Many people have weighed in on BlackBerry (BBRY) this past week. Some investors have been right, others have been wrong, and a few are still in a daze. Emotions are running high over last Friday's earnings call, but this is a time when emotions have no place in prudent investing, or trading. I have written numerous articles on BlackBerry, and feel this is the time to focus on the issues at hand and how investors can move forward from here.

Firstly, the comments on the BlackBerry articles over the past two months have been getting increasingly personal. As an investor there is value in all comments, even when the comment doesn't agree with your position. No one has a crystal ball, and that includes CEOs of publicly traded companies. The value that Seeking Alpha readers provide is a collaborative community that debates issues towards a common goal, shining light on different viewpoints for truly out of the box thinking. This out-of-the-box thinking is how one truly benefits in the market of today, in which I thank all SA readers for their input. In this article, I will endeavor to apply logic with the facts at hand to foreshadow what lies ahead for BlackBerry, good or bad.

I have always been a BlackBerry bull, and continue to be a BlackBerry bull. Now I am acutely aware that I am a bull in a Spanish bull fight; against a prized matador. I just hope that the matador doesn't get to feed on me tonight.

Thorsten Heins

While never a fan of BlackBerry's CEO Thorsten Heins' presentation style, I did take him at face value until now. Previously, I never had a reason to mistrust his statements even though I have taken them with a grain of salt. Since last Friday's earnings report, the CEO's previous statement of Q10 sales in the "tens of millions" seems to be in question. This statement may be true but the timeframe may be over a couple of years. In fairness, I have gone over Thorsten Heins' previous quotes, and while optimistic, I could not find a direct falsehood. The demeanor! during the conference call was anything but confident, and spoke of problems at the helm.

It would be complete conjecture to assume the reason for the subdued performance on the earnings call, but the earnings loss and less than stellar sales volume didn't help. As the Annual General Meeting is next week, and Thorsten Heins will be bombarded with questions from investors; it would be prudent to reserve definitive judgment until this time.

Numbers

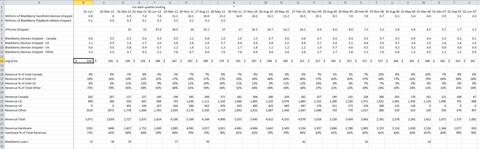

I have collected all the sales figures from previous financial statements over the past few years, and have calculated various metrics that are not readily available. I believe the data to be accurate, but I make no warranties to the accuracy of the data. The data was calculated from certain assumptions and data from previous months.

ASP Numbers

ASP Z10 $420

ASP Q10 $462

In a previous article, I calculated the ASP (average selling price) for the Z10 to be $420. The ASP for the Q10 is approximately $462. The values were calculated from the following spreadsheet, and are included below for information purposes.

(click to enlarge)

The increase in average selling price has contributed to larger gross margins and a decrease in the quarterly earnings per share loss. While BlackBerry is still reporting a loss, it is very close to the breakeven point. This quarter the EPS (earnings per share) was reported to be a loss of 3 cents per share, excluding the Venezuela deferred revenue. With Venezuela, the EPS was a 13 cent loss per share. BlackBerry would probably have reported a profit if the quantities shipped were slightly larger. Another 300,000 devices would have returned a minimum of $126 Million more to add to the top line revenue.

From the chart below, there clearly is a shift upwards regarding revenue. It was, however, small in comparison to previous quarters a couple of years ago.

(click to enlarge)!

Quantities

Q10 devices sold 1.9 Million

Z10 devices sold 0.8 Million

BB7 devices sold 4.1 Million

The quantities of BlackBerry devices sold this quarter were lower than expected. By utilizing various data sets, the above metrics were calculated. Not surprisingly, the Z10 device numbers were lower, with Q10 sales more than double.

Inventory Build up?

There has been much debate over the potential of an inventory buildup that is worrisome. The additional costs needed to be broken down to understand where the issues exist. From the previous fiscal year all the line items are roughly the same. The difference exists with the work in progress. This is very understandable as production has been increased in an effort to deliver to market. Due to the cancellation of the PlayBook tablet, some of the $80 Million in finished goods would be the Z10 and Q10 devices. Altogether, I do not see any issues from this area of the financial documents.

FY14Q1 (in millions) | FY13Q1 (in millions) | |

Raw Materials | 641 | 588 |

Work in Progress | 629 | 371 |

Finished Goods | 80 | 78 |

Excess or obsolete | (463) | (434) |

Notable

From the last quarter: The intangible assets (patents etc.) have a net book value of $3.4 billion, and this includes the 6,000 Nortel patents that were purchased by the technology consortium. This number is $3.5 billion this quarter. With the market cap at approximately $5 Billion, the patents constitute 70%. If there was a liquidation, and the patents were discounted to $2.5 Billion, there would be a significant return to shareholders based on today's share price around $10 per sh! are.

Last quarter there were discussions regarding a large 1 million device order possibly from BrightStar. This was noted indirectly in the annual financial statements for FY2013. This has been a significant increase from the previous year.There was one customer that comprised 12.7% of accounts receivable as at June 1, 2013 (March 2, 2013 - one customer comprised 8.2%). Additionally, there were two customers that together comprised 23% of the Company's first quarter of fiscal 2014 revenue (first quarter of fiscal 2013 revenue - one customer comprised 14%).

Also from the annual financial statements were some notable acquisitions in technology. The information is presented here to show the direction that BlackBerry has taken and will take in the near future. It is clear that the acquisition of the playbook technology did not directly come to fruition.

During fiscal 2012, the Company purchased for cash consideration 100% of the shares of a company whose technology will be incorporated into the Company's proprietary technology.

During fiscal 2012, the Company purchased for cash consideration 100% of the shares of a company whose technology is being incorporated into an application on the BlackBerry PlayBook tablet.

During fiscal 2012, the Company purchased for cash consideration 100% of the shares of a company whose technology offers a customizable and cross-platform social mobile gaming developer tool kit.

During fiscal 2012, the Company purchased for cash consideration 100% of the shares of a company whose technology will provide a multi-platform BlackBerry Enterprise Solution for managing and securing mobile devices for enterprises and government organizations.

During fiscal 2012, the Company purchased for cash consideration certain assets of a company whose acquired technology will be incorporated into the Company's products to enhance calendar scheduling capabilities.

During fiscal 2012, the Company purchased for cash consideration 100% of the shares of a ! company w! hose technology is being incorporated into the Company's developer tools.

Too Conservative

I have been struggling this week to make sense of all the data within the context of Thorsten Heins' earnings call performance. I believe that the game plan has been too conservative by design. Last year, there was a real concern that BlackBerry would not survive the two years required to fully launch BB10. The CORE program was introduced that drastically reduced costs. Part of the strategy was to reduce production for the new devices and gradually roll out the new devices globally. This is why there has been such a staggered rollout across multiple countries.

Also two months ago, Thorsten Heins stated he would be increasing production to 2 Million devices per month. This shows that the initial production plans were on the low end of the scale. The production was smaller as part of the reduced overhead because the availability of staff and resources would be stretched. The ecosystem would have to be fully supported, and presently there have even been calls for more support.

BB10 is still being fully developed with the recent release of BB10.1 and BB10.2 being in development. It would make sense to this author that the recent delays in US carrier deployment were due to BlackBerry resources being readily available for full carrier testing.

Marketing has been heavily criticized as being inadequate. While at the beginning of the BB10 launch I would agree with this statement, hindsight would indicate this was the right marketing approach. The production was not there to fully support an increased marketing initiative. I anticipate there would be other marketing campaigns at more appropriate times.

One of the strengths that BlackBerry possesses is the corporate product lines. Presently, BlackBerry enterprise server cannot fully support all the new devices, including the BYOD (bring your own device) movement. This is being rectified and was part of the staged rollout. Many corporations! for obvi! ous reasons have been delaying new BB10 devices until BES10 has been fully released and tested.

Corporate

If you are a believer that BlackBerry is more a B2B (business to business) product than a B2C (business to consumer) product, then patience is required. Most corporations are still evaluating the product, with the full release of BES10 yet to be delivered. Some corporations and countries have already committed in principle, and without a delivered product BES10 would not be presently billable.

Cheat Sheet

Device | Number shipped | ASP |

Q10 | 1.9M | $462 |

Z10 | 0.8M | $420 |

BB7 | 4.1M | $228 |

Millions of BlackBerry handheld devices shipped | 6.8 |

Millions of BlackBerry PlayBook tablets shipped | 0.1 |

Blackberry devices shipped - Canada | 0.6 |

Blackberry devices shipped - US | 1.1 |

Blackberry devices shipped - UK | 0.0 |

Blackberry devices shipped - Other | 5.2 |

Revenue % of total Canada | 9% |

Revenue % of total US | 16% |

Revenue % of total UK | 0% |

Revenue % of Total Other | 75% |

Revenue Canada | 263 |

Revenue US | 498 |

Revenue UK | 0 |

Revenue Other | 2,310 |

Revenue Total | |

Revenue Hardware | 2,181 |

Hardware % of Total Revenue | 71% |

Blackberry users | 72M |

Gross Margin 34%

Net Loss $ 84 Million

EPS -13 cents

Shareholders' equity $9.4 Million

Conclusion

This has been trying times for many investors and the BlackBerry CEO Thorsten Heins. I would agree that on the surface it does not appear that Thorsten Heins is a great CEO. I do think that he was the best choice at the time, and has made the tough choices required. He appears to have accomplished his biggest priority of reducing costs for long-term viability. Taking a step back to move forward is sometimes required, and now appears to be the time to move forward. Only time will tell if the corporate plan was successful, and it is even possible that a new CEO will be brought in shortly. The BlackBerry board of directors may have considered Thorsten Heins as only an interim CEO from the very beginning.

I do not know what direction BlackBerry will inevitably go, nor does anyone else. I have always stated that it will take "two years for BB10 to be fully adopted," in keeping with other investors such as Prem Watsa. Although, I will admit the progress has been slower than initially believed, and is showing a few cracks.

In terms of share price, I do see the floor to be around $8 a share for the reasons stated above. The release of the short interest at the end of the month will indicate the extent of the possible recent short covering. Until the next quarter results, the share price is not anticipated to rise significantly. Closer to the next quarter results in September, BES10 will be in the spotlight and could provide as a catalyst for the share price.

Source: BlackBerry: So You Think This Is Bad?Disclosure: I am long BBRY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment