Delafield, Wis. (Stockpickr) -- There isn't a day that goes by on Wall Street when certain stocks trading for $10 a share or less don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and sound risk management are banking ridiculous coin on a regular basis.

>>5 Big Trade Signals After Yellen's Surprise Message

Just take a look at some of the big movers in the under-$10 complex from Thursday, including IsoRay (ISR), which is exploding higher by over 28%; Bacterin International ( BONE), which is soaring higher by 26%; BG Medicine (BGMD), which is ripping to the upside by 25%; and MagneGas (MNGA), which is jumping to the upside by 22%. You don't even have to catch the entire move in lower-priced stocks such as these to make outsized returns when trading.

One low-priced stock that recently exploded higher was China-based energy player Andatee China Marine Fuel Services (AMCF), which I highlighted in Mar. 6's "5 Stocks Under $10 Set to Soar" at around $1.75 per share. I mentioned in that piece that shares of Andatee China Marine Fuel Services had been trending sideways for the last few months with the stock hugging its 50-day moving average. Shares of AMCF were just starting to spike higher off its 50-day moving average with strong upside volume and the stock was quickly pushing within range of triggering a big breakout trade.

>>5 Stocks Insiders Love Right Now

Guess what happened? Shares of Andatee China Marine Fuel Services triggered that breakout yesterday after the stock took out some key near-term overhead resistance levels at $2.17 to $2.20 a share with monster upside volume. This stock has continued to rip higher today with shares tagging an intraday high of $2.71 a share. That represents a monster gain of over 40% for anyone who got long AMCF and anticipated that breakout. Traders should now watch for another breakout to trigger with AMCF if it manages to take out today's high of $2.71 to its 52-week high at $2.75 a share with strong volume.

Low-priced stocks are something that I tweet about on a regular basis. I frequently flag high-probability setups, breakout candidates and low-priced stocks that are acting technically bullish. I like to hunt for low-priced stocks that are showing bullish price and volume trends, since that increases the probability of those stocks heading higher. These setups often produce monster moves higher in very short time frames.

>>5 Rocket Stocks Worth Buying This Week

When I trade under-$10 names, I do it almost entirely based off of the charts and technical analysis. I also like to find under-$10 names with a catalyst, but that's secondary to the chart and volume patterns.

With that in mind, here's a look at several under-$10 stocks that look poised to potentially trade higher from current levels.

Cyan

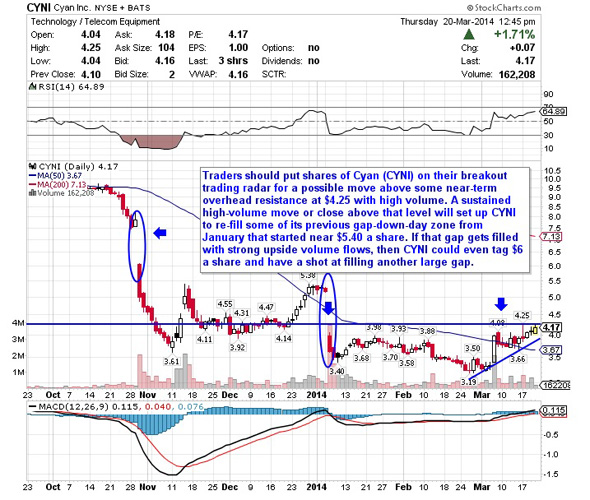

One under-$10 technology player that's quickly trending within range of triggering a big breakout trade is Cyan (CYNI), which has carrier-grade networking solutions that transform legacy networks into open, high-performance networks. This stock has been destroyed over the last six months, with shares down by 57%.

>>3 Tech Stocks on Traders' Radars

If you consult the chart for Cyan, you'll see that this stock has been uptrending for the last month or so, with shares ripping higher from its low of $3.19 to its recent high of $4.25 a share. During that uptrend, shares of CYNI have been making mostly higher lows and higher highs, which is bullish technical price action. That move has recently pushed shares of CYNI back above its 50-day moving average and it's pushed the stock into breakout territory above some past overhead resistance levels at $4 to $4.08 a share. This stock is now starting to trend within range of triggering a much bigger breakout trade.

Traders should now look for long-biased trades in CYNI if it manages to break out above some near-term overhead resistance at $4.25 with high volume. Look for a sustained move or close above that level with volume that registers near or above its three-month average action of 507,220 shares. If that breakout materializes soon, then CYNI will set up to re-fill some of its previous gap-down-day zone from January that started near $5.40 a share. If that gap gets filled with strong upside volume flows, then CYNI could even tag $6 a share and have a shot at filling another large gap.

Traders can look to buy CYNI off weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average of $3.67 a share. One can also buy CYNI off strength once it starts to bust above $4.25 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

ImmunoCellular Therapeutics

Another under-$10 health care player that's starting to trend within range of triggering a big breakout trade is ImmunoCellular Therapeutics (IMUC), a clinical-stage biotechnology company engaged in developing and commercializing immune-based therapies for the treatment of brain, ovarian, and other solid tumor. This stock has been on fire so far in 2014, with shares up sharply by 52%.

>>The Next Big Biotech Mover: Ariad Pharma

If you take a look at the chart for ImmunoCellular Therapeutics, you'll see that this stock has recently formed a major bottoming chart pattern at $1.20, $1.21 and $1.19 a share. Shares of IMUC have now started to bounce off that triple bottom and trend back above its 50-day moving average of $1.23 a share. That move is quickly pushing shares of IMUC within range of triggering a big breakout trade above some key near-term overhead resistance levels.

Market players should now look for long-biased trades in IMUC if it manages to break out above some near-term overhead resistance levels at $1.42 to $1.52 a share and then once it takes out more resistance at $1.58 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average volume of 2.66 million shares. If that breakout kicks off soon, then IMUC will set up to re-fill some of its previous gap-down-day zone from last December that started just above $3 a share. If that IMUC gets into that gap with strong upside volume flows, then this stock could easily tag $2 to $2.50 a share.

Traders can look to buy IMUC off weakness to anticipate that breakout and simply use a stop that sits right around that key near-term support at $1.20 a share. One can also buy IMUC off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Highpower International

One under-$10 energy player that's quickly moving within range of triggering a near-term breakout trade is Highpower International (HPJ), which develops, manufactures and markets rechargeable nickel metal hydride and lithium-ion batteries primarily for use in portable electronic devices. This stock has been a monster so far in 2014, with shares up huge by 107%.

>>Hedge Funds Are Selling These 5 Stocks -- Should You?

If you take a glance at the chart for Highpower International, you'll see that this stock recently pulled back off its high of $6.40 to its low of $4.21 a share, after shares had exploded higher from around $3 to that $6.40 high. Shares of HPJ are now quickly moving within range of triggering a near-term breakout trade above a key downtrend line.

Traders should now look for long-biased trades in HPJ if it manages to break out above some near-term overhead resistance levels at $5.50 to $5.95 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average volume of 351,748 shares. If that breakout gets underway soon, then HPJ will set up to re-test or possibly take out its next major overhead resistance level at its 52-week high of $6.40 a share. Any high-volume move above that level will then give HPJ a chance to tag $7 to $8 a share, or even $9 a share.

Traders can look to buy HPJ off weakness to anticipate that breakout and simply use a stop that sits a comfortable percentage point from your entry. One can also buy HPJ off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Alimera Sciences

Another under-$10 biotechnology player that's starting to push within range of triggering a near-term breakout trade is Alimera Sciences (ALIM), which is engaged in the research, development and commercialization of prescription ophthalmic pharmaceuticals This stock has been ripping strong so far in 2014, with shares up sharply by 45%.

>>5 Big Health Care Stocks to Trade for Gains

If you take a glance at the chart for Alimera Sciences, you'll see that this stock has been trending sideways and consolidating for the last two months, with shares moving between $5.81 on the downside and $7.67 on the upside. This stock has recently formed a double bottom chart pattern at $6.35 to $6.41 a share and that bottom have occurred right above its 50-day moving average. Shares of ALIM are now starting to trend higher and move within range of triggering a near-term breakout trade above the upper-end of its recent sideways trading chart pattern.

Market players should now look for long-biased trades in ALIM if it manages to break out above some key near-term overhead resistance levels at $7.05 to $7.67 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 335,998 shares. If that breakout starts soon, then ALIM will set up to re-test or possibly take out its 52-week high of $8.44 a share. Any high-volume move above $8.44 could easily send this stock north of $10 a share.

Traders can look to buy ALIM off weakness to anticipate that breakout and simply use a stop that sits right below those double bottom support zones at $6.41 to $6.35 a share. One can also buy ALIM off strength once it starts blast above those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

NeuroMetrix

One final under-$10 medical device player that's starting to trend within range of triggering a big breakout trade is NeuroMetrix (NURO), which develops and markets products for the detection, diagnosis and monitoring of peripheral nerve and spinal cord disorders, such as those associated with carpal tunnel syndrome, lumbosacral disc disease, spinal stenosis and diabetes. This stock has been on fire over the last six months, with shares up sharply by 65%.

If you take a look at the chart for NeuroMetrix, you'll notice that this stock has recently formed a major bottoming chart pattern at $2.17 to $2.26 a share. That bottom is taking place right above its 200-day moving average of $2.12 a share. Shares of NURO are starting to spike higher today back above its 50-day moving average of $2.50 a share. That spike is quickly pushing shares of NURO within range of triggering a big breakout trade above a key downtrend line.

Traders should now look for long-biased trades in NURO if it manages to break out above some near-term overhead resistance levels at $2.60 to $2.89 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 257,447 shares. If that breakout materializes soon, then NURO will set up re-test or possibly take out its next major overhead resistance levels $3.14 to $3.25 a share. Any high-volume move above those levels will then give NURO a chance to tag its 52-week high of $4.25 a share.

Traders can look to buy NURO off weakness to anticipate that breakout and simply use a stop that sits right around its 200-day moving average of $2.12 a share. One can also buy NURO off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

To see more hot under-$10 equities, check out the Stocks Under $10 Setting Up to Explode portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>4 Stocks Under $10 to Trade for Breakouts

>>2 Chinese Stocks Rising on Big Volume

>>Do You Own These 5 Toxic Stocks? Watch Out!

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

No comments:

Post a Comment