BALTIMORE (Stockpickr) -- Mr. Market has been in correction mode this month, a long overdue changeup in the trajectory for stocks. The last time the S&P 500 made a meaningful price correction was back in February.

So far, this correction is looking pretty meaningful. Since the calendar flipped to August, the S&P has shed 3.48% -- which means that, in just two weeks, the big index has returned approximately half of its performance year-to-date. But there's an important distinction between a correction and a crash. Even though stocks are retracing in August, the primary uptrend in the S&P 500 is very much intact right now.

Read More: Warren Buffett's Top 10 Dividend Stocks

The same can't be said for many of its individual components, though.

Right now, some of the biggest names on Wall Street are looking toxic. And there's a pretty good chance you even own one or two of them. That's why, today, we're taking a technical look at five toxic stocks you should sell.

Just to be clear, the companies I'm talking about today aren't exactly junk. By that, I mean they're not next up in line at bankruptcy court. But that's frankly irrelevant; from a technical analysis standpoint, sellers are shoving around these toxic stocks right now. For that reason, fundamental investors need to decide how long they're willing to take the pain if they want to hold onto these firms in the weeks and months ahead. And for investors looking to buy one of these positions, it makes sense to wait for more favorable technical conditions (and a lower share price) before piling in.

For the unfamiliar, technical analysis is a way for investors to quantify qualitative factors, such as investor psychology, based on a stock's price action and trends. Once the domain of cloistered trading teams on Wall Street, technicals can help top traders make consistently profitable trades and can aid fundamental investors in better planning their stock execution.

So without further ado, let's take a look at five toxic stocks you should be unloading.

Read More: 8 Stocks George Soros Is Buying

LKQ

Auto parts maker LKQ (LKQ) hasn't exactly painted a pretty picture for investors year-to-date. Since the first trading session of 2014, shares of the $8 billion parts firm have slipped more than 21%. But that could just be the beginning. Here's why shares could be due for another leg lower in the second half of the year.

LKQ is currently forming a long-term descending triangle pattern, a bearish setup that's formed by horizontal support (down at $25) and downtrending resistance above shares. Basically, as LKQ has bounced in between those two important levels this year, it's been getting squeezed closer to a breakdown below that $25 price floor. When that happens, we've got our sell signal in shares.

The top of LKQ's price pattern has come in the form of a range, rather than a discrete level. For a sentiment shift big enough to unwind this bearish trade in LKQ, we'd need to see shares trade above the top of the range, currently at $28, before it was safe to be on the long side of this stock again. Otherwise, if $25 gets violated, look out below.

Read More: 4 Stocks Warren Buffett Is Selling in 2014

SL Green Realty

We're seeing another big breakdown trade in shares of $10 billion real estate investment trust SL Green Realty (SLG). Even though this stock has rallied hard this year, up more than 15% thanks to a flight to yield from earlier in 2014, shares are showing signs of a reversal this month.

SLG triggered a double top pattern at the start of this week, breaking down below key support at $108. The double top looks just like it sounds: It's formed by a pair of swing highs that top out at approximately the same price level. The sell signal comes on a violation of the support level that separates the tops, that $108 price floor in the case of SLG.

Why all of the significance at $108? It's not magic. Whenever you're looking at any technical price pattern, it's critical to keep buyers and sellers in mind. Patterns such as the double top are a good way to quickly describe what's going on in a stock, but they're not the reason it's tradable. Instead, it all comes down to supply and demand for shares.

Read More: 3 Huge Stocks to Trade (or Not)

That $108 level in SLG is the spot where there's previously been an excess of demand for shares. In other words, it's a price where buyers have been more eager to step in and buy shares at a lower price than sellers were to sell. That's what makes a breakdown below support so significant -- the move means that sellers are finally strong enough to absorb all of the excess demand at the at price level. Caveat emptor.

Tibco Software

You don't need to be an expert technical trader to figure out what's going on in shares of mid-cap middleware and infrastructure software provider Tibco Software (TIBX); this chart is about as simple as they get. TIBX has been bouncing its way lower in a textbook downtrending channel since last September, and now, with shares coming off of resistance for a seventh time, it makes sense to sell the bounce lower.

That pair of parallel trend lines on Tibco's chart defined the high-probability range for shares of TIBX to trade within. And since those lines are pointing down and to the right, it makes sense to stay out of this stock in August -- it's really just as simple as that.

From here, it makes sense to sell the next trend line bounce lower in TIBX. Waiting for that bounce lower before clicking "sell" is a critical part of risk management, for two big reasons: it's the spot where prices are the highest within the channel, and alternatively it's the spot where you'll get the first indication that the downtrend is ending. Remember, all trend lines do eventually break, but by actually waiting for the bounce to happen first, you're confirming that sellers are still in control before you unload shares of Tibco.

Read More: 5 Stocks Insiders Love Right Now

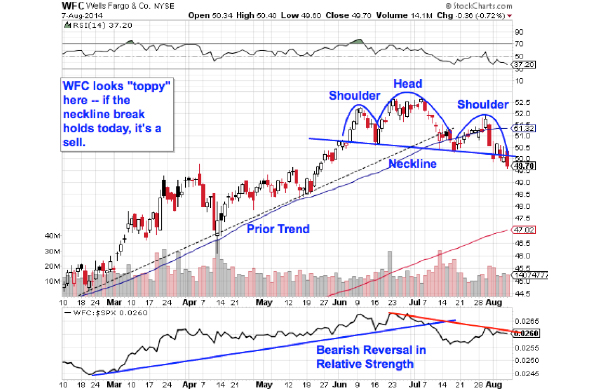

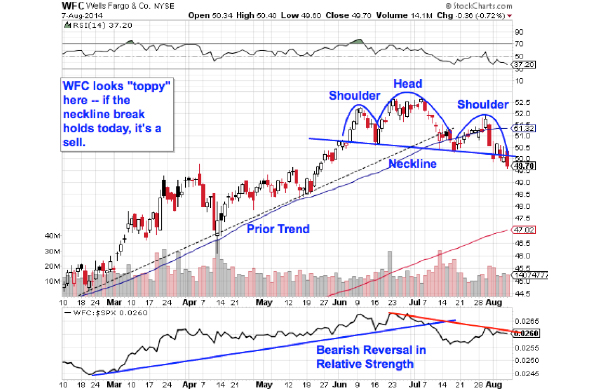

Wells Fargo

Wells Fargo (WFC) has been a strong performer so far this year. In fact, just a month ago, it was looking bullish. But that's changed. WFC is showing signs of a classic top on its chart, and now, it makes sense to take your gains.

Wells is currently forming a head and shoulders top, a setup that indicates exhaustion among buyers. The setup is formed by two swing highs that top out at approximately the same level (the shoulders), separated by a higher high (the head). The sell signal come with yesterday's close below the neckline level that defines the bottom of the head and shoulders pattern.

That bearish bet is being confirmed by relative strength in WFC. While the relative strength line had been in a bullish uptrend for most of the year, it broke at the beginning of July when Wells Fargo started underperforming the rest of the market. That's a big red flag to heed in shares this week.

Read More: 5 Rocket Stocks to Buy for Correction Gains

Google

We're seeing the exact same setup in shares of Google (GOOG) right now. Like Wells, Google is forming a head and shoulders top – the big difference is that the sell signal in shares of this search engine giant hasn't triggered yet. That sell trigger happens if the neckline gets violated with a move below $570 in its class A shares, or $560 if you own class C shares through GOOG.

Momentum, measured by 14-day RSI, is the side indicator to look at in Google. Our momentum gauge has been making lower highs over the course of the head and shoulders setup, even though price made a higher high at the head. That's an indication that buying pressure is waning, even though Google's share price is around the same place as it was when the pattern began. Since momentum is a leading indicator of price, tactical investors should think about taking gains as soon as Google violates $570 in its class A shares (or $560 for GOOG).

Read More: 5 Tech Trades Ready to Move

Lest you think that the inverse head and shoulders is too well known to be worth trading, the research suggests otherwise: a recent academic study conducted by the Federal Reserve Board of New York found that the results of 10,000 computer-simulated head-and-shoulders trades resulted in "profits [that] would have been both statistically and economically significant."

That's good reason to keep a close eye on Wells Fargo and Google this week.

To see this week's trades in action, check out the Toxic Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>4 Big Stocks on Traders' Radars

>>3 Stocks Spiking on Unusual Volume

>>5 Stocks Set to Soar on Bullish Earnings

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.

Follow Jonas on Twitter @JonasElmerraji

Spencer Platt/Getty Images It seems as if tech darlings don't want to scare off potential investors with sticker shock. Last Wednesday Apple (AAPL) became the latest company with a hefty share price to declare a stock split, agreeing to exchange every single share for seven shares trading at a much lower price. Stock splits are zero sum games. If an investor has 100 shares of Apple with the stock at $560 at the time of the 7-for-1 split, that investor would own 700 shares with a stock price of $80. But no matter how you slice it, the math still results in a $56,000 stake in the consumer tech giant. However, many think that there's a psychological benefit to having a stock appear to have a lower price. Apple isn't alone. Google (GOOG) also recently completed what was in effect a 2-for-1 stock split by giving investors a new share of non-voting stock for every share that they owned at the time. With Apple and Google validating the practice, don't be surprised if more stocks with large share prices go this route. A Split by Any Other Name Apple executed 2-for-1 stock splits in 1987, 2000 and 2005. It was quick on the trigger whenever its stock approached high double digits or poked its head into triple digits. However, the stock splits went away after that. Apple's stock continue to shoot higher as the iPod grew in popularity, followed by the introduction of the iPhone in 2007 and the iPad a few years later. Why did the company alter its behavior? The best bet is that Google changed the game when it went public around the time of Apple's final stock split. Google wanted to go public at a price that was as high as $135 during the summer of 2004. It had to settle for $85, but the message was clear: Google wasn't going to try to cater to conventional whims where companies would perform pre-IPO splits in order to hit the market at more accessible prices between $10 and 30. Google's reluctance to declare stock splits through nearly 10 years of trading let everyone know that it was in a race to hit the highest share price possible. It finally gave up the game a few weeks ago when it broke through the $1,000 ceiling, announcing a spinoff that was essentially a 2-for-1 stock split. Google's move now leaves just four stocks trading for more than $1,000 a share. The Rise and Fall and Rise of Stock Splits Stock splits were fashionable in the late 20th century. Retail investors were buying stocks in round lots of 100 shares at a time, and a company didn't want to limit its appeal. Individual investors who had just $20,000 to invest in a new stock would gravitate to 100 shares of a stock at $20 than to buy 20 shares of a stock at $100. Even today, some investors argue that a stock price can be too high. Market cap is the product of a stock's price and the number of shares outstanding. The stock price on its own is immaterial. A stock can be expensive if it's overvalued relative to its fundamentals, but there's really no such thing as a share price that is too high on its own. It's true that the greatest investor of our time is not a fan of stock splits. Warren Buffett has refused to declare a stock split on Berkshire Hathaway (BRK-A), though he reluctantly went on to offer a new class of shares (BRK-B) at a lower price several years ago. However, with the exception of a handful of successful companies, most companies don't like to see their prices get too high.

Spencer Platt/Getty Images It seems as if tech darlings don't want to scare off potential investors with sticker shock. Last Wednesday Apple (AAPL) became the latest company with a hefty share price to declare a stock split, agreeing to exchange every single share for seven shares trading at a much lower price. Stock splits are zero sum games. If an investor has 100 shares of Apple with the stock at $560 at the time of the 7-for-1 split, that investor would own 700 shares with a stock price of $80. But no matter how you slice it, the math still results in a $56,000 stake in the consumer tech giant. However, many think that there's a psychological benefit to having a stock appear to have a lower price. Apple isn't alone. Google (GOOG) also recently completed what was in effect a 2-for-1 stock split by giving investors a new share of non-voting stock for every share that they owned at the time. With Apple and Google validating the practice, don't be surprised if more stocks with large share prices go this route. A Split by Any Other Name Apple executed 2-for-1 stock splits in 1987, 2000 and 2005. It was quick on the trigger whenever its stock approached high double digits or poked its head into triple digits. However, the stock splits went away after that. Apple's stock continue to shoot higher as the iPod grew in popularity, followed by the introduction of the iPhone in 2007 and the iPad a few years later. Why did the company alter its behavior? The best bet is that Google changed the game when it went public around the time of Apple's final stock split. Google wanted to go public at a price that was as high as $135 during the summer of 2004. It had to settle for $85, but the message was clear: Google wasn't going to try to cater to conventional whims where companies would perform pre-IPO splits in order to hit the market at more accessible prices between $10 and 30. Google's reluctance to declare stock splits through nearly 10 years of trading let everyone know that it was in a race to hit the highest share price possible. It finally gave up the game a few weeks ago when it broke through the $1,000 ceiling, announcing a spinoff that was essentially a 2-for-1 stock split. Google's move now leaves just four stocks trading for more than $1,000 a share. The Rise and Fall and Rise of Stock Splits Stock splits were fashionable in the late 20th century. Retail investors were buying stocks in round lots of 100 shares at a time, and a company didn't want to limit its appeal. Individual investors who had just $20,000 to invest in a new stock would gravitate to 100 shares of a stock at $20 than to buy 20 shares of a stock at $100. Even today, some investors argue that a stock price can be too high. Market cap is the product of a stock's price and the number of shares outstanding. The stock price on its own is immaterial. A stock can be expensive if it's overvalued relative to its fundamentals, but there's really no such thing as a share price that is too high on its own. It's true that the greatest investor of our time is not a fan of stock splits. Warren Buffett has refused to declare a stock split on Berkshire Hathaway (BRK-A), though he reluctantly went on to offer a new class of shares (BRK-B) at a lower price several years ago. However, with the exception of a handful of successful companies, most companies don't like to see their prices get too high.

Stephen Colbert: The Man vs. The Character NEW YORK (CNNMoney) The Colbert Nation tuned in big time to say goodbye to "The Colbert Report."

Stephen Colbert: The Man vs. The Character NEW YORK (CNNMoney) The Colbert Nation tuned in big time to say goodbye to "The Colbert Report."

Potash Corp

Potash Corp  Older pre-retirees are furthest from being retirement-ready, according to a recent analysis by BlackRock and the Employee Benefit Research Institute.

Older pre-retirees are furthest from being retirement-ready, according to a recent analysis by BlackRock and the Employee Benefit Research Institute.