (MRK) and Novartis (NVS).

This year, Pfizer is looking like a keeper. It’s gained 2.5% this year–good news on the pipeline front has helped–while Novartis, for instance, has fallen 2.9%.

Now, Jefferies analyst Jeffrey Holford and team say it’s time to buy Pfizer’s shares, upgrading it to Buy from Hold. They write:

Oncology and restructuring are key themes for the Pharma sector. Pfizer has both with palbociclib looking like it could launch before year end, whilst management look to give increased visibility on a new organizational structure from Q1’14…

We think that many commentators are overly obsessed with a potential need for Overall Survival data from [Pfizer's] PALOMA-1 study to gain accelerated approval for palbociclib in breast cancer. We believe that the strength and magnitude of the PFS data from this study will be sufficient for filing and potential approval by year-end 2014, especially when considering that it already has Breakthrough Therapy designation from the FDA…

The strategic options being potentially pursued could result in a number of different future structures and timelines attached to them. We expect that the increased visibility, operational efficiency and improved taxation structure that may come with a reorganization will result in increased shareholder value.

Shares of Pfizer have gained 2.5% to $31.37 at 3:26 p.m., while Merck has risen 2.4% to $53.32 and Novartis has fallen 0.8% to $78.02.

Sunday, May 24, 2015

CES 2014: Fuhu introduces Dream Tab for kids

There are many cheap Android tablets. But in 2013, Fuhi's $199 Nabi took off, striking such a chord with parents that sales more than doubled, to more than 2 million units, from 750,000 in 2012.

So what does Fuhu do for an encore? Team up with the DreamWorks Animation studio (Shrek, Madagascar) for a new Nabi, the "Dream Tab," with special cartoons, songs and apps from the DreamWorks library, along with apps like Angry Birds and Cartoon Network games.

Fuhu comes to CES with the new Android powered tablet, its third in the Nabi line (the $99 Nabi and $199 Nabi 2) along with several more adult type products aimed at kids.

All are brightly colored — a hallmark of the Nabi products, which distinguish it from the more understated adult tech colors of white, black and silver.

A new bright red wireless printer — like the Nabi — connects to the tablet. "Kids want their own printer," Fuhu CEO Jim Mitchell says. "They want to have the same thing their parents have, but in their own colors."

There is also a Nabi Karaoke machine. Kids stick their tablet atop the unit, pick up the big red microphone, and start singing along to the lyrics that are shown on the Nabi screen. The unit comes with speakers.

Nabi Karaoke(Photo: Sean Fujiwara)

No pricing has been announced, but all three products will be released in the first quarter.

The Dream Tab will feature a program to teach kids how to animate, and use the 100 DreamWorks characters to wake themselves up or exercise with the donkey from Shrek.

Mitchell says CES will be a g! reat "unveiling," for the new partnership with Dreamworks and the new Dream Tab. "CES is a big show for us," he says. "It's a chance for us to get all the retailers in and showcase what our focus is for 2014."

The challenge for Fuhu and other companies selling cheaper iPad alternative tablets is the widespread acceptance of the world's most popular tablet. "Kids start saying iPad when they're three or four years old," says Richard Doherty, an independent analyst with the Envisioneering Group.

Fuhu needs more apps created specifically for the Nabi, and more widespread acceptance of the Nabi as the kid iPad alternative.

"CES will be a big testing ground for them," Doherty says. "They could make connections there that would greatly expand their market."

Nabi tablets(Photo: Sean Fujiwara)

Readers: Did you buy a Nabi tablet for your kids? How do they like it? Tell me about it on Twitter, where I'm @jeffersongraham.

Wednesday, May 20, 2015

'No-interest-now' deals can be risky

Yep, walk away. Sure, you think you'll pay off the purchase in full before getting hit by double-digit rates. But will you really? Will you be late with a monthly payment and lose that 0%?

"Deferred-interest-rate deals are a hot offering right now, as this is the busiest and most profitable time of the year for retailers," said Odysseas Papadimitriou, founder and CEO of the personal finance websites CardHub and WalletHub.

But consumer watchdogs warn that there are plenty of ways for shoppers to get caught paying far higher rates than they'd expect from what's marketed as a "no-interest-if-paid-in-full" deal. It's something to keep in mind if you're heading out for Super Saturday — the last Saturday for shopping before Christmas.

HOLIDAY SHOPPING: Get the latest news, tips for this year's shopping season

About 43% of borrowers with not-so-great credit — consumers with credit scores below 660 and known as subprime borrowers — did not pay off all their balance before interest kicked in when they participated in a deferred-interest program, according to an October report by the Consumer Financial Protection Bureau.

"Deferred-interest products can be risky for consumers in the best of circumstances," Richard Cordray, director of the CFPB, said in a statement.

This type of deal can work for people who carefully watch due dates and who could pay cash on the spot anyway.

But many still could start out with good intentions to pay off the bill in 12 months or 18 months. But say a monthly payment is mailed late during that time. Or the furnace breaks down, the tax refund doesn't arrive on time, someone gets sick or loses a job.

About 12% of consumers with the best credit did not pay off the bill in full and triggered interest charges with those deferred-interest programs, the CFPB said.

!"Lenders count on the fact that some percentage are going to trip up," said Chi Chi Wu, staff attorney for the National Consumer Law Center in Boston.

Consumer advocates would like to see deferred-interest plans banned, and some say the programs are one of the "nastiest tricks and traps" that remain after the Credit Card Accountability Responsibility and Disclosure Act of 2009 eliminated many abusive practices with credit cards.

Regulators charge that some deceptive enrollment practices can take place with "no interest if paid in full" products.

I've written about some of the troubles faced by consumers who take out such loans for medical procedures. In 2011, I wrote about a Pinckney woman who financed $5,500 for dentures using a 0% introductory rate. But she was hit later with a 22% rate and her bottom dentures weren't finished correctly. The dental chain — Allcare Dental — went out of business, and she was struggling to pay off more than $2,000 on that high-rate card.

Early in December, the CFPB announced an enforcement action against GE Capital Retail Bank and its subsidiary CareCredit. GE Capital didn't acknowledge any wrongdoing in consenting to the order.

"At doctors' and dentists' offices around the country, consumers were signed up for CareCredit credit cards they thought were interest-free, but were actually accruing interest that kicked in if the full balance was not paid at the end of a promotional period," the CFPB noted.

The promotional periods ranged from six months to 24 months, and the cards could accrue interest at 26.99%. If the patient did not pay the full balance by the end of the promotional period, the consumer became liable for all of the accrued interest.

More than 1.2 million consumers could be eligible for refunds totaling $34.1 million. Cardholders who meet the criteria for filing a claim will be sent a form from CareCredit within the next 120 days.

"Medical debt is already a big problem for many Americans. Poor credit car! d transpa! rency should not be making the problem even worse," the CFPB's Cordray said.

CareCredit said the lender has high customer satisfaction ratings and cooperated with the CFPB. CareCredit said it looks forward to providing consumers access to non-emergency health care and veterinary services from 175,000 providers. As part of the agreement, CareCredit representatives, not the doctors' office employees, would work with enrolling consumers for certain transactions that exceed $1,000 now.

For holiday shoppers, consumers need to realize that some deferred-interest offers are easier to understand than others. CardHub did a 2103 deferred-interest survey of some offers and noted not all companies are clear about their policies.

Pay attention to what kind of plastic you sign up for during the holidays. You'd still need to make monthly payments even during a deferred-interest promotional period.

"It's very hard to explain how deferred-interest works to some consumers," Wu said.

That 0% can hook you to buy more and, if you're not lucky, leave you on the hook for paying much more in interest than you expected.

Contact Susan Tompo at stompor@freepress.com

Tuesday, May 19, 2015

Tesla and Europe: A Match Made in Heaven?

The Fool's own senior auto analyst, John Rosevear, sits down with Richard Engdahl for an in-depth look at Tesla (NASDAQ: TSLA) and the electric vehicle market, as well as Chrysler's unique situation with Fiat (NASDAQOTH: FIATY).

The economic crisis in Europe has slammed the auto industry as a whole, but luxury vehicles aren't doing so badly. Coupled with governments that tend to smile on green technologies, Tesla has enjoyed a warm reception Europe.

A full transcript follows the video.

Richard Engdahl: You mentioned briefly overseas sales for Tesla. It strikes me that Europe is perhaps a better place to sell electric vehicles. On the other hand, maybe the U.S. is a better place to sell premium vehicles. How does the overseas market look for Tesla?

John Rosevear: Well, on the one hand we look at Europe -- and particularly Western Europe -- there's a recession going on. New car sales in general are at terrible lows right now and the mainstream automakers in Europe are having a lot of trouble.

Enter Tesla that walks in. They're competing with a novel product in the luxury space. Luxury cars haven't actually done that badly. Go to a place like Germany, they're still selling plenty of BMWs and Mercedes and Audis in Germany. Britain is doing well. France is doing reasonably well, and the Scandinavian countries are doing fairly well.

I understand Tesla's had a really wonderful recession in, I think Norway. They sold a whole bunch as soon as it opened in Norway. It was like, "Whoa, Norway. OK."

With some of these European governments there's more support for electrification. There's more support for infrastructure. There are tax credits and tax breaks and so forth, because they want to move the country more in that direction.

We have some of that here, of course. We have the tax breaks, but we don't have quite the national support for electrification that you could do in a place like Denmark or something like that, because it's a smaller country and it can be done a little more easily, to set up that kind of infrastructure.

Engdahl: Is there any infrastructure -- speaking of -- is there any more government response to electric vehicles in Europe, as far as setting up charging stations and the like?

Rosevear: I'm not current on all of it. Some of the European governments -- the Western European governments -- I know Germany has done some stuff. I know that a couple of the Scandinavian countries have tried to move it forward.

The EU in general, of course, wants to push toward greener outcomes for motor vehicles in general, so there's some support there. The nature and specifics of it, I don't have that in hand.

Wednesday, May 13, 2015

Stocks weak as U.S. shutdown looms

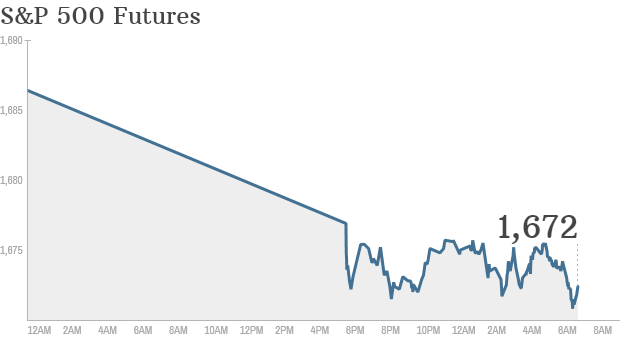

Click on chart to track premarkets

NEW YORK (CNNMoney) Stock markets are set for a sell-off Monday as political squabbling in Washington threatens to lead to a government shutdown at midnight.U.S. stock futures were all down by roughly 0.8% as investors lose faith in their political leaders and worry about the effect that a shutdown could have on the U.S. economy.

"If nothing is agreed by tonight, which seems likely, there will be an economic hit as some [government] employees are put on unpaid leave and non-essential government services close," explained economist Robert Wood from Berenberg Bank.

Monday is the last day of the month and the third quarter. Both the Dow Jones industrial average and the S&P 500 index have risen by well over 3% so far in September, hitting record highs as investors cheered continued stimulus by the U.S. Federal Reserve. All three indexes are up for the quarter, led by the Nasdaq, which has risen 11%.

But markets have pulled back as the shutdown looms and the U.S. nears its debt ceiling, a limit on the amount it can borrow. If the government hits its debt ceiling in mid-October, it will not be able to pay its bills and will default, though many people believe a last-minute solution will be found.

U.S. stocks fell Friday. The Dow and S&P finished the week with a 1% loss, though the Nasdaq eked out a gain.

European markets were all falling in midday trading, with renewed political turmoil in Italy further undermining sentiment. Of the major indexes, the CAC 40 in Paris was deepest in the red, declining by 1.3%.

Italian markets took a hit after Silvio Berlusconi pulled his support for the country's coalition government over the weekend, threatening early elections. The main Italian stock index fell by over 1.5% and yields on ! 10-year government bonds edged higher.

"Berlusconi has thrown Italian politics into potential chaos again after ordering his five ministers to resign from the coalition," wrote Deutsche Bank analyst Jim Reid, in a market report. "It's an impressive feat to knock off a potential U.S. government shutdown from top billing but Berlusconi might have achieved it."

Asian markets closed with losses, though the Shanghai Composite index bucked the trend and moved higher. China launched a free trade zone in the city on Sunday, an experiment in promoting trade, expanding foreign investment access and liberalizing the financial sector. ![]()

Tuesday, May 12, 2015

Next Banking Crisis an 'Easy Call': Mayo

NEW YORK (TheStreet) -- A sudden, sharp rise in interest rates will drive the next banking crisis, according to CLSA analyst Mike Mayo, who says the issue is an "easy call."

During a panel discussion after receiving the Daniel J. Forrestal III Leadership Award for Professional Ethics and Standards of Investment Practice from the CFA Institute, Mayo dismissed a question about efforts by regulators to improve mortgage underwriting standards.

"That's not the next problem. Let me interrupt. Mortgages are going to be fine," he said. "Number one on my list is going to be interest rate risk at these large institutions. We haven't had a big interest rate shock since 1994. So if I pick one risk in the next five to 10 years I have to come back to this room it's going to be interest rate risk. We should reallocate a lot of examiners from the mortgage area to the interest rate risk area. It's an easy call."

Mayo cited JPMorgan Chase's (JPM) more than $6 billion in trading losses on credit derivatives during 2012 -- many of them tied to a former trader named Bruno Iksil who became known as the "London Whale" -- as an early harbinger of the potential problems that may arise from a sharp rise in interest rates.

"I do think it was simply a canary in the coalmine: JPMorgan's whale. The way it came about is unique to JPMorgan but as far as having excess deposits which are invested and having a mismatch -- that's the canary in the coalmine. It's not even a tough call. You know we're going to have an interest rate spike at some point -- we don't know when -- and when that happens, that's when we're going to see damage," Mayo said.

Another problem area Mayo foresees is commercial lending.

"Some of your traditional banks... are making overly aggressive commercial loans right now," he says, adding the problem is something "we're hearing from all the banks."

-- Written by Dan Freed in New York.

Follow @dan_freed

Sunday, May 10, 2015

Workers Think They’re Maxing Out 401(k)s at $8,000

The IRS announced Thursday that the annual contribution limit for 401(k)s will remain unchanged at $17,500 for 2014, but it’s not likely to affect participants’ contributing behavior. The son-to-be-released Mercer Workplace Survey found that the average participant believes the deferral limit is $8,532, almost half the actual limit. That gives them the dangerous perception that they’re close to the maximum contribution when they’re actually far from it.

Mercer found that respondents expect to contribute just under $7,500 to their 401(k) plan in 2014.

“Plan sponsors need to do a better job of communicating the total opportunity employees have when contributing to their 401(k) plan,” Dave Tolve, U.S. leader of Mercer’s defined contribution administration business, told ThinkAdvisor on Monday. “When you start to dig into it further and start to think about the different demographics, it’s important for plan sponsors to communicate specific to their different employee demographics.”

Tolve blamed automatic features for at least some of the problem. “Automatic enrollment is pretty pervasive in 401(k) plans today. It’s great for getting employees to start contributing, but it often leads to inertia where many employees say, ‘This is great. I’m enrolled in my 401(k) and I don’t need to do any more.’”

Tolve referred to past Mercer research that shows people who contribute at the default level tend to contribute less than people who actively make a decision to contribute.

“Automatic enrollment has its place,” he said, “but it’s important to communicate to employees that there’s a lot more room to contribute beyond the default.”

Automatic escalation isn’t a perfect solution, either. “It’s a great feature, but it alone is not enough," he said. "A lot of plans will start someone at 3% and increase by 1% per year. That’s better than that employee not enrolling at all, but there’s an additional step that a lot of plan sponsors ignore, and that’s letting them know that there’s a much greater opportunity in 401(k) plans and they should be saving more.”

Another contributing factor is sponsors overemphasizing the company match as a target deferral rate rather than encouraging them to contribute as much as they can, regardless of the level their employer will match, Tolve said.

Tolve acknowledged that for some participants, saving the maximum allowable contribution just isn’t realistic. “Someone who makes $30,000 a year, it might not be feasible to contribute $17,500, but it would benefit higher-paid employees for plan sponsors to communicate to them the much greater opportunity to contribute to their plans.” There was little difference in expected contributions by age group. The 18 to 34 age group anticipate contributing $7,535; 35- to 49-year-olds said they would contribute $7,667, and 50- to 64-year-olds expect to contribute just $6,673.

“It’s surprising to see among older employees, especially among those over 50 who can add in the catch-up contributions as well,” Tolve said.

Another drawback to small contributions, Mercer noted, was that participants aren’t taking advantage of the tax efficiency 401(k) plans provide. More than a third of respondents said they would increase the contributions they made in the last year if they could, even though most respondents are saving in other plans as well as their 401(k).

“Our historical survey shows us that people who work with financial advisors have much higher levels of confidence in their ability to retire when they want to, their ability to maintain their lifestyle in retirement and their ability to leave money for their heirs,” Mercer said.

---

Check out 4 Things for Fiduciaries to Consider With IRA Rollovers on ThinkAdvisor.